Monese is one of the most popular digital banks in the UK at the moment, which, in turn, makes it popular in all of Europe, with low and clear fees.

Monese offers a UK based bank account, without requiring a UK address, receipts of utility bills issued in the UK or any other former documents from traditional UK banks.

The Monese bank account comes with a debit Monese card (MasterCard) which can be used for any transactions.

It’s an ideal solution for residents in the UK (or for those considering moving into the UK) who often travel abroad to the EU.

If you’re interested in Monese and what it has to offer as a Mobile Digital bank, keep scrolling for the most complete guide for 2020 on Monese Bank & Card.

Sign Up Monese Bonus:

Use the following Invite Code:

→ STERG083 ←

to receive 10€ in your account after completing your first purchase.

*The Referral Bonus has been temporarily paused *

Monese Guide Index:

- What is Monese?

- What does Monese offer?

- 10€ Sign Up Bonus

- Monese fees

- Is Monese safe to use?

- How do I open an account in Monese?

- How can I transfer money to my Monese account?

- Are there alternatives in Digital Banks?

- Conclusion

- F.A.Q.

What is “Monese”?

Monese is a mobile digital bank founded in September of 2015 by Norris Koppel in London.

For its time, Monese was the first (and only) 100% mobile bank in the UK.

Up till now, it counts over 500.000 customers and has more than half a billion transactions under its belt.

Before we take a closer look at what it does, let us first have a brief flashback to its foundation.

In 2014, Norris decided to move into the UK from Estonia (his birth place) and stumbled upon one of the most common issues that everyone moving into the UK have to face:

Opening a bank account as an outsider.

Explaining Myself.

In the UK, in order to create a bank account, you are required to present some form of Utility Bill, be it an electricity bill or water bill, or having some credit history with a local bank.

Norris didn’t have any of the two, so he was unable to open an account.

And without a bank account, he was also unable to rent any apartment or get paid from a job.

Norris was technically broke, and homeless. Enough to push a person off the edge.

Thankfully, they pushed Norris to Monese.

A mobile bank that offers its services to everyone, regardless of residency or credit history.

So What Does Monese Offer?

Monese, true to its values, offers customers a UK based bank account, and a Debit MasterCard card to go along with it.

Nowadays, with its expansion outside of the UK, it offers the capability of two simultaneous separate accounts.

A UK one in English Pounds (GBP) and a European one in Euros (EUR).

Neat and handy feature for UK residents who travel abroad frequently or come from another country belonging to the European Union.

The debit MasterCard linked to the bank account can be used for any transactions either inside or outside the UK.

Fee-Free ATM Money Withdrawals*

ATM withdrawals with your Monese card are fee free.

There is a withdrawal limit that depends on the pricing plan you choose.

More on that further down.

*Note: There are no fees as far as Monese is concerned. However be advised: there might be charges for such services from the ATM’s side.

For example Greek banks have issued fees for any ATM withdrawals using foreign-to-Greece cards such as Revolut, n26 and Monese as well.

Fee Free Purchases in Foreign Currency

You can pay for purchases or services in any foreign currency with your Monese card with no extra fees for the currency exchange.

Furthermore, Monese does not increase its exchange rates for profit when converting money. Instead it uses the rates that banks themselves use for conversion when dealing with one another.

The spending limit that you’ll get free of fees, depends on the pricing plan that you choose.

Sending Money in Foreign Currencies

Once again using real interbank exchange rate, you can send money from your Monese account to the following currencies:

Dollars (USD), Turkish Liras (TRY), Swedish Krona (SEK), Romanian Lei (RON), Polish Zloti (PLN), Norwegian Krone (NOK), Mexican Pesos (ΜΧΝ), Indian Rupees (INR), Hungarian Fiorins (HUF), Euros (EUR), English Pounds (GBP), Danish Krone (DKK), Czech Koruna (CZK), Swiss Francs (CHF), Brazialian Real (BRL), Bulgarian Leva (BGN) and Australian Dollars (AUD).

If the recipient has a Monese account, then the transaction is free of charges.

If not, there is a 2% fee based on the amount sent (with a minimum fee of 2€/£). In more expensive pricing plans, there are no fees.

Monese Fees

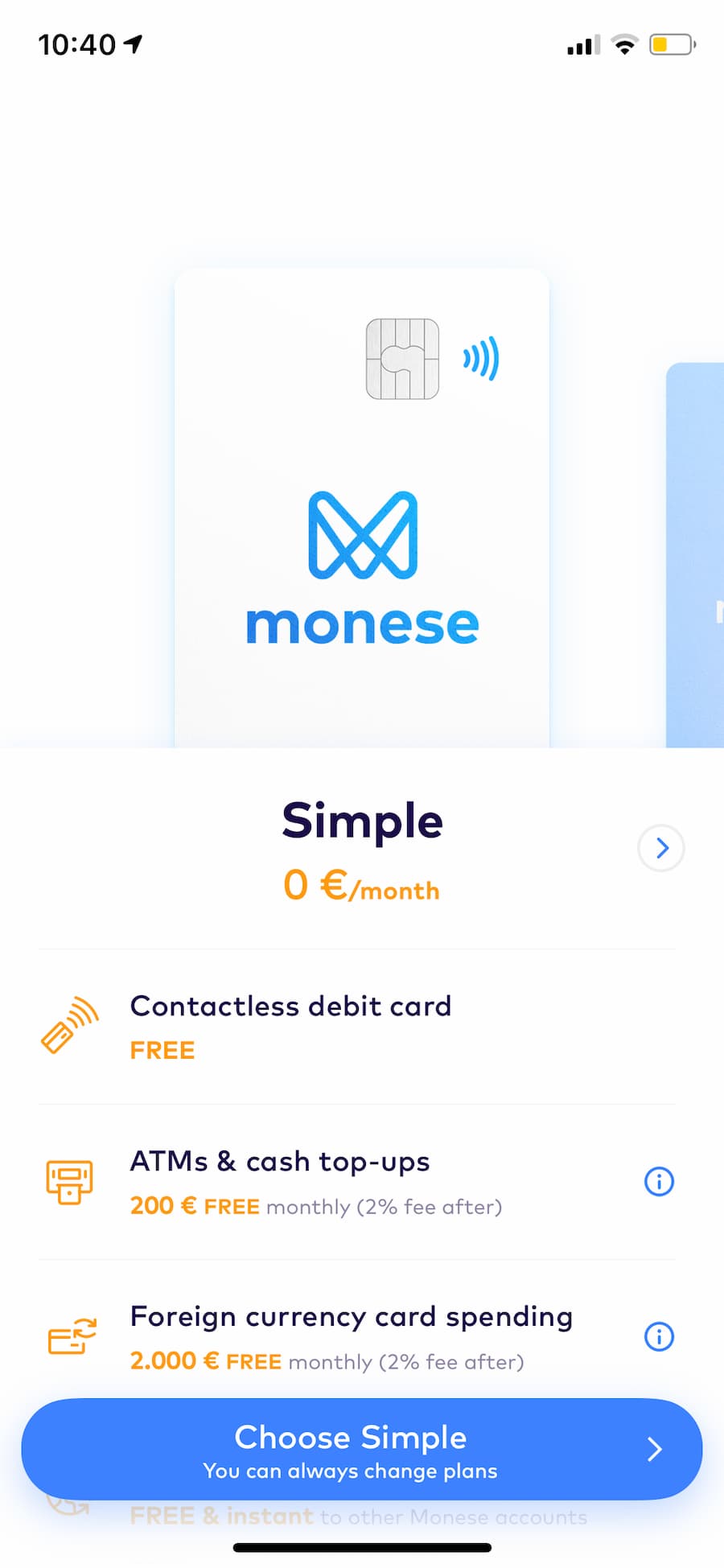

Monese offers 3 different pricing plans: Simple, Classic and Premium.

All of the above offer:

- Free debit Monese card (MasterCard)

- Free bank account in EUR & GBP

- Free top-ups with debit cards

- Free money transfers to other Monese users

Afterwards, each plan has some extra features to offer.

Let’s check them out:

Simple Monese Card Plan – 0€ /month

The basic plan, free of subscription charges and ideal for those just starting out.

If you just need a UK bank account to receive job payments or a card to make your travel spendings easier, this is the plan for you.

It offers:

- Fee Free ATM Withdrawals up to €/£ 200 per month

After the €/£ 200 limit there is a 2% fee - Fee Free Purchases in Foreign Currencies up to €/£ 2000 per month After the €/£ 2000 limit there is again a 2% fee

- Money Transfers in Foreign Currencies

2% Fee – Minimum fee of 2 €/£ Free transfers to other Monese users

*The Referral Bonus has been temporarily paused *

Invite Code → STERG083

Classic Monese Card Plan – 4.95€ /month

This is an ideal solution if you’re going to use the Monese account as your main one and you often have to transfer money in foreign currencies or are in need for more cash.

It offers:

- A Higher Fee Free ATM Withdrawals limit, up to €/£ 800 per month The 2% fee applies after the €/£ 800 limit

- Fee Free purchases in Foreign Currencies up to €/£ 8.000 per month Again there is a 2% fee above the €/£ 8.000 limit

- Money Trasnfers in Foreign Currencies 0,5% fee – Minimum fee of 2 €/£ Free for other Monese users

Premium Monese Card Plan – 14.95€ /month

The premium Monese pricing plan.

No fees, just a monthly subscription.

It offers:

- Fee Free ATM Withdrawals

- Purchases in Foreign Currencies Free of any Fees.

- Fee Free Money Transfers in Foreign Currencies

Is Monese Safe?

Monese is fully registered to the Financial Conduct Authority (FCA) of the United Kingdom and fully authorized to issue digital money and function as a payment instrument.

Furthermore, unlike traditional banks, Monese does not reinvest any of its customers’ capital, but rather stores it in a different portfolio, separate from the company’s assets.

Which translates into: worst case scenario, bankruptcy, all your investments are guaranteed 100%

Besides all of the above, Monese offers its users active control over the security features of your account.

Users always have the option to deactivate or reactivate their debit card, which might prove to be a lifesaver should your card get stolen or lost.

Moreover, every time there is any sort of transaction, be it money spent or received, Monese notifies the user with pop-up notifications.

So if there’s any unrecognized movement in your account, you can take immediate action.

How Do I Open a Monese Account?

Did everything you read sound right so far? Time to get started.

Follow this step-by-step guide and your account will be open in no time!

Sign Up Monese Bonus:

Use the following Invite Code:

→ STERG083 ←

to receive 10€ in your account after completing your first purchase.

*The Referral Bonus has been temporarily paused *

Step 1: Download the Monese App

Use the following link and choose “Sign Up Now“

Referral Code → STERG083

Then you’ll have to add your mobile number.

You shall receive an SMS from the bank with a link to download the Monese App.

Step 2: Create Your Monese Account

Got the app? Wasn’t hard was it! Now to create your account!

Fill in your e-mail and use the Invite Code: STERG083 to receive 10€ after you complete your first transaction using your new card!

This is where you fill in your address information.

You can choose under which currency you want your main account to be.

For residents of the UK I’d recommend a main account in GB Pounds

On the other hand for those who live outside the UK, I’d recommend a main account in Euros.

Then again, there’s nothing to worry about.

Creating a second account in the other currency is only 3 clicks away.

Step 3: Verifying your Monese Account

In order to activate your account you’ll have to verify all the information that you entered.

For starters, you’ll have to take a photo of a legal document that will help identify you.

Monese offers more than one options:

- Identification Card (ID)

- Passport

- Driver’s Licence

- Residence Permit

After you’ve uploaded your documents, it only takes a few minutes for their verification from the digital bank.

The process took about 5 minutes for me.

After your documents have been verified, you have to:

- Take a selfie so they can see your pretty face (and identify it of course)

- A short video where you turn your head so that they can get your profile

- And finally speak out 3 numbers in English

Another 5 minutes for the verification to process and you’re ready.

Step 4: Selecting a Pricing Plan

Done with the verification? Good. Hope you looked good on them selfies! But enough with vanity, let’s choose a pricing plan!

We’ve already talked about them, but let’s review them shortly:

- Simple Plan – Free

- Classic Plan – 4.95€ /month

- Premium Plan – 14.95€ /month

Choose the plan that better suits your needs.

I’d recommend starting with the Simple Plan since it’s free and all, and as you get to know Monese you can upgrade to a better one if the Simple one does not cover your needs.

Step 5: Shipment of Monese MasterCard

Hurray! Your account is ready!

So…what now?

Now you order your MasterCard, the one you’ll use for your transactions.

From the App menu select “Card”, and then confirm the shipment of your new Monese MasterCard. Shipping costs are paid for by the company.

Great! The card will be at your door in 10 business days.

It arrived at my door within a week.

And done!

…or are we?

In the next section we take a closer look at some ways to transfer money in your new Monese account.

Keep reading.

How Do I Transfer Money into my Monese Account

Thankfully, it’s a pretty easy and straightforward process!

Monese offers 2 different ways to transfer money into our account (with the 2nd one offering the best value for us).

- Transfer Money with a Remittance (Bank Transfer)

- Transfer Money with an Instant Top-up

Sending Money with a Bank Transfer (Remittance)

The first option is to wire money to your digital bank account from your traditional bank.

How do you Wire Transfer Money to Your Monese Account:

From the main Menu of the app, select “Add Money“and then select “Bank Transfer“.

There you can also find your bank account information in Monese (Account name & IBAN).

After keeping note of that information, you have to log in to your Online Banking account of your traditional bank, select bank transfer.

Choose the amount you wish to transfer, insert the information you copied before, and transfer the amount to your Monese account.

The transfer is completed and the money will be visible in your digital bank account within 1 to 2 business days!

Even though there are no fees for the transaction from Monese, your bank will charge you for the transfer.

In Greece for example, my local bank “Piraeus”, charges a standard fee of 1€ regardless of the amount transferred (and I’ve transferred up to 2.000€).

There are many drawbacks to this transfer method (fees, slow money transfers) and it’s usually not opted for, especially since there is the option of an instant card top-up.

Attention: -The transfer should be SEPA and not SWIFT. -The charging method selected should be SHA.

Money Transfer by Instant Card Top-up

Here the procedure is simpler, faster and cheaper.

The second method is transferring money to your Monese account through another debit card.

From the main Menu select “Add Money” and then “Instant Top Up“.

You are then prompted to fill out your debit card information (Visa or MasterCard) and the amount you wish to transfer to the Monese digital bank account.

After selecting send, your bank is charged the amount selected, which is transferred instantly to Monese!

The Top Up method, like I’ve already mentioned, has significant advantages over Bank transfers because it is:

- Free – There are no extra fees for card Top Ups.

- Instant – Your transferred money is immediately visible in your Monese account.

- Simple – It’s a simple 2 step procedure through the app

However, the only drawback is the limit of 2 top ups per day, with the maximum amount set to 300€.

Thus if you wish to transfer a larger amount to your digital bank account your only option is a Bank Transfer.

Generally, top ups are the preferred method of transfering money over to our digital bank account.

Monese Alternative Digital Banks

A ton of alternatives.

Digital banks are definitely on the rise and the options are often overwhelming.

The most notable, safe and popular alternative digital banks currently are:

Revolut

Revolut was founded in 2015 in London and it might just be the most popular Digital Bank option at the moment.

Lucky for you, I already have a Revolut guide available for you:

N26

N26 was founded in 2013 in Berlin and is one of the biggest digital banks in Europe.

Again, I’ve got you covered guidewise:

Conclusion

Monese’s low fees (although, truth be told, there are cheaper alternatives in other digital banks), the easy-to-use app, the simple card top-up method and the fact that there are no requirements of residency in the UK or previous credit history with any UK bank are some of the great features that Monese digital bank has to offer.

Before we wrap this guide up, I’d just like to note that Monese provides an ideal solution for those who are considering moving to the UK and are looking for access to essential banking services.

Sign Up Monese Bonus:

Use the following Invite Code:

→ STERG083 ←

to receive 10€ in your account after completing your first purchase.

*The Referral Bonus has been temporarily paused *

F.A.Q.

Here are some frequently asked questions regarding Monese:

What is Monese?

Monese is a mobile digital bank founded in September of 2015 by Norris Koppel in London. Up till now, it counts over 500.000 customers and has more than half a billion transactions under its belt.

What does Monese offer?

Monese offers a free digital Bank Account in the UK (either in £ or in €) with a unique IBAN that comes along with a Monese Debit Mastercard that can be used for purchases all over the world.

How can I open a free Monese bank account?

You can open a free Monese bank account via the official webpage of the company. It is a fairly easy and fast process that can be done on your mobile phone.

If you open an account via this link you will a get a 10€ bonus when you make your first purchase!

Invite Code: → STERG083

Apple Pay & Monese: Can They Be Linked?

Certainly! You can easily connect your Monese MasterCard with your Apple Wallet and use your iPhone for all your purchases.

How can I send money to my Monese account?

There are two ways you can send money to your Monese account: Either via a Wire Tranfer from your traditional bank or via Instant Top-up using any debit Mastercard or Vista.

Google Pay & Monese: Can They Be Linked?

Of course! You can easily connect your Monese MasterCard to Google Pay and use your phone for all your purchases.

What Do I Do If I Lose My Card?

Your first course of action in case of theft or loss, is to deactivate your card through the Monese app.

If you happen to reclaim it or find it later on, you can easily re-activate your card again through the Monese app.

Can I log in to my Monese account through a computer?

Nope!

Monese offers access to its banking services only through the mobile app.

![How to Become Rich [Undestanding the 3 Types of Income] How to Become Rich [Undestanding the 3 Types of Income]](https://moneyminority.com/wp-content/uploads/2020/01/How-to-Become-Rich-Undestanding-the-3-Types-of-Income.jpg)