🔄 Last updated on 20 February 2024

🥇 The #1 investment platform choice for MoneyMinority

🎁 Earn €200 off commissions (until 23.02.) →

Saxo Bank is one of the most popular investment platforms in Europe. It gives you access to more than 50 stock exchanges, 23,500 stocks, 7,500 ETFs, bonds and all kinds of stock market derivatives (options & futures). It also offers interest on money you haven’t invested and robo-advisor options.

Its credibility is excellent as it has been in operation for more than 30 years, has a banking license in Denmark, is supervised by strict regulators and in ’23 was designated as a financial institution of systemic importance.

After all that, you would expect it to be costly? That’s right… it was!

Some time ago, it rapidly changed its pricing policy by removing all fixed charges and, at the same time, reducing transaction fees. Now, it has managed to be extremely competitive and stands among the cheapest platforms in the industry.

If you are looking for an investment company with the security of a traditional bank and the prices of a discount broker then Saxo Bank can meet your needs and more.

Whether you are a trader or a long-term investor.

🎮 Create a free trial account today →

Why choose Saxo Bank:

My opinion on Saxo Bank – in a nutshell

Some years ago, when I was taking my first steps in investing, I was asked to choose a brokerage platform. With the research at the time, I had come up with a choice between DEGIRO and Saxo Bank.

And while Saxo Bank was ahead in everything, I chose DEGIRO because the former’s commissions were… prohibitive. I thought it was a great investment bank, for big pockets.

I was pleased to see a while back that Saxo Bank changed its pricing policy by rapidly reducing its high fees and commissions, in terms of trading and non-trading fees.

In fact, in some products, it has managed to be cheaper than DEGIRO, as we shall see.

It’s like having the security of a top-tier broker with a banking license, who is supervised by the Danish Capital Market Commission and is considered a systemically important institution (SIFI) with extremely affordable fees as if it were a discount broker.

Nowadays, I have transferred a significant part of my investments to Saxo Bank. The rest remains with DEGIRO.

A little diversification AND on the subject of investment companies never hurt anyone.

🛡️ Security: I consider the company to be operating at an extremely high level. It has been in operation since 1992, is overseen by highly respected regulatory bodies around the globe (DFSA 🇩🇰, FCA 🇬🇧, FINMA 🇨🇭), has a banking license and is considered a systemically important financial institution (SIFI).

Is Saxo Bank, a scam? No, Saxo Bank is not a scam!

🔍 Read more: Security, guarantees and regulation of Saxo →

💸 Commissions and fees: After the change in pricing policy, Saxo’s commissions have become very competitive. There are no account creation, deposit, withdrawal or inactivity fees, you can buy US stocks for $1 and global ETFs for €2 while the minimum deposit has been reduced to €1.

🔍 Read more: Saxo commissions and fees →

📊 Investment products: Gives you access to 50+ stock exchanges, 23,500+ stocks, 7,000+ ETFs and 5,900 government and corporate bonds. Finally, it offers alternatives to ETF investors looking for a way out of the constraint of the absurd PRIIPs regulation.

🔍 Read more: Saxo’s investment products →

💻 How to create an account: Get your passport ready, find a residential address document, get your phone in hand and click this link. If you get stuck anywhere you can email me and I’ll help you for free – all I ask is that you use the affiliate link to sign up.

🔍 Read more: How to create a Saxo account →

📈 How do I buy ETFs and Stocks: You search for the investment product of your choice in the search bar (by name, ticker symbol or ISIN) and click “Trade”. Then you enter the appropriate order (market or limit), the quantity you want to buy and… it’s yours!

🔍 Read more: How to buy and sell products on Saxo →

Contents of Saxo bank guide:

- What is it? →

- Security →

- Is it a scam? →

- Charges and commissions →

- Available products →

- How to make an account →

- How to make a deposit →

- How to invest [step by step] →

- Frequently asked questions →

What is Saxo Bank?

Founded in 1992 by Kim Fournais in Denmark, where it still maintains its main headquarters although it operates across the globe.

A few years later, in 1998, it created one of the first European online investment platforms, offering the tools to traders and investors everywhere.

In 2019, it acquired (for $428 million) the popular investment firm BinckBank, from which the founders of DEGIRO came from.

Today, it hosts more than 1,000,000 clients from around the globe, manages around $100 billion in client assets (AUM), and more than 260,000 trades take place on its platform daily with a volume of more than $17 billion.

Safety

Saxo Bank scores very high on security.

| In Operation: | 30+ years |

| Banking license: | Yes |

| SIFI*: | Yes |

| Deposit Guarantee: | up to €100.000 |

| Provided: | Danish Deposit Guarantee Scheme (Garantiformuen) 🇩🇰 |

| Main supervision: | Danish Financial Services Authority (DFSA) 🇩🇰 |

| Additional Regulation: | FCA 🇬🇧, FINMA 🇨🇭, ACPR 🇫🇷, AMF 🇫🇷, JFSA 🇯🇵, SFCHK 🇭🇰, MAS 🇸🇬 |

| Credit rating agency: | S&P Global Ratings |

| Investment Guarantee: | up to €20.000 |

| Asset segregation: | Yes |

| Balance sheet publication: | Yes (voluntarily) |

Operates under a full banking licence under the Danish Financial Services Authority (FSA). It is, therefore, forced to comply with stricter regulations than non-banking investment companies.

In addition, it operates in several countries worldwide and is supervised by the respective regulatory bodies. Some of the most prestigious ones are:

| Country | Regulator | License |

| England 🇬🇧 | Financial Conduct Authority (FCA) | No. 551422 |

| Switzerland 🇨🇭 | Swiss Financial Market Supervisory Authority (FINMA) | CHE-106.787.764 |

| Japan 🇯🇵 | Japanese Financial Services Agency (JFSA) | 0104 -01-082810 |

| France 🇫🇷 | Banque de France / Autorite Marche Financial | 495 193 849 |

For the sceptics, take a look at the list of all the regulatory licenses under which Saxo Bank operates.

🛡️ Deposit Guarantee up to €100,000: As Saxo Bank operates as a bank, customers’ cash deposits are protected by the Danish Deposit Guarantee Scheme (Garantiformuen) for amounts up to €100,000.

🛡️ Investment guarantee up to €20,000: As Saxo Bank operates as a licensed investment company, clients’ investments are protected by the EU’s Investment Compensation Scheme (ICS) for amounts up to €20,000. The responsible regulator is the Danish Capital Market Commission.

Asset Segregation: Saxo is forced (and supervised for this) to keep clients’ assets in separate accounts, segregated from its own. This way, in the event of a liquidation, clients can transfer them to another broker, and the firm has no right to use them.

❗ Systemically Important Financial Institution*: in 2023, Saxo Bank was classified as a SIFI by the Danish regulator (DFSA). This means that its operation is deemed of systemic importance to the country’s financial system. Therefore, it is monitored much more closely and in the worst case that something goes wrong… it has a better chance of being “rescued”. In short, it is ‘too big to fail’.

🧾 It publishes financial data: Despite not being listed on a stock exchange, it voluntarily chooses to publish its financials. Another step that makes it even more transparent to its customers.

Saxo Bank also commits to publish monthly data on its activity – assets under management (AUM) and daily/monthly trading volumes taking place on its platform.

Credit rating agencies: Saxo Bank’s debt is rated by S&P Global Ratings, which has assigned it a BBB rating with a positive outlook.

Is Saxo Bank a scam?

No, Saxo Bank is not a scam. It has been in operation since 1992, is overseen by prestigious regulatory bodies around the globe, has a banking license and is considered a systemically important financial institution (SIFI).

🛡️ Security: I would rank it on par with Interactive Brokers, higher than DEGIRO and well above eToro, Trading212 and Freedom24.

Charges, Commissions and Fees

For years, Saxo Bank was one of the most expensive investment platforms in Europe, until it decided to become… one of the cheapest!

Making a radical change to its pricing policy, it has significantly reduced commissions at every level. It will no longer charge you any non-trading fees, and on many products, trading fees are lower than discount brokers like DEGIRO. Let’s go over them in more detail:

Non-trading fees: no new account creation, deposit, withdrawal, or inactivity fees. There is a 0.25% fee for currency exchange.

Finally, there is a portfolio fee (0.15% per annum), which you can avoid completely if you activate stock lending in your account.

| Account creation: | Free |

| Deposit: | Free |

| Withdrawal: | Free |

| Inactivity fee: | No |

| Connectivity fee: | No |

| Min. Deposit: | €1 |

| Currency Exchange: | 0.25% |

What are non-trading fees? Non-trading fees are fixed charges that have nothing to do with product purchases and sales.

Trading fees:

After the changes in pricing policy, trading fees have also been reduced quite a bit. They depend on the level of your account:

- Classic account

- Platinum account

- VIP account

Below is a table of Saxo’s transaction fees:

| Classic | Platinum | VIP | |

| 🇺🇸 American Stocks: | 0,08% (min $1) | 0,05% (min $1) | 0,03% (min $1) |

| 🇬🇷 Greek Stocks: | 0,3% (min €10) | 0,25% (min €10) | 0,2% (min €10) |

| 🇬🇧 British Stocks: | 0,08% (min £3) | 0,05% (min £3) | 0,03% (min £3) |

| 🇩🇪 German Stocks: | 0,08% (min €3) | 0,05% (min €3) | 0,03% (min €3) |

| 🇨🇳 Chinese Stocks: | 0,08% (min. 15 CNH) | 0,05% (min. 15 CNH) | 0,03% (min. 15 CNH) |

| 🇯🇵 Japanese Stocks: | 0,08% (min 800 JPY) | 0,05% (min 800 JPY) | 0,03% (min 800 JPY) |

| 📈 Global ETFs: | 0,08% (min €2) | 0,05% (min €2) | 0,03% (min €2) |

| 🏷️ Government bonds: | 0,2% (min €20) | 0,1% (min €20) | 0,05% (min €20) |

| 🔮 Futures: | €/$ 3 /contract | €/$ 2 /contract | €/$ 1 /contract |

| 📝 Options: | €/$ 2 /contract | €/$ 1 /contract | €/$ 0,75 /contract |

What are trading fees? These are commissions that the platform withholds on every trade you make.

Example of trading fees at Saxo Bank:

Let’s say you want to invest €5,000 with a classic account, here are some examples of fees depending on the investment product you want to buy.

| Account level: | Classic |

| Investment amount : | €5.000 |

Fee to buy American stocks: If you want to buy shares of Apple (APPL), Meta (META) or any other US stock with a capital of $5,000 you will be asked to pay a commission of $4.

Commission for buying Greek stocks: If you want to buy shares of Mytilineos (MYTIL), OPAP (OPAP), Jumbo (BELLA) or any other Greek stock with a capital of €5,000 you will be asked to pay a commission of €10.

How much does it cost to buy an ETF: The same ETF can be traded on different exchanges, so you have to choose the one that suits you.

Based on Saxo’s fees, it is in our interest to choose the Amsterdam (Euronext), Brussels, Lisbon and Paris exchanges for two reasons:

- no foreign exchange is required – they are in Euro

- They have the lowest charges.

Purchase commission of a SP500 ETF: If you want to invest in an S&P500 ETF (equivalent to VUAA) with a capital of €5,000 and you choose one of the above-mentioned exchanges, you will be asked to pay a €4 fee.

The corresponding transaction in DEGIRO would cost €3 + €2.5 ( annually)

💸 Fees and commissions: After the change in pricing policy Saxo Bank became highly competitive. There are no account creation, deposit, withdrawal, or inactivity fees and by activating stock lending you also avoid portfolio fees. Also, you can buy US stocks from $1 and ETFs from €2.

Investment products

Saxo Bank offers a wide variety of investment products that satisfy even the most demanding clients. It also rewards you with a monthly interest rate on the uninvested funds you keep in your account.

You get access to more than 50 stock exchanges worldwide with 23,500+ stocks, 7,000+ ETFs and 5,900 bonds available for investment.

| 🏛 Stock Exchanges: | 50+ | |

| 📊 Stocks: | 23.500+ | |

| 📈 Global ETFs: | 7.000+ | |

| 🏷️ Bonds: | 5.900+ | |

| 🇺🇸 NASDAQ | 🇺🇸 New York (NYSE) | 🇬🇷 Athens (ATHEX) |

| 🇨🇦 Canada (TSX) | 🇬🇧 London (LSE) | 🇩🇪 Frankfurt (XETRA) |

| 🇨🇳 Shanghai (SSEC) | 🇨🇳 Shenzhen (SZSC) | 🇯🇵 Tokyo (JPX) |

| 🇮🇪 Dublin (Euronext) | 🇳🇱 Amsterdam (Euronext) | 🇫🇷 Paris (Euronext) |

| 🇵🇹 Lisbon (Euronext) | 🇮🇹 Milan (Borsa Italiana) | 🇨🇭 Switzerland (SIX) |

| 🇭🇰 Hong Kong (XKEX) | 🇦🇺 Australia (ASX) | 🇸🇬 Singapore (SGX) |

In addition, traders get access to stock market derivatives (options and futures) and Forex via CFDs or real assets. Finally, if you want investment advice you can use Saxo Select’s service, which is something like a robo advisor – there is a minimum deposit of €20,000 and commissions of between 0.5% and 1%

| 💱 Forex: | 🟢 | 190 price pairs |

| 📝 Options: | 🟢 | 20 markets |

| 🔮 Futures: | 🟢 | 28 markets |

| ₿ Cryptocurrencies : | 🟢 | via ETPs or Crypto FX |

| 🤖 Robo Advisor: | 🟢 | 0,5% to 1% commission |

| 🙌 Stock Lending: | 🟢 | Earn extra interest |

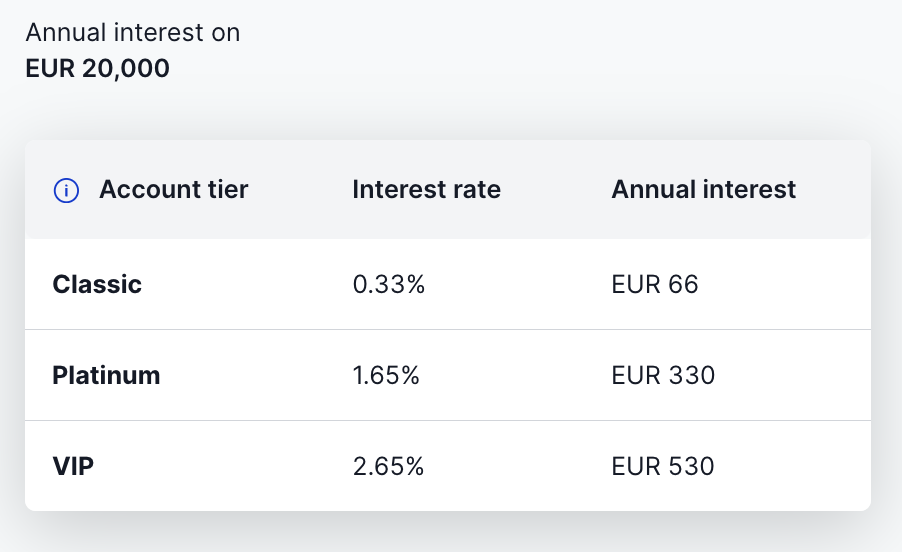

💰 Can I earn interest on my money? Yes, Saxo Bank will reward you with monthly interest on the money you keep in your account. The amount of interest depends on the central interest rates, the level of your account and the amount you keep in your account.

On 07.02.24. the following interest rates apply:

Can I invest in bond ETFs? Yes, there are many options which involve government and corporate bonds. Typical examples are the Global Government Bond (LU0908508731) with bonds of countries worldwide and the US Treasuries (LU0429459356) with US bonds.

Can I buy ETFs? Yes, of course! Saxo Bank offers more than 7,000 ETFs covering stocks, bonds, precious metals, REITs and even Bitcoin.

Can I invest in the SP500? Yes, you can invest in the 500 largest US companies through an ETF such as the S&P 500 ETF from Xtrackers with ISIN: IE000Z9SJA06.

Is there an alternative to VUAA? There is and it is cheaper! The S&P 500 UCITS ETF from Xtrackers has a cost of 0.06% (while the VUAA has 0.07%), and you’ll find it under the ticker symbols of XDPU (or XDPC, XDPE, and XDPG). It benefits you to buy it from the Milan or Frankfurt stock exchange.

Can I invest in a highly diversified ETF with stocks worldwide? Sure. Take a look at Xtrackers‘ MSCI World ETF (ISIN: IE00BJ0KDQ92) tracking the MSCI World index which invests in 85% of the investable market, developed and developing countries.

❗ Is there a problem with PRIIPs? Unfortunately, yes! Due to European legislation, platforms are not allowed to sell ETFs that don’t have their KID documents translated into the local language. However, Saxo offers a wide range of ETFs which will meet all needs.

Can I invest in gold? Yes, there are many ETFs (ETCs) available to invest in gold. Some examples are the Xetra-Gold ETC (DE000A0S9GB0), the IE Physical Gold ETC (DE000A2T0VU5) from Xtrackers and the Physical Gold ETC (IE00B579F325) from Invesco.

Can I buy VUAA from Saxo? You can buy an identical S&P 500 ETF from Xtrackers (ISIN: IE00B8KMSQ34) which is fully compliant, tracks the same index (SP500) and is UCITS.

Can I buy VWCE from Saxo? You can buy the MSCI World ETF from Xtrackers (ISIN: IE00BJ0KDQ92) which is fully compliant, tracks the index (MSCI World) and is UCITS.

Can I invest in Real Estate and REITs? Yes, you can invest in both real estate company dividends and REIT ETFs. A typical example is VanEck’s Global Real Estate (NL0009690239) and Xtrackers’ FTSE Developed Europe Real Estate ETF (LU0489337690).

Can I invest in Bitcoin ETFs? Yes! You can buy the Physical Bitcoin ETC (GB00BJYDH287) from WisdomTree or the Physical Bitcoin ETN (XS2376095068) from Invesco.

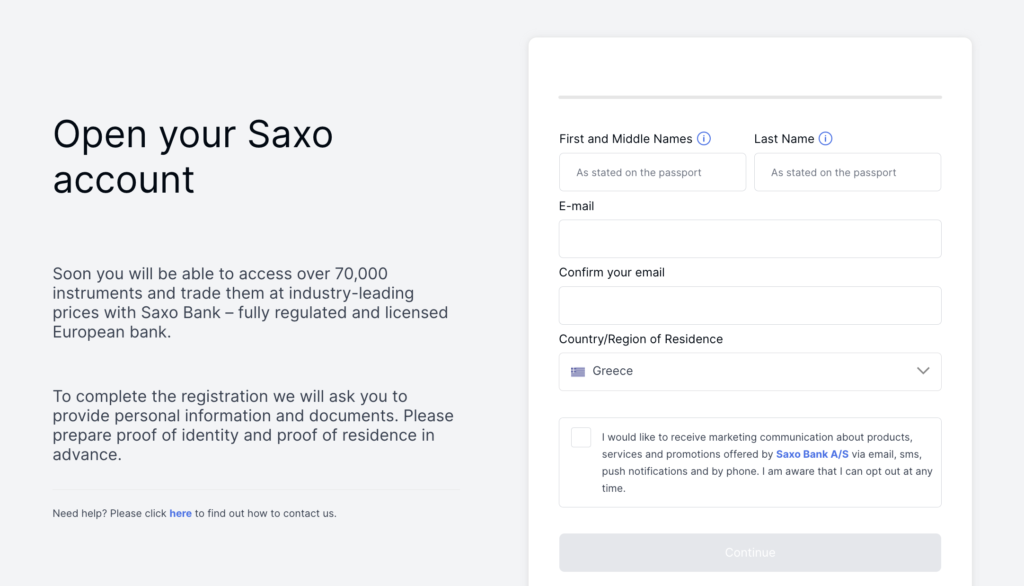

How to create an account

The most boring part of investing is setting up a new investment account. For regulation purposes, all investment companies are forced to identify their clients and put them through a “screening” process.

In the case of Saxo Bank, the account creation is entirely online, relatively easy and relatively quick.

What you will need:

- Identification document: Passport, driving licence or ID card

- Document of residential address: Any official document showing your home address. This can be a utility bill, a bank account or a card statement.

- Internet connection

- Mobile phone

How to get started: All you have to do is start the process from your computer or mobile phone and complete all the requested steps.

⏳How long it will take: Since I have all the documents ready, the process took me about 30 to 40 minutes. The confirmation from Saxo’s side took 1 day.

Tip: If you have a passport or driver’s license, use it. The residential address certification document should be in English so you can use statements from some digital banks like (Revolut, N26, Wise, etc.)

🎁Is there a signup bonus? If you use this link you will earn €100 discount on fees for your first transactions →

What if I get stuck? You can contact them via +45 3977 4113 or email [email protected] and someone from customer service will help you.

🤝I can help too: If you run into a problem, send me an email and I’ll help you for free if I can. All I would ask in return is that you use my affiliate link to sign up.

Deposit money to Saxo

To start investing, you will first and foremost need to fund your investment account with money.

| Deposit Fee: | Free |

| Minimum Deposit: | €1 |

| Methods: | Wire transfer |

| Duration: | 1 business day |

👍The good news: There’s no fee for receiving money from Saxo, the minimum transfer is €1, and the money appears in your account by the same business day.

👎The bad news: The bank from which you send money via transfer will, most likely, charge you.

How to deposit money at Saxo Bank:

- Log in to your new account and click “Fund” or “Deposit Funds” from the menu.

- You will see the deposit details of your unique bank account (IBAN) in Denmark.

- Copy the IBAN and SWIFT/BIC (if your bank asks for a beneficiary name, fill in “SAXO BANK A/S”)

- Log in to the e-banking of the bank you are working with and proceed to send money by wire transfer.

- In the beneficiary details, fill in the details from your new Saxo Bank bank account.

- You will find the money available the same day up to 5 business days (the first deposit may take a little longer to process, subsequent deposits are confirmed the same day)

🙋🏻Personal experience: My last deposit was made through Viva Wallet, which charged me 0.8€ for shipping and the money arrived the same day.

How I invest through Saxo

Let’s see, step by step, how to invest through Saxo Bank.

💡The process is similar for whichever investment vehicle we choose, whether it’s stocks and ETFs, or bonds and mutual funds.

Quite a few people want to invest in the US economy through the S&P500. One of the most popular ETFs that follow the index is called VUAA issued by Vanguard.

❗Due to European PRIIPs legislation and the fact that Vanguard has not translated the KID document into some languages, this ETF is not available to investors in some countries.

The truth is that we don’t mind at all because there is an alternative that is both compliant and… better!

What is the alternative to VUAA? I am referring to the S&P 500 UCITS ETF issued by Xtrackers (DWS). It tracks the same index (S&P500), has a lower unit price (ideal for retail investors) and has lower management costs than VUAA. Vanguard’s ETF has a TER of 0.07% while Xtrackers’ has a TER of just 0.06% per annum.

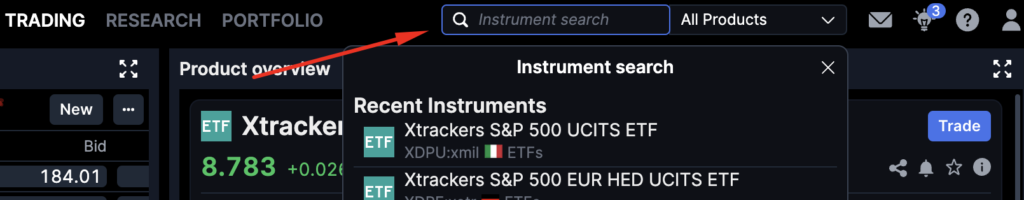

How do you look for investment vehicles?

To locate the stock or ETF you want on Saxo’s platform you need to search for it from the top right bar.

Stocks have two distinct names by which you can locate them, the Ticker Symbol (4 letters) and the ISIN Number.

An ETF can be traded on different exchanges with different Ticker Symbols and ISINs.

Specifically, you can find Xtrackers’ S&P 500 UCITS ETF on 4 exchanges:

- 🇬🇧 London with Ticker: XDPG and ISIN: IE00BM67HX07 in British Pounds (GBP)

- 🇨🇭 Zurich with ticker: XDPC and ISIN: IE00B8KMSQ34 in Swiss francs (CHF)

- 🇩🇪 Frankfurt with ticker: XDPE and ISIN: IE00BM67HW99 in Euro (EUR)

- 🇮🇹 Milan with ticker: XDPU and ISIN: IE000Z9SJA06 in Euro (EUR)

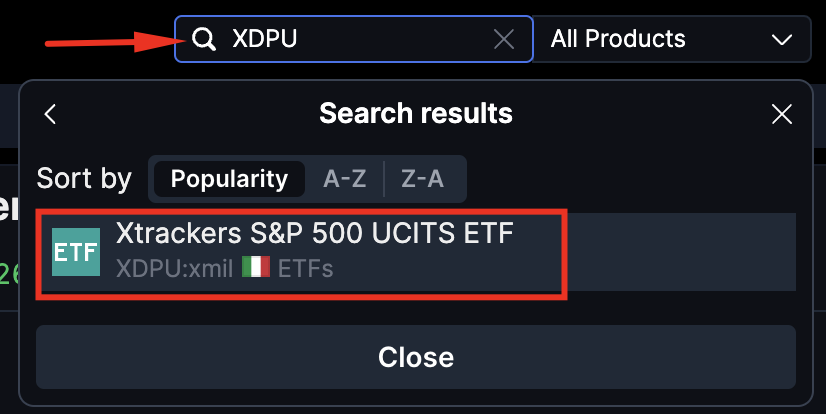

How do we choose the right stock exchange?

#1 Trading Currency: since we do not want to get into currency conversion procedures(they are costly), we should identify exchanges that trade in Euro. So, we automatically exclude Zurich and London.

#2 Saxo charges: as we saw in the corresponding chapter, each exchange has different charges. In this case, we see that XETRA and Borsa Italiana have exactly the same fees (0.08% with a minimum of €3), so it doesn’t make much difference which we choose.

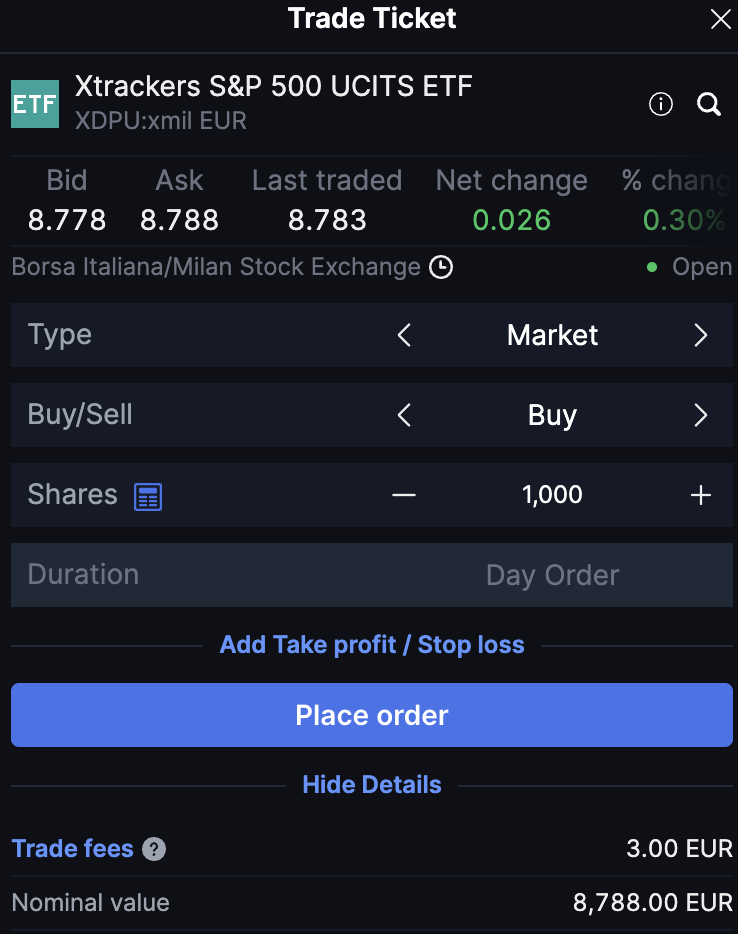

Let’s say we choose to buy it from Milan, via Borsa Italiana.

How do we identify the ETF?

You go to search and type in either the ticker “XDPU” or the ISIN: “IE000Z9SJA06“.

Selecting it will open a tab with basic information about the ETF. To buy it, select “Trade“.

In the tab that will open, you will be asked to enter the order in which to buy the ETF:

What you need to know:

- Type. If you choose “Market“, it will execute the order directly at the current market price. If you choose “Limit“, it will execute the order at a specific price you set (if and when it touches it).

- Buy/Sell: If you want to buy then you select Buy, if you want to sell then you select Sell.

- Shares: refers to the quantity you want to buy.

At the bottom, you will see the total amount invested (Nominal Value: €8.788) and Saxo’s commission (Trade fees: €3).

🤌As you can see, to buy 1,000 pieces of this ETF worth €8,788 we are only asked to pay €3.

Saxo Bank Frequently Asked Questions

Here are some of the most frequently asked questions online about Saxo Bank’s operations:

Are there any alternative online brokerage platforms?

Of course! Take a look at our detailed comparison between the most popular investment platforms available →

Χρηματιστηριακές πλατφόρμες αγοράς μετοχών | ||||

Πλατφόρμα | Saxo Bank | DEGIRO | Trading212 | eToro |

Ίδρυση | 1992 | 2008 | 2004 | 2007 |

Τραπεζική άδεια | ✓ | ✓ | ✗ | ✗ |

Επίβλεψη | Δανία (DFSA) | Γερμανία (BaFin) | Κύπρο (CySec) | Κύπρο (CySec) |

Μετοχές εξωτερικού | 50 χρηματιστήρια | 29 χρηματιστήρια | 17 χρηματιστήρια | 14 χρηματιστήρια |

Ελληνικές μετοχές | ✓ | ✓ | ✗ | ✗ |

Εγγύηση καταθέσεων | έως €100.000 | έως €100.000 | ✗ | ✗ |

Εγγύηση επενδύσεων | έως €20.000 (100%) | έως €20.000 (90%) | έως €20.000 (90%) | έως €20.000 (90%) |

Οδηγοί | ||||

Bonus | Κέρδισε €250 έκπτωση στις προμήθειες σου! | Κέρδισε πίστωση €100 σε τέλη συναλλαγών | Κέρδισε μια μετοχή έως €100, εντελώς δωρεάν | *Το 79% των CFD Traders χάνει χρήματα |

Risk Disclaimer:

I am NOT a professional investment advisor and the following is NOT an investment recommendation but is my personal experience and opinions.

Keep in mind that always investing = risk.

Only invest money that you are willing to lose!

Affiliate Disclaimer:

The above links to the services listed may be affiliate links. If you use the service through them then you are helping MoneyMinority to continue to exist, at no extra cost to you.

Feel free not to use them if you do not wish to.

Read more about Risk & Affiliate Disclaimers of MoneyMinority.