Having already delved into the basics of investing, you believe it is time to move into action. Excellent!

Despite having most of the questions answered, one of the initial questions remains unanswered: Which stocks to buy?

The options seem endless:

- Should you go for cheap stocks? In fact, when is a stock considered cheap?

- Should you look for stocks with upside potential in the future? Is it possible to know this, in advance?

- Maybe you should exclusively choose dividend stocks to increase your cash flow? And altogether, how do you find the ones with the highest dividend?

Don’t worry! In today’s article, I will attempt to get to the bottom of the issue and provide an answer by presenting the three most popular types of stock investors.

☕ Make some coffee and… start reading!

What are the best stocks to buy – in a flash

Before getting into the detailed article, here’s a summary of what we’ll be discussing today and also some answers to some of the most popular questions about which stocks to choose:

How do stocks work? Stocks are a piece of ownership in a company. By being a stockholder, you gain rights to both profits and assets of the company.

How do you make money from stocks? The profit for a stockholder is two-fold: it comes from dividends (regular cash payments) and the revaluation of the value of the stock (price increase).

How do you buy stocks? The easiest, quickest and simplest way to buy stocks is through a stock exchange platform. It acts as an intermediary by giving you access to a stock exchange where stocks are traded. If you need help, check out the 5-step stock buying process →

Which are the best stocks to buy: Indicative categories of stocks worth your attention are cheap/undervalued stocks (value stocks), those with the potential for upside in the future (growth stocks) and those that offer the highest dividend (income/dividend stocks).

Cheap stocks to buy: Stocks are considered cheap when they are trading at prices lower than their intrinsic value. In the world of investing, cheap stocks are undervalued stocks and not necessarily those with the lowest price. They fall into the category of value stocks with low P/B, P/E και PEG ratios as potential common characteristics among them.

Stocks with upside potential: Stocks are considered to have great upside potential when companies grow faster than the market average and whose value is expected to be much higher… in the future. They are classified as growth stocks, and you will find them in fast-growing sectors such as technology and biotechnology. Possible common characteristics are reinvestment of earnings and high P/B, P/E and PEG ratios.

Dividend stocks: Many companies decide to distribute a portion of their profits back to stockholders as a dividend in the form of cash. Payments are made monthly, quarterly or annually, providing regular passive income to investors.

What to do before investing: Study how stocks work, set goals and strategy, define the time frame, decide the amount of money you will allocate and choose the right stock exchange platform. Oh, don’t forget to consider taxes.

How to buy stocks: Choose the stock exchange platform that suits your needs, open an investment account, deposit money by wire transfer and buy the stock by placing the appropriate order. If you need help, read the guide.

What is the best platform to buy stocks? With safety as a priority, I chose Saxo Bank. It was founded in 1992, has a banking license, is regulated by the Danish Financial Services Authority (FSA) and recently received the title of Systemically Important Financial Institution (aka, too big to fail). It has now lowered commissions quite a bit and I believe it has no rival.

✍ Sign up for free at Saxo Bank →

In this article, you will read:

- Cheap & undervalued stocks →

- Stocks with upside potential →

- Dividend stocks →

- How to choose a stock →

- Where to buy stocks →

- My platform of choice →

- Tips for stocks →

- ❓ Frequently asked questions →

| 🗂️ Stock Categories: | Value, Growth, Dividend, Income, Cyclical, Defensive |

| 💎 Cheap Stocks | Value stocks |

| 📈 Stocks with upside potential: | Growth stocks |

| 💰 Dividend Stocks: | Dividend/Income Stocks |

| 🔝Highest dividend stocks: | Dividend Aristocrats |

| 💻 Stock Platform: | Saxo Bank |

#1 Cheap and undervalued stocks

or, value stocks 💎

| Value Stocks: | Cheap/Undervalued Stocks |

| Investors: | Value Investors |

| Expectation: | Price < Value |

| Tool: | Fundamental Analysis |

| Indicators: | Low P/E, P/B and PEG Ratios |

One of the most popular categories of investors in the stock market is value investors – see Warren Buffett, Benjamin Graham and Mohnish Pabrai.

What is their goal? They try to discover stocks trading at prices below their intrinsic value. In short, they are looking for potential “bargains” in the stock market.

💡 Kind of like finding a high-quality, branded leather jacket at a discount. The quality and value of the jacket remain the same, even though you can get it at a lower price.

Their strategy? They look for companies whose stock price is trading at a lower level than they think is fair. They buy them, hold them for long periods, and once the market correctly assesses their value, they sell them for a capital gain.

What do they believe? Various market news and situations cause investors to overreact (either positively or negatively), creating distortions in stock prices (inflating or deflating) and taking them away from their true value.

How to find cheap stocks?

Cheap stocks are not the ones trading for a few dollars or euros on the stock exchange. Their absolute price has no meaning whatsoever.

Only an undervalued stock is considered a cheap stock.

When is a stock undervalued? They say that price is what you pay and value is what you get. A stock is considered undervalued when its market price is lower than its actual value.

- Share price < actual share value → Undervalued

- Share price > actual share value → Overvalued

So, how can you calculate the real value?

The primary tool in every value investor’s quiver is called fundamental analysis, aiming to calculate the value of a stock.

Unfortunately (or fortunately), there is not a correct way to do a valuation. What is usually done is calculating specific indicators that reveal fundamental metrics of the company in question.

Characteristics of undervalued stocks

According to Investopedia, some signs that may indicate that a stock is undervalued are:

- a low Price-to-Earnings (PE) Ratio

- a Price-to-Book (PB) Ratio <= 1

- a Price/Earnings to Growth (PEG) Ratio < 1

#1 Low Price-to-Earnings (PE) Ratio

This ratio shows the price of the stock today relative to its earnings. A low P/E may indicate that the stock is undervalued and trading below its intrinsic value. In short, it is “cheap”.

P/E ratios should be compared between companies operating in the same industry.

#2 Price-to-Book (P/B) Ratio <= 1

The P/B Ratio is a ratio that shows the current share price relative to the company’s net book value.

When the P/B Ratio is close to or below 1, the stock is trading close to (or below) its net book value and is potentially undervalued.

It’s like paying less to buy a company whose net worth is higher at the time.

3 Price/Earnings-to-Growth (PEG) Ratio < 1

The PEG Ratio is a more “advanced” PE Ratio, as it considers the growth rate of a company’s earnings.

A PEG ratio below 1 indicates that the stock is trading at a price below its expected earnings growth.

💡 Remember: Contrary to what the general public believes, a low share price does not automatically make a stock cheap or undervalued. Pay attention to its fundamentals.

Therefore, what are the cheap stocks? The undervalued stocks. A value investor’s goal is to discover stocks trading at a “bargain”, i.e. below their true value – excellent companies at a lower price than they are worth.

#2 Shares with upside potential

or, growth stocks 📈

| Growth Stocks: | Stocks with upside potential |

| Investors: | Growth Investors |

| Expectation: | Faster growth than the market |

| Aim: | Profit through capital gains |

| Indicators: | High P/E, P/B και PEG Ratios |

On the other side, we meet growth investors.

What is their objective? They are trying to discover stocks that will outperform compared to their competitors. In short, they are looking for the next “performance champions” within the stock market.

Their strategy? They are investing today in stocks that, despite looking expensive, continue to remain cheap relative to their future prospects.

In short, they are investing in a company simply because of their high expectations of its future performance.

💡 If value stocks can be compared to a quality piece of clothing you can buy at a discount, growth stocks can be compared to an innovative technological gadget that radically changes society, and you can acquire it before others.

⚠️ Attention: We said that an investor buys growth stocks because of the potential for a rapid rise that he believes he has. If that rise doesn’t translate into action, he quickly gets disappointed and sells them. When the selling is massive, then the share price collapses. Hence, the higher risk compared to a value stock.

How do you find stocks that will go up?

According to Investopedia, the key elements shared by growth stocks are:

#1 Good leadership

It is said the fish “stinks” from the head. One of the key reasons companies outperform the rest is the innovative, risky and radical ideas they bring to market.

Who makes these decisions? CEOs, managers and executives. Look at their background, temperament, and possible past achievements.

#2 Emerging industry

It is said that you become what your environment is. Your chances of discovering a growth company in a fast-growing industry like tech and biotech are much higher than traditional industries that have matured or are heading into their decline.

#3 Market size

No matter how fast-growing a company is, if the market within which it operates is small, there is little room for growth. Choose stocks that target large markets and many potential customers (ideally, the entire planet).

#4 Sales growth rate

High revenues and profits lead to an increase in a stock’s price. Target companies that are growing sales, revenue and earnings at an accelerated rate.

Characteristics of stocks with upside potential

In general, growth stocks always look expensive for what they offer at the time.

Some key characteristics they share are:

- A high Price-to-Earnings (PE) Ratio: given that their earnings may be low (or even zero), at the moment, their PE Ratios tend to be high.

- The reinvestment of dividends: instead of distributing profits to shareholders, they reinvest them into the company to fuel even more growth.

- The positive rate of revenue and profit growth: The continuous and steady increase in the rate at which revenues and profits come into the company is a potential indicator of growth stock.

Examples of Growth stocks: Classic examples of stocks with frantic growth are Amazon (AMZN), Tesla (TSLA), NVIDIA (NVDA), META (META) and Alphabet (GOOGL). As you can see, they all come from fast-growing sectors such as technology.

📈 You can invest in all of them, with the best fees, through Saxo Bank →

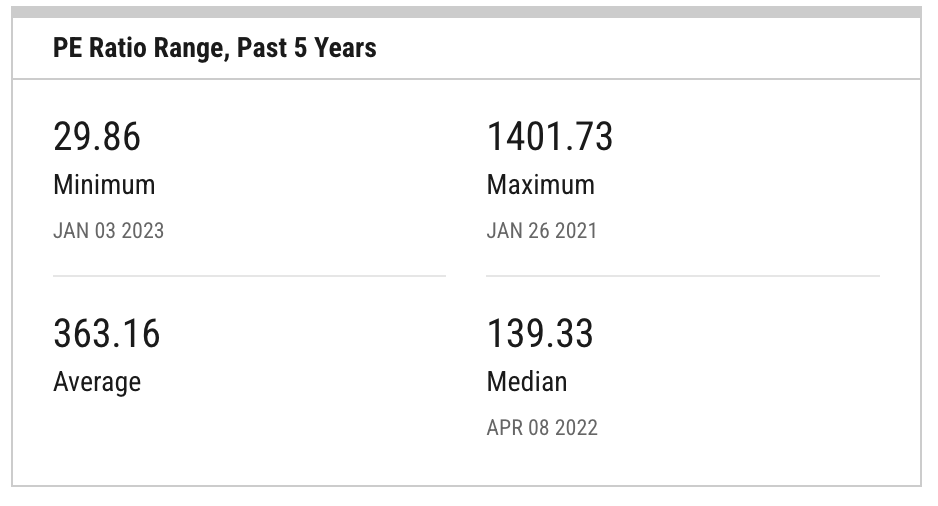

Tesla (TSLA) is a stock that investors have thought has the potential for a big increase for years. Hence, the very high PE ratio at which it trades. At the beginning of 21′ it was over 1400 (!!!)

Therefore, what are the stocks with potential? YYCY: The most promising companies are companies that are the most promising.

#3 Dividend stocks

or dividend/income stocks 💰

| Dividend Stocks: | Stocks that share dividends |

| Investors: | Income/Dividend Investors |

| Expectation: | Regular passive income |

In the third category, we will find investors seeking dividend stocks.

Their objective: They try to identify companies whose strategy is distributing part of their earnings in dividends.

What are dividends? They are regular (quarterly, semi-annual or annual) payments to a company’s shareholders in cash or additional shares (stock dividends).

Their strategy? A dividend investor aims to build a portfolio of companies that pay frequent and high dividends. His goal is to build a steady income stream that is 100% passive. For each share they own, they are entitled to the corresponding dividend.

💡 We could compare investing in dividend stocks to planting an orange tree: the initial attempt requires effort (and money), but it will regularly yield oranges (dividends) without additional work over time.

⚠️ Attention: just because a company has paid dividends in the past does not mean it will continue doing so in the future. The basic rule of investing is that past performance is not an indication of future performance.

How dividends are calculated:

The size of the dividend is determined by the dividend yield, a percentage of the stock price.

Calculation example: If the dividend yield is 1% and the stock price is €100 then the investor will receive €1 for each stock held.

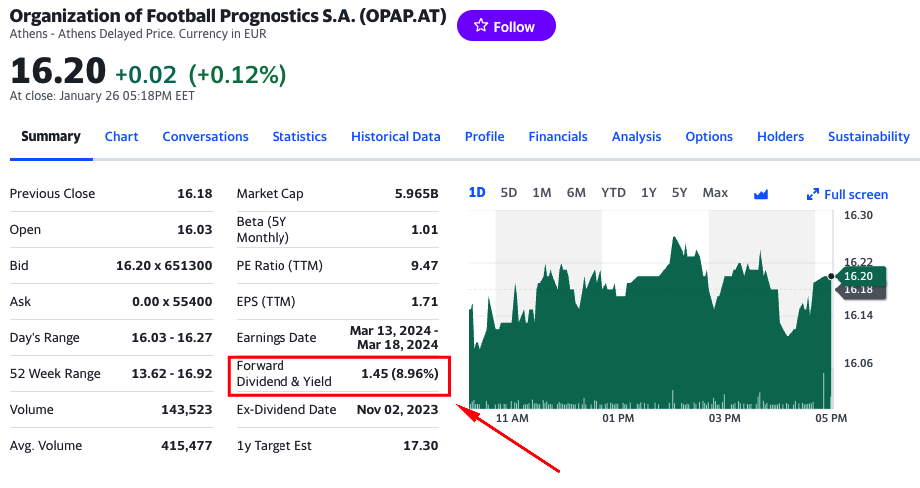

How to find the dividends: Look up the dividend yield of the company in question on Yahoo Finance or Google by typing, for example, “OPAP dividend”.

⚠️ Attention: a high dividend yield is not always a positive sign. A large dividend can hinder growth and damage the business if its financial health is not good.

How to collect the dividend:

The timeline is as follows:

- Announcement Date: the date on which the company announces the dividend.

- Ex-Dividend Date: The deadline to be eligible for the next dividend payment. In short, you must own the stock before this date.

- Record Date: the date the company determines which shareholders are entitled to the dividend.

- Payment Date: the date the dividend is paid to shareholders.

Stocks with the highest dividend

Before closing with dividends, I would like to mention one particular category of dividend stocks standing out, called dividend aristocrats.

It is a list of US stocks that meet the following criteria:

- They must pay dividends for at least 25 consecutive years, continuously increasing.

- Participate in the S&P500 index

- Meet specific capitalization and liquidity criteria.

These companies are often leaders in an industry and have consistent earnings, a long track record of profitability and stable fundamentals.

On the other hand, they remain susceptible to market risks and may not have high growth (in price terms) as they prioritise profit-sharing back to investors.

Examples of stocks with the highest dividend: are Procter & Gamble Co (PG), Johnson & Johnson (JNJ), The Coca-Cola Company (KO), 3M Company (MMM), Colgate-Palmolive Company (CL), McDonald’s Corporation (MCD), Abbott Laboratories (ABT), Walmart Inc (WMT), Kimberly-Clark Corporation (KMB), PepsiCo, Inc (PEP).

📈 You can invest in all of them, with the best fees, through Saxo Bank →

How to choose which stocks to buy

Although at MoneyMinority I’m not of the “individual stock” school as I prefer a more “broader strategy” approach to the market (meaning broad index ETFs), I think I’ll make an exception.

A few things to look at before choosing the right stock to invest in are:

#1 Company key stats

Revenue Growth: Companies growing their revenues steadily or incrementally show signs of good health.

Earnings Growth: Since revenue alone doesn’t mean much, look for companies showing a history of consistent growth in earnings.

Profit Margins: The higher the profit margins, the more efficient and stable a company’s growth is.

Dividend Yield: While a high dividend may seem attractive if it is not sustainable for the company, it can work against it. Stability over time is more important than the dividend amount.

#2 Fundamental indicators of company valuation

Earnings Per Share (EPS): an indicator that measures the company’s profitability per share. A consistently rising EPS is a positive sign.

Price-to-Earnings (P/E) Ratio: Compares the share price to earnings per share. As we saw earlier, a low PE ratio can indicate an undervalued stock.

Debt-to-Equity Ratio: compares the company’s total liabilities to its equity – in short, it shows the degree of debt dependency. A high D/E Ratio understates potential risk.

Price-to-Book (P/B) Ratio: An indicator that measures the relationship between price and the book value of a stock. A low P/B ratio can be a sign of an undervalued stock.

Return on Equity (ROE): Compares a company’s net income to its equity to measure its profitability. The higher the ROE, the more efficiently they are managed.

Price-to-Sales (P/S) Ratio: A metric that calculates how much investors are willing to pay per dollar/euro of a stock’s sales. Exceptionally helpful indicator for companies with sales that are not yet profitable. A lower-than-average P/S Ratio may indicate an undervalued stock.

#3 Historical stock performance

How the price has fluctuated: Keeping in mind that past performance is no indication of future performance, steady growth over the years is still a positive sign.

What dividend it pays: A company’s stable or growing dividend yield can be a positive sign. Both in terms of its financial health and how it decides to treat its shareholders.

#4 Market dynamics

Trends: What is the current state of the industry in which the company operates? It’s prospects? Form an opinion by looking at consumer behaviour and possible technological/economic developments that affect the operation of the market.

Growth: What stage is the industry currently at? Growth, stagnation or decline? An industry in a growth phase is more likely to include companies with the potential for rapid growth than one in its decline.

#5 External factors

Macroeconomic indicators: Interest rates, GDP, and inflation are all variables that affect the economy and, therefore, the performance of companies operating within it.

Geopolitical events: International conflicts, political turmoil or natural disasters cause volatility in stock prices. Most of the time, they are temporary and will not affect investors with long time frames.

Regulatory environment: is the regulatory framework in which the company operates relaxed or strict? Clear or hazy? Are there likely to be legislative changes that will “shake it up”?

Where do you buy stocks?

A private investor buys stocks through stock brokerage firms – stock brokers.

Stock brokers are companies that take on the role of intermediaries between private investors who want to buy and sell shares and the exchanges on which the trades take place.

Through them, you can access the world’s financial markets and buy investment products such as stocks, ETFs, bonds and mutual funds.

Therefore, they offer 3 things:

- Access to the markets: They are directly linked to the world’s stock exchanges

- Execution of orders: They undertake executing buy and sell orders for you

- Tools, analysis and news: Many platforms give you additional tools with which you can do your analysis of companies and markets

Before choosing a platform, do your due diligence by answering the following questions:

Commissions: What are the commissions for each order? Are there hidden fees such as spreads? Are there any deposit, withdrawal, inactivity or currency conversion fees?

Security: Does the broker have a banking licence? How many years has it been in operation? In which country is it based? Which regulatory authorities does it operate under? Does the €100,000 guarantee apply to your deposits and €20,000 to your investments?

Ease of use: How easy to use is the platform? Is it friendly for beginners?

Customer service: In which way can you contact the company? Chat? eMail? By phone? How quickly do they respond?

What is the best brokerage to buy stocks?

Upon extensive searching, I settled on Saxo Bank.

I was familiar with Saxo Bank beforehand as a Tier 1 Premium platform for high net-worth investors. Given that the commissions charged were “prohibitively” high, they would not allow me to use it. A while ago, the fee policy changed, and it has become quite competitive. So I decided to opt for it.

Additional reasons?

- Founded in 1992: It has been operating for more than 30 years – founded in 1992

- Operating in Denmark: based in Denmark and has offices in more than 15 countries.

- Has a banking licence in Denmark: which means it is regulated by the country’s central bank, and our deposits are protected by a guarantee of up to €100,000.

- Monitored by the Danish regulator (FSA): this means that our money and investments are in separate accounts, cannot be used for any of the company’s operations and are protected by an additional investment guarantee of up to €20,000

- Considered a Systemically Important Financial Institution (SIFI): in short, the Danish regulator has recently deemed Saxo Bank to be a financial institution of systemic importance for Denmark. This means that they will not even let it go bankrupt.

- Plenty of options: You can choose from more than 71,000 investment vehicles, including stocks, ETFs and bonds.

- Interest on your idle money: For amounts over €10,000 that you keep uninvested in their bank you receive a monthly interest rate.

With the recent change they’ve made to fees, they’ve become quite competitive:

- $1 for each order to buy U.S. stocks

- 0.3% for Greek stocks (with a minimum of €10).

- 0.05% on government bonds and bills

- They removed every deposit, withdrawal, inactivity or account maintenance charge.

Beyond that, you will come across several platforms worth mentioning, such as:

✍ Read also: how to buy stocks, step by step →

Tips for investing in stocks

Before I let you rush out and buy stocks, few tips to help you:

#1 Get your finances in order

There’s no point in getting into stocks and investing if you don’t have your finances straightened out first.

- Take control: It is crucial to be aware of what goes in and out of your wallet every month. A useful tool that will solve your problems is a personal budget.

- Spend less than you earn: In the same sense that a company has no reason to exist if it doesn’t make a profit, you should aim to become surplus. Flank the issue from all 3 sides by following the C.I.I. tactic – Cut, Increase, Improve →

- Build an emergency fund: Put some money aside for possible setbacks that may happen in the future. The more uncertain your income, the larger this fund should be. Start by building a fund to support your basic expenses for 3 months.

- Stop being in debt: If active debts are weighing you down then your money is earning you negative interest every month. Before you make any investment, you should get rid of your debt.

- Structure your savings: The cornerstone of your financial health is the savings you manage to make. It involves money that is truly yours and is what will fuel your investments. Aim for at least 10% of your monthly income.

#2 Set the right investment foundations

The Investment world is chaotic and can seem extremely difficult for a newcomer. The good news is that it can be simplified quite a bit, as long as you know where to start.

💭 Here’s a list of comprehensive investment guides that will help you learn more about what you don’t know (knowns, unknowns), as well as help you identify what it is that you don’t know… that you don’t know (unknowns, unknowns).

If you want to start somewhere, I would suggest three articles:

- ✍ A Beginner’s Guide to Investing →

- ✍ Stocks and Stock Market for Beginners →

- ✍ How to buy stocks online →

#3 Set clear goals

Buying stocks is an investment. Investing is the process of agreeing to sacrifice something today (money) to receive something more in the future (money + profit).

Without goals, it’s like walking down a path that never ends.

Make it easier for yourself by creating your investment plan, in which you clarify why you are investing, the goals, the time frame and why you are choosing the specific stocks.

Do you want an extra fund to help you with retirement or to secure a generous down payment for the house you plan to take after 35? For how many years are you willing to commit this capital?

Be specific, honest and… realistic.

#4 Decide the level of risk you are willing to take

No investment comes without risk – if there were no potential risks, there would be no return.

What can you do?

- Determine the level of risk you are willing to take (“At what level of risk will you continue to sleep well at night? How will you feel if the stock you chose loses 10% overnight?)

- Is taking that particular risk worth the potential potential return the investment offers?

The level of risk you take by buying an up-and-coming growth stock in the technology sector is extremely higher than buying an established blue chip stock that is trading undervalued in the market.

There is no right and wrong, there are just different approaches to the same issue.

💡 The longer the investment period and the more diversified the portfolio, the lower the risk without sacrificing much of the return.

Finally, only invest money you are willing to lose.

💡 A mental model that seems to work great for me is considering every Euro I have invested as a loss. That way, the investment money is not budgeted for other expenses, and when it comes time to liquidate, it seems like a fat bonus to me.

Frequently Asked Questions

Here are some of the most frequently asked questions about which are the best stocks to buy today:

What are the best stocks to invest in 2024?

The best stocks for 2024 will be the ones offering the largest dividend or the greatest price increase. No one can answer this question with certainty – anyone who does is either lying or ignorant. Stock prices are only influenced by supply and demand, which is determined by countless factors: company performance, general market conditions, the country’s economic indexes, the industry in which it operates, and so on.

What are the best stocks?

The best stock is the one that best fits your investment philosophy. If you are looking for undervalued stocks that trade at prices below their intrinsic value, it is value stocks. If you are looking for stocks with the potential for rapid price growth in the future, you should look for growth stocks. Finally, if you are interested in receiving regular payments and increasing your income, then look for stocks with the highest dividend – dividend stocks.

What are the highest dividend stocks?

One category of stocks with the largest dividend is Dividend Aristocrats. They are companies in the S&P500 index with high market capitalization and liquidity that have paid solid and growing dividends to shareholders for more than 25 consecutive years.

Which are the cheapest stocks?

Contrary to popular belief, a cheap stock is not one trading at a low price but one trading below its intrinsic value. In short, cheap stocks are those whose price is lower than their intrinsic value. Thus, cheap stocks are undervalued stocks.

How do I find undervalued stocks?

The tool you use to find undervalued stocks is called fundamental analysis. It allows you to calculate their intrinsic value and compare it to their current market price to see if they are undervalued or overvalued. Some characteristics of undervalued stocks are low P/E Ratio and P/B Ratio as well as high dividend yield.

How do I buy stocks?

To buy stocks, there are 4 steps you need to follow: Create a new investment account, confirm your identity, transfer money by wire transfer and buy the stock of your choice. If you want to buy the stock at the current market price you should select “Market Order” If you want to choose the price yourself, then “Limit Order”.

Where do I buy stocks from?

The easiest and quickest way to buy stocks as an individual is through a brokerage platform taking on the role of an intermediary, and offering access to the exchanges. The key criteria for platform selection are security, fees, available investment options and ease of use. Some popular platforms are Saxo Bank, DEGIRO, Trading212 and eToro.

Which is the best platform for stocks?

I choose Saxo Bank as it meets most of the criteria – and then some. It has a banking license from Denmark (hence a deposit guarantee of up to €100,000), has been operating since 1992, is regulated by about 9 regulators and recently received the Systemically Important Financial Institution (SIFI) designation. The only ‘problem’ it faced was extremely high fees, which have recently been greatly reduced.

What are the best books for stocks?

Books are an essential ingredient of success for any investor. Some of the most important books on stocks are:

- The Intelligent Investor

- One Up On Wall Street

- A Random Walk Down Wall Street

- The Little Book of Common Sense Investing

- The Bogleheads’ Guide to Investing

What are the best sites for stocks?

Some websites that I get my information from are TradingEconomics, Bloomberg, Investopedia, MorningStar and YahooFinance.

What are the best stocks to buy?

Based on Google search volume, the most popular foreign stocks to buy today are Apple Inc. (AAPL), Microsoft Corporation (MSFT), Amazon.com, Inc. (AMZN), Alphabet Inc. (GOOGL), Meta Platforms, Inc. (META), Tesla, Inc. (TSLA), Berkshire Hathaway Inc. (BRK.A), JPMorgan Chase & Co. (JPM), Johnson & Johnson (JNJ), Visa Inc. (V), Walmart Inc. (WMT), Procter & Gamble Co. (PG), NVIDIA Corporation (NVDA), The Home Depot, Inc. (HD), Mastercard Incorporated (MA), The Coca-Cola Company (KO), Pfizer Inc. (PFE), Bank of America Corporation (BAC), Intel Corporation (INTC), and Exxon Mobil Corporation (XOM). You’ll find them all, with the best commissions, at Saxo Bank.

How do I find stocks with potential?

More material about investing:

Did you like the article? Read more about investments in the articles below:

How to Invest with Little Money as a Beginner: 100, 1000 and 10000 Euros

Well, well, well … 1.000€ in your pocket, ready to…

How to Invest in Gold as a Complete Beginner: Ultimate Guide [2024]

Being here, you must be interested in learning more about…

Don’t forget that investing involves risk. You may lose part or all of your fortune.

Risk Disclaimer:

I am NOT a professional investment advisor and the following is NOT an investment recommendation but is my personal experience and opinions.

Keep in mind that always investing = risk.

Only invest money that you are willing to lose!

Affiliate Disclaimer:

The above links to the services listed may be affiliate links. If you use the service through them then you are helping MoneyMinority to continue to exist, at no extra cost to you.

Feel free not to use them if you do not wish to.

Read more about Risk & Affiliate Disclaimers of MoneyMinority.

![How to Invest in Gold as a Complete Beginner: Ultimate Guide [2024] How to Invest in Gold as a Complete Beginner Ultimate Guide](https://moneyminority.com/wp-content/uploads/2024/01/How-to-Invest-in-Gold-as-a-Complete-Beginner-Ultimate-Guide-768x432.png)