Being here, you must be interested in learning more about investing money in the market of gold.

Here is an in-depth guide aiming to answer as many questions as possible.

💨 TL;DR

Throughout the centuries, people have always seemed fascinated by the “glamour” and glitter of gold. That’s why they wanted to own the metal, either as a means of transferring value (money) or as a method of storing value.

Nowadays, Investors often add gold to their portfolios as a hedge against inflation and a safe haven against financial crises.

If you want to learn how to invest, take a look at the available ways →

We’ll begin by analyzing the specific characteristics that give gold the value we consider it to have and examine why an investor might want to add it to their portfolio.

We will proceed to present how an individual can invest in gold, whether that is gold coins, bars, gold stocks, ETFs or gold cryptocurrencies.

Lastly, we will attempt to determine whether or not investing in gold is ultimately worth it.

☕ Grab a coffee and let’s go see if whatever shines… is gold!

- Why is it worth it? →

- When to invest? →

- Is investing in gold worth it? →

- How to invest? →

- 🔴 Gold Price →

| 📈 Investing in: | Gold |

| 🤔 Worth it? | as a hedge against inflation & crises |

| ⚙️ How? | Bars, Shares, Crypto, ETFs |

| ⏳ Gold Price: | Today |

| 📉 Gold Chart | Live |

Gold price today- Live 🔴

Here is a live chart of the Gold price in Euros per ounce (oz):

💡1 ounce (oz) = 28.34952 grams (g)

🔖 Put it in your favourites so you can return whenever you want.

Why invest in gold?

Or else, where does its value come from?

Let’s take things from the very beginning.

The first form of economy on our planet was that of exchange. In such an economy, to “buy” an item or service, you necessarily had to exchange it for another item or service you possessed.

Needless to go into too much depth, you can perceive the numerous problems that can arise in such an economy.

The only way they could be overcome was by creating ‘an instrument for exchanging value’.

This would be an object acting as an intermediary and a tangible transfer of value to facilitate all transactions in a free economy.

The instrument for exchanging value we seek is none other than the familiar: Money.

Over the centuries, money has been represented in various materials such as shells, salt and precious metals. The material, however, which managed to win over people’s hearts for extended periods was gold.

According to Aristotle, there are 4 characteristics that a material must have to qualify for playing the role of money in an economy:

#1 Gold is durable

Gold’s durability derives from the fact it is probably the most “boring” metal on the periodic table.

It does not react with any other element

When we say it doesn’t react with any other element, we mean it! Imagine this is why edible gold exists, it can be eaten (yes, with your mouth) without causing you any problems.

It cannot be destroyed or ” consumed “

Unlike other materials (such as petrol or wood), gold is an element that cannot be consumed in the production process nor can it be completely destroyed. The only thing that can happen to it is to be broken down.

It does not rust

The fact that it does not react with other elements means that it does not react with oxygen either, so gold does not oxidize. In other words, it does not rust. Hence its use in dentistry and electronic circuits.

These characteristics, therefore, make gold an excellent way to “store the value” you own safely, and you don’t have to worry about any possible damage.

This is also the reason why we cannot use a non-durable object as money. The durability over time of an edible, for example, is minimal. It will simply rot and lose its value.

#2 Gold is portable

While not the easiest thing to do, it is generally possible to transport gold from one place to another. Additionally, small amounts of gold tend to “represent” large amounts of value.

#3 Gold is divisible

Gold is highly pliable, enabling it to be easily divided into smaller pieces.

In the above photo, you can see how a 23-carat gold weighing the equivalent of 3 US pennies ($0.5) can cover walls of 28 square meters

#4 Gold has intrinsic value

When we talk about intrinsic value we are referring to the value of the material itself on which money is reflected.

📖 Example:

The intrinsic value of a banknote refers to the value of the paper (as a material) from which it was created.

Gold acquires some of its intrinsic value through its usefulness in various industries.

Due to its unique characteristics, it can be used in the creation of jewellery (strength & reflectivity), in dentistry (non-reaction with other elements) and in creating electronic circuits (absence of corrosion).

The primary source, however, from which gold derives its intrinsic value is its rarity.

Only a finite amount of gold is found on Earth, is underground and can only be mined through excavation.

Combine this with the fact that you cannot synthesize or produce your own gold, and we can realize that the total supply of gold on the market is increasing slowly, steadily and at a predictable rate.

💡 Total Gold supply & where is it?

According to the World Gold Counsel, it is estimated that by 2020 total of 201,296.1 tonnes of gold has been mined and is reserved as follows:

→ 46.3% in jewellery (~93,253.1t)

→ 22% in Coins & Bars (~44,384t)

→ 17% in Central Banks (~34,211t)

→ 14.6% in Other (~34,211t)

A requirement for the above assumption is that gold demand continues to exist. If, for whatever reason, there ceases to be demand (with a constant supply), the price will fall.

How does the price of gold increase?

Before proceeding, it is important to note that the above characteristics are not what, in the end, increase the price of gold over the years.

What influences and increases the price of gold is the demand it has in the market.

Demand comes from the belief we all have that gold is a method of storing value and, in addition, to the commercial sectors that use it.

As demand increases (with supply remaining constant), so will its price. If we stop considering gold to have value then the demand for the metal will fall and the price will follow.

So far, however, gold seems to have passed the test of time.

A 5,000-year course which ended about 50 years ago (with the Breton Woods deal) found gold dominating as a medium of exchange of value (i.e. money) for the world’s economy.

Today, the money we use is completely independent of the gold in circulation, is called Fiat Money, is issued by central banks and is a social contract.

Gold, however, is not extinct. It seems to have taken on a different role in the economy in recent years.

What is that? We will look at it in the next chapter.

📚 History of Money:

If you want to learn more about the Historical Course of Money, check out the following:

► What is Money?

► Gold as Money

► The Transition to the First Banknotes ► What is Money?

► What is Fiat Money?

When to invest in gold?

Well, well!

We went over those unique characteristics that have given this otherwise “boring” metal the value it has had over the centuries.

But as an investor, why would you want to add it to your portfolio?

Should you ask someone more experienced in investing, they would tell you the main reasons for adding gold to your portfolio are two:

Let’s see what they mean.

Protection against Financial Crises

Safe Haven

The first and most important ” virtue ” gold is credited with is the protection it offers investors’ funds in crises, unexpected turmoil and market downturns.

Gold, traditionally, is said to act as a Safe Haven.

🔎 What is a Safe Haven?

A Safe Haven is an asset whose price is either not correlated or negatively correlated with other assets during periods of turmoil or crisis. In simpler terms, while other assets may experience a drop in value, a Safe Haven asset’s value remains unchanged or may even increase.

The logic this theory is based on is that gold, unlike fiat currencies (€, $ etc.), cannot be fully devalued.

Gold has managed to be classified as one of the most popular “Store of Value” Assets, which has maintained its value for thousands of years regardless of wars, changing powers, technologies, etc.

How does it behave, however, in a real-life crisis?

Should gold be the Safe Haven that it is rumoured to be, we should notice an increase in its price in times of crisis and, likewise, a decrease in its price when the markets go “back to normal”.

How will we determine this?

Rather roughly, of course, we will look at two examples of gold’s performance during the financial crisis of 2008 and the health crisis of 2020.

The 2008 Financial Crisis

After the Great Depression of 1929, the next major crisis the global economy ever faced was, perhaps, the financial crisis of 2008.

By mid-2008, the price of gold had followed an upward rally for several years, reaching $1,240/oz in March.

From March through October 2008, the tables were turned, and gold had a massive sell-off in the markets, with the price falling to $922.94/oz, as you will notice in the chart below.

(crisis period outlined)

Following the drop in October came a period of continuous rise in the gold price, which, after almost 3 years, in August 2011, did x2.5 and reached $2,200/oz.

The Health Crisis of 2020

In the footsteps of 2008, the price of gold in 2020 seemed to follow a similar pattern.

Since the beginning of the pandemic outbreak in March and until July 2020′ the price soared to $2,080/oz. From there, the price declined to lower levels to find it at $1,770/oz in March 2021.

Gold and the Stock Market

Having seen how the gold price behaved during the last two crises, it is of great interest to put the stock market performance during the same period into the equation.

In the chart below, we see the percentage performance of gold relative to the Dow Jones Industrial Average from 2006 to the present.

Orange shows the performance of gold (GOLD), while blue shows the Dow Jones (DJIA).

2020 found the DJIA declining far more sharply, yet, recovering much faster than in 2008.

Likewise, gold rallied strongly initially (showing a negative correlation with the DJIA) and then declined.

We can see that 2008 started out finding DJIA and GOLD to be negatively correlated (DIJA was dropping while GOLD was rising) and then gained a positive correlation.

To conclude, many people claim that gold is indeed, the Safe Haven Asset it is perceived to be. One minor objection, though.

That objection is that gold tends not to offer protection during a crisis but instead, after it is over.

As a protection against inflation

Inflation Hedge

The second ” virtue ” that Gold is credited with is the protection it offers to investor funds during periods of high inflation.

Inflation Hedge means compensating for inflation.

🔎 What is Inflation?

Inflation is the overall tendency for the prices of goods and services in an economy to rise. 1 Euro today is (usually) worth more than 1 Euro tomorrow. Central banks aim for a healthy annual inflation rate of 2%.

Find out more in our detailed guide to inflation ►

The main argument of the advocates of this theory is that while fiat money can be inflated at will by central banks (through so-called quantitative easing), the supply of gold on the market is stable and relatively predictable.

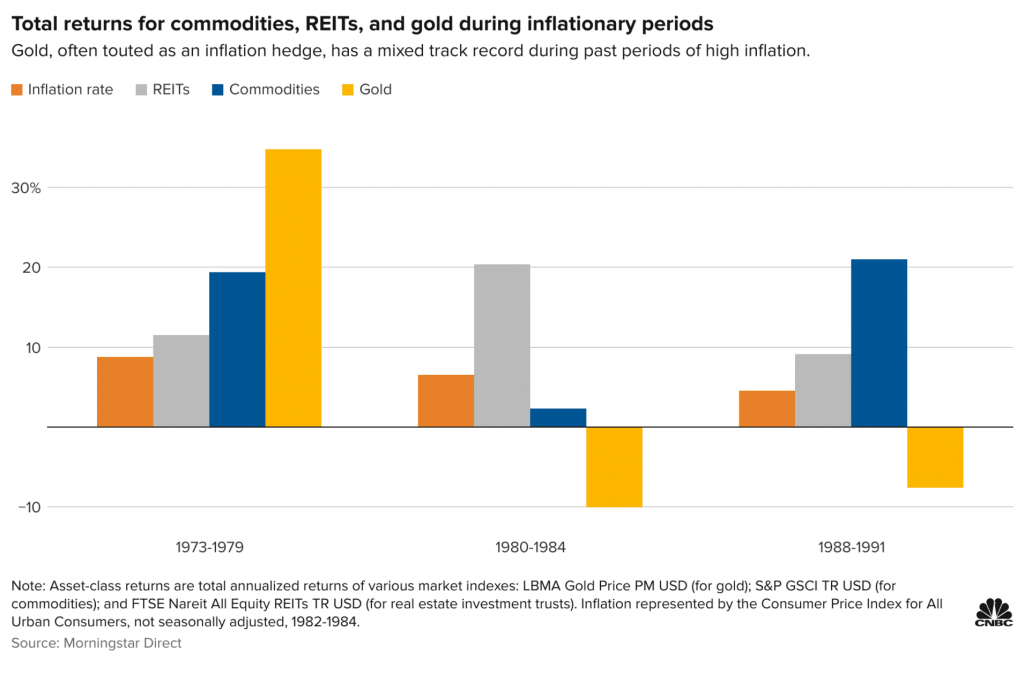

In the image below from Bloomberg, we can see, on the same chart, the price of Gold (ounce) along with the percentage change in inflation.

Between 1973 to 1979, we see that the price of gold outperformed the increase in inflation.

However, the same was not the case for the periods 1980-1984 and 1988-1991, where while inflation was higher than 4%, the gold price seemed to decline.

According to Amy Arnott, Portfolio Manager at MorningStar, the correlation between the price of gold and rising inflation is 0.16 over the last half century (where 1 = absolute correlation and 0 = no correlation).

Hence, is the inverse relationship between gold price and inflation growth just a myth?

According to the paper “The Golden Dilemma” by Claude B. Erb and Campbell R. Harvey, in which they analyze various hypotheses and theories about gold, the following conclusion seems to be reached:

In “normal” times, gold does not seem to be a good hedge against realized or unexpected short-run inflation. Gold may very well be a long-run inflation hedge. However, the long run may be longer than an investor’s investment time horizon or life span.

The Golden Dilemma – Page 17

When our reference time horizon is short (short term), gold appears to not live up to its reputation as an inflation hedge. On the other hand, when we are talking about much longer time horizons (long term), it seems to maintain its value against inflation.

📈 Absolute Inflation Guide:

If you want to know more about Inflation, what it is and what you can do to protect yourself against it, take a look at

MoneyMinority’s In-depth Guide to Inflation ►

How to invest in gold?

There are several ways in which an investor can gain exposure to gold.

While some are more direct and involve the acquisition of physical gold (such as gold coins and bars), others are more indirect and involve stocks in gold mining companies or gold ETFs.

In short, you can invest in gold by buying:

- Bars and Coins →

- ETFs →

- Cryptocurrencies →

- Contracts of Gold Difference (CFDs) →

- Stocks in Gold Mining Companies →

- Gold Futures →

Beyond direct or indirect exposure to the gold price, each form of investment appears to serve more specific investor profiles over others.

This chapter will briefly analyse how a private investor can invest in gold.

Let’s go!

Gold Coins and Bars

Just ask most people out there about how one can invest in gold, and most likely, they will answer through buying Gold Coins.

In fact, if you even get a cinephile with a lot of bank robbery movies under his belt, he might even mention Gold Bars.

The truth is that neither of them fall short.

Buying gold bars & coins is the most direct way of investing in gold as it involves purchasing the actual physical metal.

To acquire it, you have to contact local or international gold dealers or banks providing this service.

Characteristics of Coins & Bars

Whether we are talking about gold coins or gold bars, both different forms of the same metal share the following information.

Engraved on them should state:

- The Issuer

- Their Weight

- Their Purity

The Issuer refers to the company that produced the specific bar or gold coin.

Weight refers to how much the bar or coin weighs, starting at 1 gram and going up to 12.5 kilograms.

Lastly, Purity refers to the percentage of gold contained in the bar or coin you own. Since you are interested in the investment side of things, there is no point in looking at something at less than 99.5% purity. Ideally, you only go for 99.9% purity.

What is Premium?

As we’ve discussed, to be able to buy physical gold you’ll need to go to a local or not gold dealer or a bank.

For their services, they will charge you an additional commission called Premium, applied on top of the international gold price, the Spot Price.

How do you figure out the Premium you are paying?

All you have to do is subtract the Spot Price from the price that each dealer sells you.

Gold Premium = Gold Purchase Price – Gold Spot Price

You can use various websites to check the international gold price (Spot Price).

One of the most popular is kitco.com.

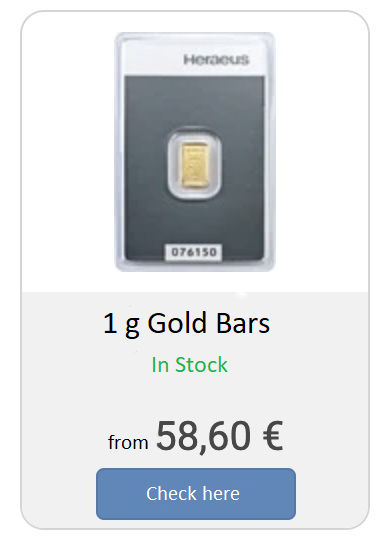

We can see that the international price (Spot Price) on 09.09.21 is €48.69 per gram of gold.

Now, let’s look at the price at which a gram of gold is sold (Retail Price) at a Gold Dealer.

We can see that a bar weighing 1 gram of gold costs €58.60.

Determining the Premium this particular dealer asks us for requires us to subtract the Spot Price from the Retail Price.

So:

Premium =

Retail Price – Spot Price =

58,60 – 48.69 =

€ 9,91

This means we will pay €9.91 Premium over the Spot Price for each 1-gram bar at this dealer.

The size of the Premium depends on the demand for gold in the market at the time and usually ranges from 1% to 20%.

♻️ Method Summary:

The Gold Coins & Bars Market is the most traditional form of investing in gold for an investor looking for exposure to its price.

The investor can obtain physical gold through accredited dealers or a banking institution.

The downsides of buying physical gold include the need to store it, its low liquidity and high premiums.

Gold ETFs

Gold ETFs (Gold Exchange Traded Funds) are Funds which contain only one Asset under their “umbrella”, which (as you correctly guessed) is none other than gold.

They are an excellent solution for investors who want to gain direct exposure to the gold price without buying the physical metal.

Unlike owning the physical metal, an ETF offers high liquidity and low acquisition, holding and management costs.

The high liquidity stems from the fact that ETFs behave just like stocks. This means you can buy and sell them easily, quickly and instantly through an Online Broker.

The purchase cost depends on the Online Broker you choose (up to zero) while holding and management costs (expense ratio from 0% to ~0.50%) are significantly lower than those of holding physical gold.

🚨 Attention:

Owning a gold ETF entitles you to redeem it for its cash value rather than actual physical gold.

For the two reasons mentioned above, gold ETFs have gained remarkably high popularity among investors, to the point that the 35 largest U.S. Gold ETFs manage more than $117 billion in gold AUM.

The “pioneer” of gold ETFs was SPDR’s Gold Shares (GLD), issued in 2004 in the U.S.

Within the first 3 days of its release, it exceeded $1 billion in value. It is now one of the largest (if not the largest) gold ETFs worldwide, managing gold stocks worth more than $57 billion.

📚 Guide to ETFs:

If you want to learn more about ETFs, you can read MoneyMinority’s Detailed Guide:

► What is an ETF?

► Key Features of ETFs

► Analysis of an ETF

► Are ETFs Bubble?

Examples of Gold ETFs

Following are some examples of the most popular gold ETFs which we’ll look a little more into their key features:

1. Deutsche Boerse Commodities Xetra-Gold ETC

🔎 ISIN: DE000A0S9GB0

🏷 Ticker: 4GLD

💸 Annual Management Fee: 0%

More information in the Fact Sheet and the KIID Document ►

Xetra Gold ETC accurately tracks the price of Gold. In particular, each ETC unit reflects the price of one gram of gold.

The difference between the Xetra Gold ETC (Exchange Traded Commodity) and other Gold ETFs is that it gives you the right to redeem your Bearer Notes (i.e. the amount of ETC units you hold) for real gold at a ratio of 1 ETC = 1 g of gold.

🛒 Find it on DEGIRO, Trading212, TradeRepublic and Freedom24 ►

2. SPDR Gold Shares ETF

🔎 ISIN: US78463V1070

🏷 Ticker: GLD

💸 Annual Management Fee: 0.40%

More information in the Fact Sheet and Prospectus ►

SPDR’s Gold Shares ETF was the first gold ETF for the US market and, today is the largest gold-backed ETF on the planet (in terms of fund volume).

GLD tracks the spot price of gold by holding gold bars stored in corresponding vaults in London.

🛒 Find it on Freedom24 and TradeRepublic ►

3. iShares Gold Trust ETF

🔎 ISIN: US4642852044

🏷 Ticker: IAU

💸 Annual Management Fee: 0.25%

More information in the Fact Sheet and Prospectus ►

Similarly, the iShares Gold Trust ETF ( by Blackrock) offers a “cheaper” alternative to the previous SPDR ETF.

While their objective and strategy are similar, their expense ratio is at 0.25% currently, well below GLD’s 0.40%.

It similarly manages a lower volume of assets under management (AUM) of just over $27 billion, compared to GLD’s $57 billion.

🛒 Find it on Freedom24 and TradeRepublic ►

The above ETFs are not an investment recommendation and serve merely as examples for your research. I am not in a position, nor is it my role, to recommend investment options.

Besides the above ETFs tracking the price of real Gold, you can invest in ETFs that contain shares of gold mining companies. We’ll discuss more about these companies in the next chapter.

iShares Gold Producers UCITS ETF Accumulating

🔎 ISIN: IE00B6R52036

🏷 Ticker: IAUP

💸 Annual Management Fee: 0.55%

A prime example is the Gold Producers UCITS ETF from iShares, designed to track an index including the largest listed companies engaging in gold exploration and mining.

🛒 Find it on DEGIRO, TradeRepublic and Freedom24 ►

Online Brokers for buying ETFs

The simplest way to buy a gold ETF (like any other) is through an Online Broker. Below is a table of some popular Brokers:

♻️ Method Summary:

The Gold ETF market is one of the most widely used forms of Gold investment for investors who want immediate exposure to the metal’s price while maintaining high liquidity and low trading costs.

An investor can buy and sell Gold ETFs through an Online Broker just as they would with stocks.

Gold Cryptocurrencies

Gold Crypto coins are Stable Coins, whose price is pegged (i.e. follows the price of a gram or ounce of gold).

🔎 What are Stable Coins?

A Stable Coin is a type of cryptocurrency “living” on a blockchain designed specifically to maintain a fixed value relative to another asset. This asset can be the US Dollar, the Euro, or this case, gold.

Stable Gold Coins run mainly on the Ethereum Blockchain and are ERC-20 Tokens.

Unlike more traditional cryptocurrencies (such as Bitcoin and Cardano), which are not backed by any other asset, a gold crypto coin is backed up by the equivalent amount in real gold.

Let’s take, for example, Pax Gold (PAXG).

A Stable Coin issued by Paxos following the price of an ounce of gold. Each PAXG stable coin issued by Paxos has its value mirrored with an ounce of pure gold held in Brink’s vaults (in the form of 400 oz London Good Delivery Gold Bars).

Therefore, for every PAXG you own, you retain the right to one ounce of gold held on your behalf by the Paxos Trust Company. You can, in fact, redeem it for real gold as an LBMA-accredited Good Delivery gold bullion bar.

🚨 Attention:

Stable Gold Coins do not skimp on risk.

They often have low liquidity on exchanges and it’s uncertain whether the issuer holds the claimed amount of gold.

Another less popular, Stable Gold Coin is the Tether Gold (XAUT).

📚 Guide to Cryptocurrencies:

If you want to learn more about Cryptocurrencies, you can read MoneyMinority’s Detailed Guide:

► What are Cryptocurrencies?

► The Most Popular Crypto

► How to buy Cryptocurrencies?

► Storing Cryptocurrencies

► Cryptocurrency Risk

Where do I buy Stable Gold Coins?

The simplest, fastest and safest way to acquire a gold crypto coin is to buy it through an Online Crypto Exchange.

Some of the most popular platforms are the following:

Binance | ByBit | Crypto.com | Nexo | Wirex | Pionex | |

|

|

|

| 💳 |

| |

Founded: | 2017 | 2018 | 2016 | 2018 | 2014 | 2019 |

Coins: | 401 | 555 | 321 | 70+ | 250 | 365 |

Pairs: | 1.507 | 799 | 669 | 596 | ||

Spot Fees: | 0.1% | 0.1% | 0.075% | 0% | depends | 0.05% |

Futures Fees: | 0.05% | 0.055% | 0.017% | 0.02% | ||

Crypto Card: |  |  |  |  | ||

Cashback: | up to 5% | up to 2% | up to 8% | |||

Interest on Stables | up to 6,5% | up to 16% | up to 20% | |||

Interest on BTC | up to 5% | up to 7% | up to 6,5% | |||

Bonus: | -10% fees + $100 rebates | up to $30.000 | $25 in CRO | $25 in BTC | $15 | -10% on fees |

📚 Guides: | Read more → | ByBit | Read more → | Wirex | Pionex | |

Looking for an app to track your portfolio? Try GetQuin for free → | ||||||

Pax Gold is not an investment recommendation and only serves as an example for your research. I am not in a position, nor is it my role, to recommend investment options.

♻️ Methodology Summary:

The Stable Gold Coins Market is an alternative method of investing in gold, taking advantage of Blockchain technology.

Stable Gold Coins are Digital Assets operating on a Blockchain (e.g. Ethereum), backed by real gold held by the issuing company in a vault.

An investor can acquire them through Online Crypto Brokers and store them in their own Crypto Wallets for maximum security.

Gold Stocks

An indirect way to invest in gold is through buying stocks in companies whose main commercial activity is gold mining.

🔎 What are stocks?

A stock is a “security” that certifies an ownership stake in a company. Hence, if you own shares in a company, then you own a share in that company and are one of its shareholders.

As we saw at the beginning of this guide, gold is found underground (most of it) and requires mining processes to get it into our hands.

A Gold Mining Company does just that.

🚨Attention:

Understandably, the stock prices of gold mining companies differ from the Spot Gold Price and do not have an absolute correlation.

The reason is that they are individual companies whose stock prices are affected by other variables such as management costs, revenues, expenses and profits.

Just because the gold price is going up or down does not mean it will (necessarily) raise or lower the Gold Miner’s share price.

Examples of Gold Mining Company Stocks

According to Wikipedia, the 3 largest gold mining companies in the world are the following:

The above stocks are not a recommendation for investment and serve simply as examples for your research. I am not in a position, nor is it my role, to recommend investment options.

📚 Guide to Stocks:

If you want to learn more about Stocks, you can read MoneyMinority’s Detailed Guide:

► What is a Stock?

► How do I make money from Stocks?

► Where do I buy Stocks from?

► How do I buy Stocks [Step by Step]?

Online Stock Brokers

Like any stock, gold stocks can be acquired through Online Stock Brokers. Some popular options are:

♻️ Method Summary:

Buying shares in gold mining companies is an indirect way of investing in gold as their price movements do not have an absolute correlation with the metal’s price.

Gold CFDs

If you are only interested in short-term gold trading, CFDs might be the right way to engage in this particular metal.

A CFD (Contract for Difference) is a contract between you and an Online Broker that gives you exposure only to the price fluctuations of an asset (in this case, gold) without, however, acquiring the actual asset.

Meaning, if you only want to buy and sell gold at short intervals looking to profit from the price difference then it may be more advantageous to do so through CFDs rather than actual gold.

🚨 Attention:

CFDs are advanced products only intended for advanced users who understand and recognize how Trading works and are ok with taking the risk that comes with it.

If you are a beginner, move along Sir (or Madam)…

Additionally, CFDs offer leverage, meaning you can multiply the ” strength” of your position x2, x5, x10 up to x20 times. This exponentially increases the risk you are taking translating into higher gains or losses.

Online CFD Gold Brokers

You can trade gold CFDs at the following Online Brokers:

| ||||

| x1, x2, x5, x10, x20 | x1, x2, x5, x10, x20 | x1, x2, x5, x10, x20 | |

| $50 | €0 | 0.001 BTC | $100 |

| ||||

| $5 | €0 | 0.0005 BTC | €0 |

| ||||

| FCA, CySEC, ASIC | FCA, FSA | CBI, BVI, ASIC, FSCA, CySec | |

Disclaimer: | *Το 79% των επενδυτών CFDs χάνει χρήματα. | *Το 76% των επενδυτών CFDs χάνει χρήματα. |

Gold Futures

Gold Futures are contracts between a buyer and a seller in which they agree to enter into a gold transaction at a predetermined price in the future.

This contract explicitly states the quantity of gold, its spot price and the date the deal will be executed.

In short, the details and the contract are agreed and signed today but processed in the future.

The buyer does not have to pay in full now, and the seller is not required to ship his gold until the processing date arrives.

🚨 Attention:

As with CFDs, Futures are advanced products intended for advanced users only.

If you are a beginner, don’t bother…

Gold Futures are usually chosen by Hedgers who want to mitigate the risk they have taken from their previous positions and by Speculators who use them for Trading.

On settlement day, traders aim to sell or buy back contracts they bought or sold, realizing profits or losses.

🛒 Gold Futures can be bought and sold via Online Exchanges such as Trading212 ►

Is investing in gold worth it?

I come on the clutch, yet again, to ruin it for you.

As in all matters of investing, there is no specific answer, nor is there any “tried and true” path that guarantees correct and certain returns.

On one side, you will find ‘fanatic enemies’ of gold who argue that is a metal with ‘anachronistic’ – almost religious – origins.

They believe that gold only has value in the industry of jewellery production, electronic circuitry and dentistry.

On the other side, you will find “fierce supporters” (the so-called Gold Bugs) who believe that gold is the highest form of money because of its unique characteristics.

They believe it should be an integral part of every investment portfolio as a hedge against inflationary fiat money and that is the metal on which we will “turn” at the first economic collapse.

One of the “Super-Star” investors, Founder, Co-Chairman and Co-Chief Investment Officer of Bridgewater Associates, Ray Dalio, suggests an allocation of 7.5% in gold in his portfolio, All-Weather.

I am quoting his words:

“You need to have a bit in your portfolio so that it does well with the ever-increasing inflation, so you need a percentage in it (gold).”

Ray Dalio on Gold

On the other hand, another “Super-Star” investor, chairman and CEO of Berkshire Hathaway, Warren Buffett, seems to find the choice of gold as an investment far from wise.

The reason is that it contradicts his core investment philosophy of Value Investing. He cannot see any value in gold because of its little utility as a metal in the real economy.

He characteristically states – and I quote:

“It does nothing more than sit there and stare at you”

Warren Buffett on Gold

“(Gold) is mined from Africa or other places. Then we melt it down, drill another hole, dig it up again and pay people to sit around and guard it. It’s of no use. Anyone looking at us from Mars would scratch their head (in wonder).”

Warren Buffett on Gold

What does MoneyMinority do?

As of writing this guide, I have not added gold to my portfolio in any of the formats we’ve discussed above.

If I did choose to do so, however, it would not be as an investment but as an alternative form of savings.

What do I mean?

You can think of it as an alternative Emergency Fund which would be less affected (compared to Cash) by ever-increasing inflation and safer against any stock market collapse.

Moreover, as cool as I think Pirates still are, I’d rather choose an ETF (or Stable Coin) that follows the price of gold than the physical metal in coin or bar form. While the idea of being the owner of gold (let alone keeping it in a chest) intrigues me immensely, I think I would pass and choose forms that offer easier liquidation and much lower premiums.

That’s it from me.

What did you think of this particular guide?

Do you think it’s worth investing in gold? Would you put in your time, money and attention?

Write in the comments!

Until the next article, Stay Golden!

...or not…

Sterg

Don’t forget that investing involves risk. You may lose part or all of your fortune.

Risk Disclaimer:

I am NOT a professional investment advisor and the following is NOT an investment recommendation but is my personal experience and opinions.

Keep in mind that always investing = risk.

Only invest money that you are willing to lose!

Affiliate Disclaimer:

The above links to the services listed may be affiliate links. If you use the service through them then you are helping MoneyMinority to continue to exist, at no extra cost to you.

Feel free not to use them if you do not wish to.

Read more about Risk & Affiliate Disclaimers of MoneyMinority.

Καναδάς

Καναδάς Η.Π.Α.

Η.Π.Α.

CFD Χρυσού:

CFD Χρυσού: Μόχλευση:

Μόχλευση: Ελάχ. Κατάθεση:

Ελάχ. Κατάθεση: Προμήθεια Κατάθεσης:

Προμήθεια Κατάθεσης:

Demo Account:

Demo Account: Regulated:

Regulated: