Well, well, well … 1.000€ in your pocket, ready to invest? Who do I have in front of me, Soros or a Rothschild?

All jokes aside, €1,000 may be considered little money in the investment world, but it is still an excellent start!

As Zig Ziglar once said, “You don’t need to be great to start, but you do need to start to become great.”

Forget what you know! I come to debunk the rumour that investing is only for deep-pocketed “elite” businessmen.

Today, we will discuss investments anyone can make with a small initial capital of €5,000, €1,000 or even €100.

☕ Make some coffee, and let’s go!

Where to invest with little money – in short

Here’s a summary of what we’ll be covering and some quick answers to your questions. Whether you’re a beginner or an advanced investor, I recommend reading the whole article – it will answer plenty of questions.

Investing with little money: Indicative and popular forms of small capital investments are: Stocks – ETFs – Bonds – Gold – Mutual Funds – P2P Lending – Real Estate – Small Business – Education.

What is the best investment for a beginner? If you ask me, the best investment for a beginner is a broad-based index ETF. It offers high diversification, passivity and an excellent risk/potential return ratio.

Should I invest or save? Before you start investing, you should have your finances in order. In short, you should have money set aside, maintain an emergency fund and not be in debt to third parties.

Can I invest €1000? Yes, you can! €1,000 is an amount capable of being the kick-off for your new long-term investment journey.

How to invest €1000? One intriguing way to invest €1,000 is through a LifeStrategy ETF from Vanguard. It offers exposure to both stocks and bonds, high diversification, auto equalisation and requires minimal management.

Can I invest €100? Yes, even a small amount of €100 is enough to get you started. Although it alone won’t take you far, it will help you build the habit of investing.

How to invest €100? You can invest €100 in a broadly diversified equity ETF such as VWCE and Vanguard’s VUAA.

How to invest 10000 Euros? You can invest €10,000 in a portfolio of stocks, bonds and real estate made to your specifications.

Advice for beginner investors: The best advice for any newcomer is to develop an investment mindset – there are no quick wins, investing is not gambling, investing is boring, and slow and… it won’t make you rich!

How do I properly invest my money? To properly invest, you need to have defined your investor profile – Set a time frame, understand the level of risk you are willing to take, set precise goals, take tax into account and don’t forget to feed your investment systematically.

Best investing platform: with safety as a priority, I chose Saxo Bank. A tier 1 broker that has been operating since 1992, has a banking license, is regulated by the Danish Financial Services Authority (FSA) and recently received the title of Systemically Important Financial Institution ( aka, too big to fail). Not long ago, it slashed commissions significantly and now has no rival. There you will find stocks, bonds, ETFs and mutual funds.

✍ Sign up for free at Saxo Bank →

In this article, you will read:

- Is €1000 enough? →

- Investing with little money →

- How to invest €1000 →

- How to invest €100 →

- Investing money the right way →

- Tips for investing →

- ❓ Frequently Asked Questions →

| 📈 Investing with little money | ETFs, Stocks, Bonds, Gold, Bitcoin |

| 💲 How to invest €100: | All-world equity ETF |

| 💲 How to invest €1000: | LifeStrategy ETF |

| 💲 How to invest €10000: | Complete Portfolio |

| ✅ Investing money the right way: | In 5 steps |

| 💡 Investing Tips: | The 12 Rules |

Can I start investing with 1000 euros?

Yes, of course, you can start investing with €1,000.

🎉 First of all, give yourself a thumbs up! With most people around you recording low or negative savings rates, you managed to save €1,000 that you want to invest. That’s no small feat…

What return can an investment of 1000 Euros have, though?

Supposing you decide to put this capital into the US economy through an ETF that follows the S&P500 index (we will see later what this means).

According to data from officialdata.org, if you had invested $1,000 in early 2003 your capital would now be worth $7,449.

- Total return → 645%

- Average annual return → 10.2%

- Time period → 20 years

Let’s start from the basics: Yes, investing makes sense even when it comes to €100, €1,000 or even €10,000.

Warning: the example is referring to the past – the past is not an indicator of a repetition in the future.

How do I invest my money the right way?

Correct and clever investing involves 5 steps: time frame, risk profile, goals, taxation and systematic feeding.

In short, you need to build your plan. Investing without it is like trying to get out of a maze with your eyes closed – I’m not saying you can’t do it, but will luck be enough?

#1 Time Frame

The first decision you’re called upon to make is the time frame you want to invest your money.

A long time frame allows:

- Compound interest to show its power and multiply our capital over the years.

- Minimizing short-term price volatility in times of downturns, crises and geopolitical issues.

Ask yourself: How do you feel about committing this amount?

💡 It is advisable to invest only long-term with time frames exceeding 10+ years.

#2 Risk Profile

Let’s start with the first premise of investing: there is no investment without risk.

Completely avoiding investment risk is unrealistic. Your goal is to recognise the risk and decide whether to take it for a potential return.

Ask yourself: What level of risk am I willing to take so I can sleep well at night?

One way to reduce risk without significantly sacrificing performance is to increase diversification.

You wouldn’t put all your eggs in the same basket, so don’t place all your hopes in a single investment vehicle (e.g., a single stock).

💡 It is advisable to apply risk diversification to your investments.

#3 Goals

If I were to bet, you wouldn’t find anyone investing just for fun!

The basis of investing is based on the concept of delayed gratification.

In short, you agree to forgo momentary spending pleasure today in hopes of a more valuable future reward.

Ask yourself: What are you investing for? Do you want to buy a house? A second pension for the future? To create an additional passive income stream?

💡 It is advisable to define your investment goals before you start. Clear goals serve as a compass to keep you on track.

#4 Taxes

Unfortunately, once again, the government misses no opportunity to get its hands on your assets.

Όπως και να έχει, το καθεστώς φορολογίας για επενδύσεις στην Ελλάδα είναι αρκετά ευνοϊκό. Για παράδειγμα, τα UCITS ETFs έρχονται με μηδενική φορολογία, τόσο σε επίπεδο υπεραξίας όσο και σε μερισμάτων.

💡 Despite the tax-free nature of several types of investment, every transaction should be properly declared in our tax return because it is presumptive. It is advisable to consult with a tax advisor or accountant who specializes in investments to ensure peace of mind.

#5 Systematic supply of funds

Disappointing to many, investing is not something you do once and you are done.

Don’t get me wrong, you can do it, but you won’t have the best results.

For an investment to perform at its best, in addition to time, it needs a systematic supply of additional funds.

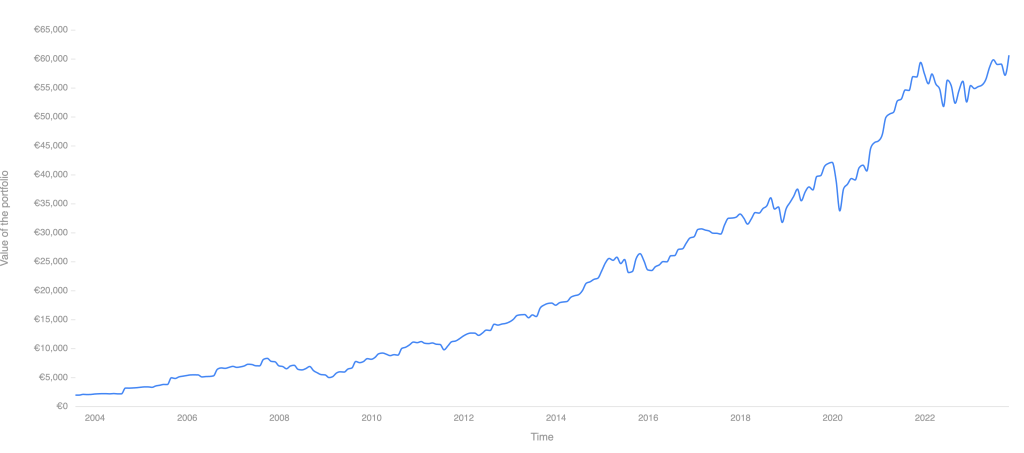

If you invested €1,000 in early 2003 in an ETF that follows the global economy (VWCE) for 20 years later, your capital would be worth €4,911.

If, along with the initial capital, you chose to invest an additional 1,000 Euros every year, the value of your capital today would be €60,665!

💡 It is advisable to create a plan that includes regularly feeding your investments with additional funds. It doesn’t need to be done with great frequency (e.g. every month) as the commissions can… skin you!

What to consider before investing

🤚 Whoa, wait a minute! Before you start investing, you need to take care of your finances.

#1 Know what is coming in and what is going out

The first step is about gaining control. It is in your best interest to know, at all times, the income and expenses of each month. That way, you can identify potential problems and “leaks” secretly nibbling away your income.

A budget will help you get started →

#2 Become surplus

In the same sense that every business aims to make a profit, the goal of any personal budget is surplus. In short, you need to plan a way to reduce your expenses and/or increase your income.

One technique that will help you is C.I.I. – Cut, Increase, Improve →

#3 Create an emergency fund

It’s a fact that you can’t avoid a setback. All you can do is be prepared to greet it when it comes.

A cash fund will help you cover any emergency arising solved with money without resorting to a loan – a layoff, a breakdown, or an accident.

You can start by setting aside an amount sufficient to cover your basic needs for 3 months →

#4 Pay off debts with a high-interest rate

Think about how crazy it is to try to achieve positive returns when, at the same time, you are burdened with guaranteed negative returns of 20% on your credit card.

If you have debt, your #1 priority should be paying it off →

#5 Save systematically

Saving is the foundation of your financial health. Without it, the idea of investing shouldn’t even exist. Try to save at least 10% of your income monthly.

Investing with little money as a beginner

Let’s look at some ideas on how you can cleverly invest small funds like €1,000 :

💡 Idea #1

Investing in Stocks

| 💰 Min. Amount: | Less than €100 |

| 🤝 How? | Through an online broker |

I am sure many people will discourage you from investing with little money in stocks. And while it is true that you’ll need a lot of capital to see substantial profits, the start can be made with as little as €100.

Think of it like a seed that you plant today. Over time, you give it care and attention so that, in the future, it grows into a magnificent tree. Just be careful that it doesn’t end up as a bonsai.

After all, Rome wasn’t built in a day.

What is a stock?

A stock is an asset that represents ownership in a company. As a shareholder, you are one of the (many) owners of the company and have a share in its profits.

How do you make money from stocks?

Stocks offer profits to an investor in 2 ways:

- 📈 Capital Gains: profit resulting from selling the stock at a higher price than it was bought.

- 💰 Dividends: regular payments to shareholders deriving from the company’s profits.

Example:

Apple is one of the most popular technology companies on the planet. If you buy stocks in Apple, you become the owner of an infinitesimal percentage of the company with a right to its profits.

What’s the risk?

Investing in individual stocks implies that the returns will be closely linked to the performance of the company in question. In short, if the company doesn’t do well, your return will be negative. If it goes out of business? You’ll lose your capital!

How do you reduce the risk? By increasing diversification through an equity ETF →

How do I invest in stocks?

Stocks are sold and bought by stock exchanges around the world. The easiest way to access them is through an exchange platform – an online broker.

Two of the most popular options for stocks are:

- The Dutch DEGIRO with more than 2.5 million users and incredibly low fees →

- Trading212 which offers one free fractional share up to €100 if you sign up with the code “STERG“ →

📙 Beginner’s Guide: Learn how to invest in stocks →

💡 Idea #2

Investing in Bonds

| 💰 Min. Amount: | >€100 for ETFs, €1,000 for Bonds |

| 🤝 How? | Online brokers, banks & investment companies |

A bond is a more fancy way to refer to a loan.

What are bonds?

Businesses and governments, in their effort to finance their operations and growth issue bonds intended to raise funds from the market.

Potential investors buy the bonds by committing their capital for a fixed period and earning interest (coupon) at specified intervals.

Example:

Typical examples are the bonds issued by the Greek government, the Republic of Cyprus and countries such as America or England.

- Treasury Bills (T-Bills) refer to short-term bonds of the USA with a maturity of up to 1 year.

How do you make money from bonds?

Investors receive regular payments in the form of interest (coupon) whilst their original capital is returned to them on the expiry date of the bond.

💡 A bond with a face value of €1,000 and an interest rate of 5% yields €50 in interest income annually.

What is the risk?

The main risk for a bond investor is non-repayment by the issuer.

In short, if a company or country goes bankrupt, its lenders may not receive all their money back.

📙 Beginner’s Guide: Learn all about bonds →

How to invest €1,000 in bonds?

You can invest €1,000 in bonds in 3 ways:

- Initially, when they are first issued in the primary market

- During their lifetime in the secondary market.

- Through a bond ETF

While buying bonds in the primary market is a relatively complex process, purchasing a bond ETF or through the secondary market is possible through online brokers.

🛒 Two popular choices are Saxo Bank and DEGIRO →

💡 Idea #3

Investing in ETFs

| 💰 Min. Amount: | less than €100 |

| 🤝 How? | Through Online brokers |

ETFs have managed in a few years to become one of the most popular investment vehicles, ideal for the average investor out there – and not without reason!

What are ETFs?

You could compare them to a basket that contains various assets inside – such as stocks, bonds or commodities.

An ETF allows investors to reduce risk by automatically, quickly and easily increasing diversification. In other words, instead of buying individual stocks and bonds, you buy an ETF that includes stocks and bonds.

Unlike mutual funds, an ETF is traded on the stock market and can be bought and sold just like a stock.

It is a popular choice among beginners because it offers a simple way to invest in a wide range of assets with a single purchase.

📙 Beginner’s Guide: Learn how to invest in ETFs →

How do you make money from ETFs?

An ETF offers profits similar to a stock:

- 📈 Capital Gains: if you sell the ETF at a higher price than you bought it

- 💰 Dividends: just as a company distributes a dividend, an ETF passes on the dividends of all the underlying companies to investors.

Examples of ETFs:

- Vanguard FTSE All-World UCITS ETF (VWCE): a stock ETF that tracks the performance of the FTSE All-World Index, with more than 3,900 stocks of mid– and large-cap companies from around the globe.

- Xtrackers II Global Government Bond UCITS ETF (XG7S): a bond ETF that tracks the FTSE World Government Bond Index, including government bonds of all lengths from developed countries.

- Amundi ETF MSCI Emerging Markets UCITS ETF (CEMU): a stock ETF from Amundi that tracks the MSCI Emerging Markets index allowing investors to gain exposure to emerging market equities.

Can I invest €100 in ETFs?

Of course, you can! Most ETFs trade at prices below €100/unit making them an ideal choice for investors with little money.

How to buy ETFs?

The most popular options at the moment are Saxo Bank, DEGIRO, Freedom24, eToro and Trading212 →

💡 Idea #4

Investing in Real Estate

Look, you know it, and I know it: with €1,000 as available capital, our options in terms of real estate are limited.

Don’t expect to invest directly in land, residential or commercial property.

📙 Beginner’s Guide: Learn how real estate investing works →

💡 Idea #5

Investing in Gold

And while a small investment in gold isn’t going to turn you into the successful pirate with chests full of treasures you might imagine, it can add a little “sparkle” to your portfolio.

Is investing in gold worth it?

Investors tend to buy gold for two reasons:

- As “protection” against crises: When investor trust is lost from traditional markets (stock markets), they tend to go to “safe haven assets” such as gold. Thus, in financial crises, unexpected turmoil and market downturns, gold tends to “retain” its strength.

- As a hedge against inflation: While traditional currencies can be inflated at will by central banks (by increasing their quantity), the amount of gold on the market grows steadily and is relatively predictable.

You could say that buying gold is not an actual investment but a form of alternative savings.

How can you invest in gold?

There are many ways in which you can acquire gold:

- Buying physical gold in the form of coins, bullion and bars.

- Buying an ETC – Exchange Traded Commodity – a mutual fund that follows the global gold price.

- Investing in stocks of companies that are involved in gold mining.

- Buying cryptocurrencies which follow the price of gold.

📙 Buying gold: Learn more about gold investment methods →

What is the best way to invest a little money in gold?

The simplest, safest and easiest way to invest in gold is through an ETC like Xetra-Gold (4GLD). It has zero commission, whilst the value is reflected in real gold.

Where to find it? At Saxo Bank, DEGIRO and Freedom24 →

💡 Idea #6

Investing in Bitcoin

📙 Beginner’s Guide: Learn how and why to buy bitcoin →

💡 Idea #7

How to invest in your own Business

How to invest 1000 Euros?

Short answer: Create a portfolio of stocks and bonds by taking advantage of the automatic diversification offered by an ETF

Possible recommendation: A Vanguard LifeStrategy fund. These ETFs are an all-in-one, highly diversified solution consisting of stocks and bonds from around the globe in ratios of 100:0, 80:20, 60:40 and 40:60.

Every investor’s goal is to create a portfolio with the right assets, in the right proportion and offering a well-balanced mix of risk and return.

The two most popular investment vehicles from which to choose are stocks and bonds.

In general, stocks offer higher returns and are associated with higher risk, while bonds have lower returns and lower risk.

Roughly speaking, we would say that the role of stocks is to increase returns while bonds are to maintain the strength of our capital.

What proportion of bonds and stocks should you have?

The longer the time frame, the more risk you can take, and the greater the percentage of your capital that can be invested in stocks.

The shorter the time frame, the more exposed you are to potential short-term market declines, crises and negative financial events, so you should have more exposure to bonds.

Several investment professionals recommend a portfolio of 80% stocks and 20% bonds for ages 25 to 35.

If you’re older, increase the percentage of bonds. If you’re younger, you increase the percentage of stocks.

How do you reduce risk?

One way to reduce risk without sacrificing much of the return is by increasing the diversification of your investment.

Just as you wouldn’t put too many irons in the fire, putting all your money in a single stock or bond is not wise.

If you use €1,000 to invest in one company, your capital is automatically linked to that company. You will lose 100% of it if it goes bankrupt.

If you split the capital into stocks of different companies, you automatically reduce your exposure to individual company mispricing.

How can I invest €1000?

€1,000 is sufficient capital to invest in:

- Individual stocks

- Stock and Bond ETFs

- Government or corporate bonds

- Cryptocurrencies

- REITs and Real Estate Crowdfunding

- Gold and Bitcoin

Where else can I invest €1000?

If traditional forms of investing don’t satisfy you, you can always invest in yourself!

Become the photographer, programmer, designer, YouTuber or Blogger you’ve always dreamed of with €1,000 as the initial capital that will lay the theoretical foundations to make it happen.

📖 Platforms like SkillShare can help you with thousands of courses →

How to invest 100 Euros?

Short answer: Invest €100 in your first ETF symbolically, marking the start of a long-term investment plan for 10+ years.

Possible recommendation: A broadly diversified stock ETF like Vanguard’s VWCE.

Really, can you get rich with just a €100 investment?

Plenty of influencers can be found through a quick internet search claiming this is entirely possible. They even provide examples to support their claims.

What do they say? If you had invested €100 in Bitcoin back in 2013, you would have about 8 BTC. Their current value would be over €330,000 (!!!). Similarly, you would achieve similar returns with Amazon and Tesla shares.

| Vehicle | Value in 2013 | Value today |

| Bitcoin | €100 | €336.000 |

| Amazon | €100 | €1.190 |

| Tesla | €100 | €12.081 |

And while the numbers are real no one will tell you that the above situations are extremely rare, if not… unattainable!

For every Bitcoin and Amazon that succeeded, there are thousands of failed examples that would send your €100 down the drain.

🧠 It’s called confirmation bias – a logic error – whereby people only tend to pay attention to information that only confirms their prior opinions.

The reality? It is impossible to know in advance what the development of a small company, a cryptocurrency or

And if it does, it will only be by chance. But we can’t base our investments solely on luck, can we?

So, you don’t have a chance? On the contrary!

While €100 won’t make you a millionaire, it can be an excellent start to your journey in investing.

Build a strategy, set your risk level, set your time frame and use it to mark the start of your investment plan.

How can I invest €100?

€100 gives you access:

- most ETFs

- Stocks

- Bond ETFs – Most bond ETFs start at €1,000 /piece in the primary market

- Cryptocurrencies – no, you won’t buy the whole bitcoin but part of it

- in real estate through REITs or CrowdFunding and not through acquiring the physical property

Where else can I invest €100?

If you don’t want to invest your €100 in the markets, the best alternative investment you can make is – once again – yourself!

With €100, you can purchase almost 5 books. Books are an excellent way to gain condensed knowledge, learn from third-party experiences, and benefit from risk-free lessons. In summary, with €100, you can learn from other people’s mistakes.

📚 You can start with the 5 best books for investing in my opinion →

How to invest 10,000 Euros?

Short answer: With €10,000 you can create a comprehensive portfolio of stocks and bonds made to measure.

Some years ago, I attempted to do something similar.

I wanted to create a personal long-term passive investment portfolio with the prospect of securing an extra retirement fund in the future.

Of course, instead of 10,000 Euros, I started with €4,100

Its features are as follows:

- Long-term maturity of 30 years with liquidation at the age of 60

- Minimum time commitment as it will consist only of passive investment products such as ETFs

- Minimal costs as transaction fees are infrequent, while the average management cost of ETFs is 0.22%/year

- Maximum possible diversification as it has exposure to the global economy (equity ETF), the global bond market (bond ETF) and the global real estate market (REIT ETF)

- Ideal risk management for my investment profile with a mix of 70% equities, 15% bonds and 15% REIT ETFs

You can take inspiration from this portfolio and create your own. €10,000 is an excellent start!

💡 Want to learn more? Take a look at my passive portfolio →

How to invest €10000? – All at once or gradually?

If your investment plan is long-term, you have a large spread and you believe the global economy will continue to grow, there is no reason not to invest all at once.

Think about it: If you believe markets will be bullish over the long term, why are you keeping your money in cash?

💡 Besides, strategically it’s cheaper (less fees) and less complex.

🔍 If you don’t believe me, Morgan Stanley and Vanguard agree on this dilemma: They both discovered it’s best to put it all together at the beginning of investing.

How can I invest €10,000?

With €10,000 the range of options opens up considerably. You can create a complete portfolio with:

- Company stocks

- ETFs and Mutual Funds

- Bonds and Bond ETFs

- Bitcoin and altcoins

- Real estate

- Gold

Where else can I invest €10,000?

10,000 Euros can be enough to provide the initial capital to start your new business.

I have personal examples of friends who, with smaller capital than 10k, opened small businesses and managed to grow them to bring in multiple revenues very quickly.

And while most people tend to fear the upfront costs and taxes, if you ask me, all of that is secondary.

Unless you choose something capital-intensive (e.g. you want to be an industrialist) – I’ll pass on that.

The important thing is to find a field you know well, have something to offer that others don’t and be willing to go all in on it. With work, strategy, persistence and patience, I believe the formula works…

Investment Tips

Although I’ve gone over many times why I consider advice on investing to be completely invalid (even dangerous), I’m going against it and giving you some general rules with which you can approach investing.

Here are some mental models that will help you better understand the world of investing. By keeping them in mind, you will avoid many mistakes and pitfalls that a beginner usually falls into.

The 12 rules of investing:

- All investments involve risk:

A U.S. government bond goes together with significantly less risk than a share in a Greek company or a new cryptocurrency. In all 3 cases, there is risk. Sometimes more, sometimes less. - Every return contains risk:

If it helps you, think of it the other way around. Performance arises as a reward precisely because you agree to take some risk. - There are NO guarantees in investing:

No company can guarantee, in advance, that it will continue to do well enough to offer dividends and increase its stock market value.

No government can guarantee its fiscal health in advance to always manage to repay its creditors (i.e. those who have invested in its bonds). - There is no high yield without high risk:

The higher the return someone is willing to offer you, the higher the risk they are willing to take.

For example, look at bank loans: The more they believe in your ability to repay a loan, the cheaper the interest rate they will give you… and vice versa! - The past is NOT a guarantee for the future:

The fact that a company has been paying dividends for 10 consecutive years is no guarantee that it will continue to pay dividends for the 11th. - Past performance, shows almost NOTHING about future performance:

The fact that the US stock market has grown at a 10% annual average for the last 20 years, in no way means that it will continue to do so for the next 20. - Investing is one thing, trading is another:

Investing → I buy assets intending to hold them for the long term to benefit from the increase in their value or from regular cash payments they make.

Trading → I make frequent purchases and sales of assets to profit from the difference between the purchase and sale price, in the short term. - Investments do NOT offer quick profits:

For reasons such as compound interest and short-term market volatility, the only way to make a profit (without taking on too much risk) is by investing for the long term. - Investing is good at preserving wealth:

If you want to create wealth from scratch you need to go into the market and add value through your work, ideas or business. Then investing will help you feed that wealth back into the market to protect it from phenomena like inflation. - Investment is boring, long-term and slow:

If you are looking for something exciting that will keep you constantly in front of your computer or mobile screen and give you frequent dopamine hits, look at gambling, betting and online trading. - When something sounds too good to be true, well… it is!

Ignorance of risk does not automatically imply an absence of risk. - No one, ever and for any reason, will NOT approach you on their own to help you make money:

If someone knows the formula for immediate profits, they will not share it with you. Perhaps the most basic rule of the internet.

Frequently Asked Questions

Here are some of the most frequently asked questions online about small capital investments such as €100 and €1,000:

What is an investment?

Investing is the act of buying something today (stocks, bonds, real estate) in the hope that:

- its value will increase over time

- and/or provides money in the form of regular payments to its holders.

It is like planting a seed today with the expectation that it will become a large tree whose fruit you will continually enjoy in the future.

What to invest in Europe?

The good news is that as a Greek resident, you have access to a great variety of investment vehicles. Some of them are:

- Stocks & Shares

- ETFs

- Bonds

- Gold

- P2P Lending

- Real Estate

It’s up to you, to pick the ones that go hand in hand with your investment profile and risk tolerance. I hope that this article was a great way to start.

What is the best investing platform?

After extensive research, I chose Saxo Bank because it meets most of the criteria – and then some. It has been operating since 1992 with a banking license from Denmark (hence a deposit guarantee of up to €100,000), is regulated by about 9 authorities and was recently considered a systemically important financial institution (SIFI) by the Danish regulator – hence too big to fail. Meanwhile, it has lowered its fees considerably, making it one of the best and most affordable solutions for private investors.

What are the smartest money investments?

If you ask me, one of the smartest investments you can make with your money is broad index ETFs that track a global stock market index.

Do you want the American economy? The European? The global one? The return-to-risk ratio they offer is exceptionally favourable while requiring no active management on the part of the investor.

A prime example is Vanguard’s VWCE, which I have also chosen for my personal passive portfolio →

Beyond that, in the above article, we looked at many forms of smart investing, such as:

- 📈 stocks →

- 💴 bonds →

- 🏡 real estate →

- ₿ Bitcoin →

Will I make a profit for sure?

No, no investment can guarantee a sure profit! Sorry if I’m spoiling your dreams, but one of the basic rules in investing is how: without risk, there is no return.

How quickly will I make a profit?

How quickly you make a profit solely depends on the levels of risk you are willing to take. In general:

- Low returns → Low risk

- High returns → High risk

Keep in mind that the more you increase the risk, the more you increase the probability of reaching that tipping point at which the investment collapses, losing all your capital.

Tip: Quick profit and investing don’t go together. In pursuing it, you risk exceeding the tipping point, turning it into a gamble. Investments are made to be slow and boring.

Can I double my money?

Yes, you can double your money through investments!

How fast it will double depends on the performance of each investment – the higher, the faster the doubling will come.

The easiest way to calculate this is through the rule of 72: take the number 72 and divide it by the interest rate of the investment to find the doubling years.

For example, a bond with a 4% annual interest rate will double your capital in 18 years, whilst an investment in the US stock market will double in just 7 years (!!!)*.

*Attention: the calculation is based on historical data from the last 20 years, where returns were at 10.2% per year. They are no indication that they will recur again in the future.

What is the most appropriate investment?

The most appropriate investment is the one that matches your investment profile, time frame, goals and risk tolerance.

In short, you won’t find a single investment that works as universal and fits everyone.

In general, one rule that seems to hold is that the more years you have ahead of you, the higher the level of risk you can take.

For example, an investor close to retirement cannot afford to be only invested in stocks. A potential crisis or market downturn can jeopardize the value of his portfolio.

In contrast, a 20-year-old can be 100% invested in stocks as he has many years ahead of him, capable of absorbing any short-term price volatility.

Where can I find a 10% return?

Perhaps the easiest and simplest way for an everyday investor to achieve a 10% return is through a broad index ETF.

And this is confirmed by the numbers:

- Using data from the last 50 years, U.S. stocks have offered a nominal annual average return of 10.44%.

- With 20 years of data, the global economy (as expressed by global stock indices such as the FTSE All-world) offered a nominal annual average return of 8.45%

The Key premise to keep in mind is to always have a long-term time horizon of 10+ years.

What is the easiest way to invest money?

If you ask me, the easiest way for a novice investor to approach the markets is through an ETF. Why?

- Passive investment: you don’t have to be in front of a screen all day giving sell and buy orders. You buy once at regular intervals.

- High diversification: An ETF contains many underlying assets under its umbrella

- Convenience: They are traded on exchanges while offering ownership of many assets with one purchase.

- Risk: Return Ratio: They offer an excellent risk: return ratio given that an investor has a long-term time horizon in their strategy (10+ years)

What is worth investing in?

Stocks or cryptocurrencies? Bonds or bond ETFs? Real estate in the form of REITs, Real Estate Crowdfunding or buying property? Where is it worth investing your money?

To be able to answer the above questions, you must first understand the basics of investing.

Is there the best stock to invest in?

Of course, some stocks are better than others for investing. The problem is that we figure it out after the investment is made and never before.

If you invested 100 Euros in Tesla stock in 2013, today your investment would be worth more than €12,000. And while today, such an investment may seem obvious, back in 2013 it would have been an extremely risky and careless move.

Remember: For every triumph of a Tesla and an Amazon, there are thousands of companies fading into obscurity.

More material on investing:

If you liked this article, you can read more about investing in the articles below:

Which Stocks to Buy as a Beginner: An In-depth Guide 2024

Having already delved into the basics of investing, you believe…

How to Invest in Gold as a Complete Beginner: Ultimate Guide [2024]

Being here, you must be interested in learning more about…

Don’t forget that investing involves risk. You may lose part or all of your fortune.

Risk Disclaimer:

I am NOT a professional investment advisor and the following is NOT an investment recommendation but is my personal experience and opinions.

Keep in mind that always investing = risk.

Only invest money that you are willing to lose!

Affiliate Disclaimer:

The above links to the services listed may be affiliate links. If you use the service through them then you are helping MoneyMinority to continue to exist, at no extra cost to you.

Feel free not to use them if you do not wish to.

Read more about Risk & Affiliate Disclaimers of MoneyMinority.

![How to Invest in Gold as a Complete Beginner: Ultimate Guide [2024] How to Invest in Gold as a Complete Beginner Ultimate Guide](https://moneyminority.com/wp-content/uploads/2024/01/How-to-Invest-in-Gold-as-a-Complete-Beginner-Ultimate-Guide-768x432.png)