“Having money is not everything… Not having it, is”

Lots of money gives you the luxury of taking it out of your focus. It offers freedom and security to pursue personal goals, dreams and ambitions.

On the contrary, when you are low on money, it tends to become your sole focus involuntarily. The survival instinct wakes up, puts it as a top priority and rightly thinks only of them.

If you don’t have to eat, personal ambitions take a back seat.

What can you do when you have no money? I have talked several times about how we can manage our finances:

- Create an emergency fund

- Pay off your debts.

- Spend less than you earn

- Save systematically

- Invest systematically

By following these 5 simple steps, you can easily get ahead of the majority of people.

Let’s go through 6 behaviours that will help us save money fast, even on a low income:

- Delay gratification

- Create friction

- Go for Premium

- Make conscious purchases

- Say no to upgrading

- Review subscriptions

- ❓Frequently Asked Questions →

| 🎯 Goal: | How to Save Money |

| 📝 What to do: | Proper money management |

| 💲Fields: | House, Power, Food, Water |

| 📋 How; | 6 behaviours |

| ⏳Application: | On a Low Income |

| ⚒️ Tool: | Budgeting |

#1 Delayed gratification

or else, don’t be at the mercy of your emotions

When you’re in dire straits and don’t have a single euro in your pocket, it’s easy to reflect on the necessity of saving money.

“Son, I’m not falling for that again!

Should I be broke before the end of the month? Uh-oh!

Starting today, I’m going to save more, never buy coffee outside again, and turn off the water heater immediately.”

On the other hand, the secret to successfully managing your finances seems to lie in changing your mindset when you HAVE money.

What do I mean?

When you hold a fat wallet stuffed with money, everything seems rosy, every good and service just a purchase away while our every inhibition seems a little more relaxed.

The result?

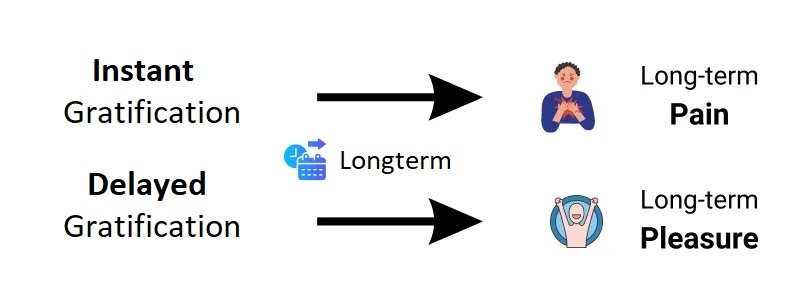

The monkey in the back of your head grabs the reins and commands you to follow the quicker, easier and more painless path, which is none other than that of instant gratification.

And – you know it yourself – when the paycheck comes in, it’s harder to say no to the voice that keeps spamming “BUY! CONSUME! EAT!”

Excellent lead-in to introduce you to the concept of delayed gratification

😌 What is Delayed Gratification?

Read more about delayed gratification →

This concept seems to be closely related to your financial situation and understanding it can help you improve it dramatically.

How?

The easiest thing you can do is to apply the 30-day rule!

📆 What is the 30-day rule?

Read more about the 30-day rule →

Naturally, do you get itchy fingers and hit “add to cart” on any interesting product you come across during a simple stumble through Amazon?

Instead of immediately giving in to the purchase, try placing the product on your favourites list first and returning to it after 30 days.

That way you take time to consider whether this purchase is impulsive, provides long-term value, or has cheaper alternatives.

After 30 days, you’d be surprised how many purchases no longer make any sense…

In a nutshell: Small meaningless sacrifices today give you a chance to achieve something important, in the long run.

#2 Create Friction

in other words, use the 4 laws of behavioural change

James Clear in his – amazing – book, Atomic Habits, presents us with 4 laws of behaviour change.

What do they say? You could say they are simple rules to create (or get rid of) any habit.

📋 What is a habit?

And while there are good habits like going to the gym in the afternoon, paying off your credit card on time or trimming your nails with a nail clipper, there are bad ones…

Like ordering pizzas in the afternoons, paying off your credit card whenever you feel like it, or cutting your nails…by biting them!

James urges us to compare these laws to levers. When in the right place they set the foundation for you to create good habits, effortlessly.

The 4 laws for turning any behaviour into a habit are:

- Make it visible

- Make it attractive

- Make it easy

- Make it satisfying

On the contrary, if you make a behaviour invisible, repulsive, demanding and unsatisfying you will be able to get rid of negative habits you have acquired over the years.

If you are haunted by questions like “Why do I never have money” or “How come I always max out my credit card” or “Why do I never do what I should do but always do what I feel like doing”, then you should look for the answer somewhere in the 4 laws.

And while they fail to cover all of human behaviour, they have broad applicability in most areas of everyday life.

…and I can’t think of one more typical than that of personal finance.

Essentially, you can manage your finances more efficiently by identifying bad habits and then getting rid of them using the 4 laws of behaviour change.

If you want to stop a costly habit, ask yourself:

- How do you make it invisible?

- How will you make it unattractive?

- How do you make it demanding?

- How do you make it unsatisfying?

“Yeah, all good in theory Sterg, but what about in practice?”

Let’s say you’re prone to constantly ordering takeout food via delivery apps. And it seems both your wallet and your stomach unanimously agree on this.

Following the 4 laws you can make a habit:

- Invisible, by deleting the app from your phone (if you don’t see it, it doesn’t exist)

- Repulsive, by putting the app in the same folder as health or money management apps

(each time you will remind yourself you are spending money and hurting your body) - Demanding, deleting the credit card from your account

(you have to go through the details of it every time, manually) - Unsatisfying? No, the truth is I haven’t thought of a way to stop deriving satisfaction from souvlaki. Do you have any ideas?

In a nutshell: Do you identify a negative habit that’s “eating away at your money”? Get rid of it by generating the appropriate friction with the use of James Clear’s 4 laws of behaviour change.

#3 Premium – not Luxury, nor Cheap

or, in other words, If you buy cheaply, you pay dearly.

While I was a kid, one of the main mantras which dictated my life was:

The cheaper, the better.

If it was free? It didn’t get any better, give me free and get my soul!

I was late, you see, to understand the now unbreakable rule that nothing and never is free – there ain’t no such thing as a free lunch

Free always has a cost. The question is who bears the cost…

I can still remember a (current) friend who I used to go for souvlakia with in elementary school and he would add ketchup on top.

Not because he liked the taste so much, but because it was free… At the time, it made perfect sense to me…

Growing up, I was one of those who was obsessed with Chinese stores (aliexpress, banggood, gearbest) and ordered all kinds of available cheap gadgets with direct shipping from China.

Not because I had any particular need for Bluetooth, but simply because it cost… $3.

A typical consumer oriented only on price and quantity.

→ The more, the better

→ The cheaper, the better

If a company’s marketing department made a buyer persona for me they would, without a doubt, rank me among the fully price-oriented consumers.

The result?

A room crammed with poor quality useless gadgets capable of giving the average American minimalist Youtuber an aneurysm, which in the end, I didn’t even use.

And the ones I did use?

I couldn’t even do my job properly as they were completely unreliable and, usually, they gave up pretty quickly.

One thing my narrow mind failed to grasp was that being in the lowest price range, I would buy products of equivalent quality.

Honestly, I could perceive it but… I didn’t mind!

And I didn’t mind because that same narrow mind couldn’t understand that, ultimately, this whole thing was costing me… a lot more.

→ If I didn’t use it, I wasted money to get it.

→ If I did use it, it quickly broke down or didn’t perform adequately so I was forced to pay more money to replace it and do my job properly.

If I was smart enough to sit down and do the math I would realize that the total amount I was wasting exceeded the cost of the equivalent premium option.

What do we call it in Greece? ”Η φθήνια τρώει τον παρά; ”,or else, ”If you buy cheaply, you pay dearly?”

Today? Well, the mantra I follow has changed and it goes:

Focus on the quality: price ratio, it’s all that matters.

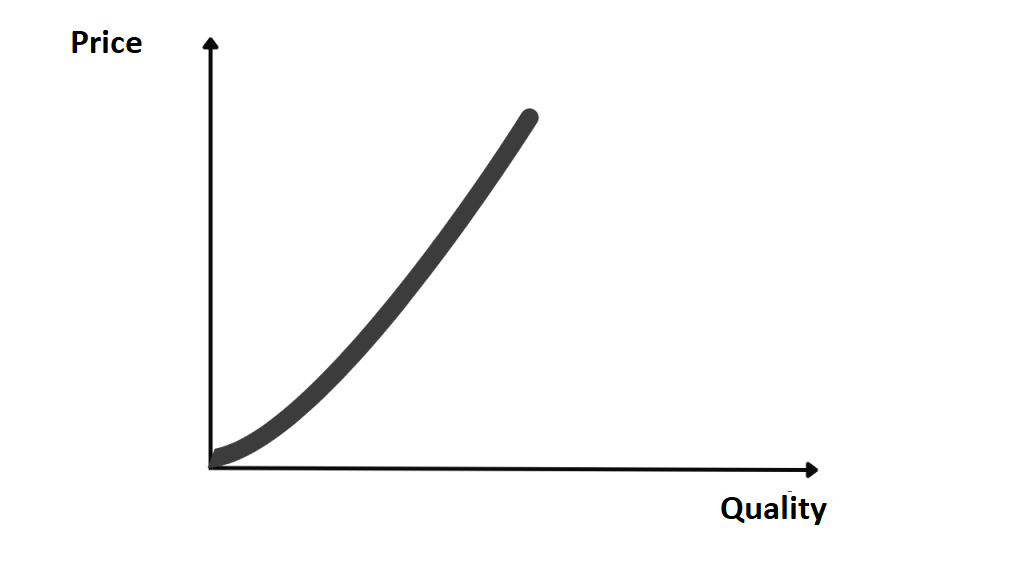

More often than not, it’s the premium options that score the highest in this ratio. Not the cheapest products and, definitely, not the luxury ones either.

What does this mean in practice?

I would choose a premium coat in the range of 400€ over the cheap disposable option of a fast fashion brand that costs 60€.

Why? It would allow me to use it for many years, enjoying the same high quality over a cheap option that would deteriorate in a shorter period.

⚠️ Warning:

To make this strategy work your purchases must be conscious, therefore, less. Meaning, you can’t have 10 premium coats. You’ll have to settle for 2.

We will discuss conscious choices in the next chapter.

Besides, I would prefer it over the €3,000 luxury version of a popular fashion house.

Why? Simply because, after a certain point, the increase in price does not offer a proportional increase in the quality you receive.

There is a “tipping point” beyond which you start paying for branding, exclusivity and all the things that a luxury good offers.

Value for money? Premium? Call it what you will.

In a nutshell: Consuming premium, high-quality products with high durability tends to cost less than cheaper, low-quality, unreliable options. Provided you’re a conscious consumer…

#4 Shopping Therapy is not Therapy

or else, make shopping, conscious

Previously we saw how buying high-quality products and services can end up costing you less money in the end.

But is it really that simple? Of course not!

I forgot to mention a key factor which, if not taken into account, may well ruin everything.

What is that?

Stop consuming so much!

If you live in a Western society, you are probably consuming more than you need.

And no, I have no problem with high consumption. My problem lies in non-conscious consumption.

And for the record, I don’t think there is anyone who has missed the term shopping therapy…

Are you in a bad mood? Did you have a rough day? Did something bad happen that made you sad?

Don’t worry. Go for a walk to the market, go to ZARA and those T-shirts will put you back in the mood!

If you follow MoneyMinority you already know that shopping therapy is nothing more than a… scam.

The reasons?

- It offers temporary pleasure

- It tends to numb symptoms rather than offer meaningful solutions

Pleasure is temporary

No matter how many items you buy, how expensive or luxurious they are, the pleasure they give you will only last briefly.

🤫 Come on, between us now, don’t you already know that?

All of us have bought a new mobile phone, motorbike, car or clothes. How long have we stayed excited about these purchases?

Why is this happening? Because… hedonistic treadmill!

Pardon?

🏃 What is a hedonic treadmill?

Read more about the hedonic treadmill→

It acts as a painkiller

If you think about it, shopping therapy can’t be a solution… by definition.

It would be more accurate to say that it acts as a painkiller which tends to relieve by temporarily “numbing” the symptoms that a situation is causing, rather than providing a solution to it.

Kind of like alcohol, drugs and anything else that messes with our dopamine…

It is a great tool if you want to hide momentarily behind your problems – in short, ostriching – and nothing more.

Whether you’ve fought with your wife, you’re behind on your work project or your child won’t talk to you, no matter how many Macbooks you buy the problem doesn’t change.

Take the time to find a solution to the problem and leave consuming for another time.

Before you buy anything, try to consciously ask yourself:

- Do I really need this product?

- In what way will I use it? How often?

- What need it meets?

- Maybe I already bought something that can adequately meet that need?

One way to avoid unnecessary purchases is to know what you already own. If you know you have 4 pairs of jeans in good condition, you probably won’t look for the 5th pair.

Also, the 30-day rule we saw in the first chapter is helpful here as well.

In a nutshell: Your purchases should be conscious, fulfilling needs or desires, not acting as painkillers to temporarily numb your unpleasant feelings. Shopping therapy is a scam.

🛠️ Save money with the Budgeting Tool

One of the easiest ways to discover and quantify your spending habits is a personal budget.

MoneyMinority’s budget tool allows you to both record and automatically calculate income, expenses, savings and debts so you can take control back into your own hands and manage to save money.

What does it include?

→ Recording of income and expenses monthly, for all months of the year

→ Categorization of expenses based on needs, desires, savings, investment & debt

→ Automatic calculations based on the 50/30/20 rule

→ Actual expenses vs Budgeted expenses

→ Graphical visualizations

→ Where did your money go?

→ Year’s total

→ Tracking long-term goals for purchases, investments or savings

→ Detailed instructions

It’s available on all devices as all you need is a Google account – opens with Google Sheets.

📚 or read our guide to proper money management →

#5 You don’t need the upgrade

or else, don’t buy the new version

Following the same topic, another way to escape overconsumption is avoiding the upgrade trap.

I’ll speak for myself again…

For unrelated reasons, I chose to join the sect that goes by the name “Apple ecosystem”.

Excellent connectivity between devices, above-average performance, reliability and when you add in that the resale value remains high over a long period, they are my premium choice when it comes to electronic devices.

Unless you make a small mistake…

What’s that?

Considering that they require constant upgrading!

You see, Apple every year announces new models in most of their products. And the way they do it is so cool that, like it or not, you feel like you’re being left behind.

Add to the mix a few tragic tactics like deliberately reducing the performance of old phones for the sake of battery life then everything, consciously and unconsciously, pushes you to buy the new batch of devices.

Or not…

The new iPhone has a faster processor, better camera, bigger screen, satellite connection, and 4k video at 120 fps.

The new upgrades may sound significant but reality shows they are not as noticeable and certainly not at all necessary for the average user:

- Why do you need a better camera? If you’re a photographer or Instagram influencer and that 5% will give your work something extra, I get it. Otherwise, why?

- What would you need a better processor for? If you’re the average user, you can do your job just as well with an iPhone 8 as you can with an iPhone 13.

“Hey, Sterg, the phone is fine, but the battery doesn’t even make it through the day anymore, I need to upgrade!”

On board! Did you check first to see if you can solve the real problem by replacing it?

It’s too easy to unwillingly let yourself get into a perpetual cycle of consumption where you’ll always try to satisfy it by buying the new model, only to feel, a few months later, that you’ve “fallen behind” and repeat it.

One tactic you can follow is to stop focusing on what you don’t have and focus on what you already have.

Four years ago, I bought my laptop.

Since then, so many upgraded versions have come out and another devil constantly appears in my mind spamming me to get them because, as they say, I need them. Struggling to hold on, I look at the laptop I already have and see that it is still an extremely reliable machine.

Yes, it has its scratches and gets hotter but is still able to deliver the job without a fuss.

If you feel you often fall into the trap of the perpetual consumption cycle, you can see it as a game:

- How much more life can you get out of your device?

- How much longer can you keep it running?

In a nutshell: Before you upgrade, make sure you really need it. Don’t become a slave to your possessions, let them be yours!

#6 Review your subscriptions

or else, cancel your, freaking, Netflix

The new trend dictates subscription models.

They’re everywhere, constantly growing, and the majority of companies are experimenting with how to fit them into their strategy.

The terminology for this global trend is called “membership economy”, an economy where consumers tend to buy “access” to goods and services rather than “ownership”.

You won’t find a more iconic example than that of Netflix and Spotify: rather than buying specific movies and songs, you buy access to whichever songs and movies you want, for a specific period.

While it has already succeeded in becoming the dominant charging model in the tech industry, everyone is flirting with it.

- Leasing cars instead of buying them

- Baby diapers with subscription-based home delivery instead of buying them at the supermarket

- Digital books on subscription instead of buying their physical copies

To the point where BMW launched heated seats as a service for a fee of $18/month.

From a business perspective, it makes perfect sense:

Why charge customers only once by offering them the product when you can build a steady stream of money by giving them access to the same product?

Marketing costs are reduced, financial projections become more easily and… you throw him the ball!

What do I mean?

Now, the liability of “cancelling” an active subscription falls on him while the company is not constantly trying to “convince” him to buy their product.

And we all know that humans are creatures characterized by how easily they can be left to idleness and apathy. Most of the time they would rather take no decision, than waste energy to get the best one.

Meaning, subscriptions barely used (or not at all), end up staying active wasting money.

And before you rush off to make fun of others, do a little reflection:

How many times have you nagged that Netflix hasn’t added a worthwhile series since Stranger Things, but you continue remaining a loyal subscriber in hopes something will change in the future?

Or that while you’ve stopped listening to songs on Spotify (you’ve switched to podcasts) you keep the subscription active in case something changes in the future?

If so, you’re probably a victim of this business technique also…

In a nutshell: Take back control by cancelling subscriptions you don’t use, barely use, or offer you no additional value.

If your brain continues to put up fierce resistance, reassure it by telling it that you can reactivate them, whenever you want, with 3-4 clicks.

Frequently asked questions

Below are some frequently asked questions on how to save money. I’ll try my best to answer them:

How to Save Money Fast on a Low-Income?

You can save money by practising the following 6 behaviours:

- Consume consciously

- Delay your big purchases

- Review your subscriptions

- Don’t fall into the upgrade trap

- Find value for money

- Create friction (where needed)

As James Clear wisely stated:

“You do not rise to the level of your goals, you fall to the level of your systems.”

Meaning that it’s not what you want to achieve that counts is the system you have set up to achieve it that counts.

And achieving it may not take as much effort but rather a method…

How to save?

The most efficient way to save is through the C. I. O. method – Cut, Increase, Optimize.

- Cut your expenses by reviewing your subscriptions and eating out less at restaurants.

- Increase your income with a second job, more clients or using the internet to make extra income.

- Optimize basic expenses like rent (with a roommate), your commute (with a bike) and the supermarket (by buying in bulk).

To keep money in the bank, you need to make more than you spend or… spend less than you earn!

✍️ Read also: How to save more money →

Self-improvement books: how to save money:

Some of my favourite books on how to save money are:

- The Richest Man in Babylon

- Rich Dad, Poor Dad.

- The Psychology of Money.

- I Will Teach You To Be Rich

- The Millionaire Next Door

How to save money at home?

Other additional ways to save money at home include:

- Save on electricity: replace old light bulbs with LEDs, seal gaps in doors and windows, and turn off lights when not in use.

- Sell what you don’t need or use: Something useless to you may have value to someone else. See how to sell items you don’t need while making extra money →

- Buy budget/ family-sized packaging: A conscious consumer always looks at the price per kilo/litre. The cheapest prices are always found in bulk products.

What does this mean? Long-life products (rice, canned goods, pasta) and non-expiring products (toothpaste, cleaning products) should ONLY be bought in large packs.

How to save money on food?

I believe, besides cutting down on unnecessary and frequent visits to expensive restaurants and pubs, the best advice is meal planning.

Instead of cooking the day’s food, try cooking the whole week’s meals on Sunday – trust me, it works!

It will save you as much time, effort and dishwashing as it will save you money due to lower energy and produce consumption!

More content for money management

If you liked this article and want to learn more about money management, take a look at the following articles:

Emergency Fund, Because Capitalism Doesn’t Give a Fuck About You Dear

How to Become Rich [Undestanding the 3 Types of Income]

Bunq Bank & Travel Card Review: The Ultimate Guide [2020]

Monese Card: The Complete Digital Bank Guide [2020]

How to Become a Millionaire Quitting Coffee [Power of Compounding]

Curve Card Review: The Ultimate Guide for 2022

What are your thoughts?

Do you use any other methodology that seems to work? I’d love to learn it , so be the kind one and post in the comments.

Until the next one, see you!

![How to Become Rich [Undestanding the 3 Types of Income]](https://moneyminority.com/wp-content/uploads/2020/01/How-to-Become-Rich-Undestanding-the-3-Types-of-Income-270x180.jpg)

![Bunq Card: The Complete Guide [2019]](https://moneyminority.com/wp-content/uploads/2019/11/Bunq-Κάρτα-από-Ελλάδα-Ο-Απόλυτος-Οδηγός-2019-270x180.jpg)

![Monese Card: The Complete Guide [2019]](https://moneyminority.com/wp-content/uploads/2019/10/Monese-Κάρτα-στην-Ελλάδα-Ο-Απόλυτος-Οδηγός-2019-1-270x180.jpg)

![Curve Card & App Review: The Ultimate Guide of 2020 [+Bonus £5]](https://moneyminority.com/wp-content/uploads/2019/11/Curve-Card-App-Review_-The-Ultimate-Guide-of-2020-Bonus-£5-270x180.jpg)

![How to Become Rich [Undestanding the 3 Types of Income] How to Become Rich [Undestanding the 3 Types of Income]](https://moneyminority.com/wp-content/uploads/2020/01/How-to-Become-Rich-Undestanding-the-3-Types-of-Income.jpg)

![Bunq Bank & Travel Card Review: The Ultimate Guide [2020] Bunq Card: The Complete Guide [2019]](https://moneyminority.com/wp-content/uploads/2019/11/Bunq-Κάρτα-από-Ελλάδα-Ο-Απόλυτος-Οδηγός-2019.jpg)