🔄 Last updated article: 02 March 2024

🎁 Online exchanges to buy BTC with sign-up bonus →

Being here, I guess you want to buy bitcoin but don’t know how. Isn’t that right?

If you’re looking for a quick answer, then follow the steps below:

- Step #1: When to buy →

- Step #2: How to buy →

- step #3: How to store →

⚠️ If you are not in a hurry, it is recommended to read the full detailed article →

I’m sure that, before getting here, you did some research which complicated things even more: a mess of information, news and opinions that confused you even more.

Not to mention you have to deal with every nutcase trickster, con artist and scammer out there.

Where to start your research? What should you do? Should you just leave the Bitcoin for your little cousin and go for a beer?

☕ First of all, calm down… Leave the beer and go to the kitchen, make a hot cup of coffee and come to read. You’re in the right place!

Here’s a super-analytical Bitcoin buying guide for beginners designed to help you solve your questions.

By the end, you’ll be fully informed on how to buy Bitcoin (and where) so you can invest in the cryptocurrency easily, quickly and safely!

So let’s go!

| 📱 What you need: | Mobile or computer |

| 💰Min. Amount: | From 10€ |

| ⚙️ How to do it: | via an exchange |

| ⏳Time: | ~30 minutes |

TL;DR

Buy Bitcoin in 3 steps

If you don’t have enough time to read the following lengthy article, I’ll summarize the steps a beginner should take to buy Bitcoin:

#1 When to buy Bitcoin?

You made the decision and now you’re being asked to answer the “when to buy” question.

Really, why do you want to buy Bitcoin?

🔛 Do you want to make frequent purchases for immediate profit? Commonly, to become a short-term trader?

Then the strategy you should follow is timing the market: you buy when the price drops and sell when the price rises – sounds simple, but in practice, it is challenging.

In your attempt to predict future price movements, you will have help from tools such as technical analysis, with which you can analyse price charts and trading volumes.

🔜 On the other hand, if you believe that the value of Bitcoin will increase in the future and you want to invest in holding it for a long time (as a long-term investor), then there are two strategies:

- Dollar Cost Averaging (DCA): you invest a fixed amount at regular and fixed intervals, regardless of price.

Example: €20/month, regardless of price

It works most efficiently when the market trend is downward - Lump Sum: you invest the entire amount at the beginning of the investment, regardless of price.

Example: €1,000 at the beginning of the investment

Works most efficiently when the market trend is upwards

#2 How to buy Bitcoin

- You choose the right cryptocurrency platform

- Create a new account and confirm your identity

- Deposit money (€, $)

- Buy Bitcoin

- Proceed to step #3 to ensure its security

Given that the platforms selling Bitcoin are infinite, I would suggest limiting yourself to only those with a proven track record of several years of operation behind them.

This way, you’ll guard against potential frauds, scams, Ponzi schemes and possible security loopholes that a “fresh” platform might face.

Some of the most popular options are:

🛡️ Learn the necessary steps to follow to buy cryptocurrencies safely →

Buy Bitcoin ETFs

If you want to buy Bitcoin without getting involved with the technical side of the cryptocurrency world, you can look at Bitcoin ETFs. They are traded on exchanges (like stocks), managed by fund managers, have a clearer tax treatment, and are mirrored by real Bitcoin.

Some of the most popular Bitcoin ETFs you can buy are:

1. The Physical Bitcoin ETC (BTCW) from WisdomTree (ISIN: GB00BJYDH287)

2. The Physical Bitcoin ETC (BTIC) from Invesco (ISIN: XS2376095068)

3. The Physical Bitcoin ETC from CoinShares (ISIN: GB00BLD4ZL17)

You can find them by searching for them by ISIN, at Saxo Bank’s investment bank →

#3 How to store Bitcoin

Once you’ve bought it, the next step is to decide where to store it.

The options are two:

- Leave it at the cryptocurrency exchange where you bought it 📲

- You transfer it to a private cryptocurrency wallet 🔒

The following question to yourself will help you decide:

“Why did I buy Bitcoin?”

☝ Exchange: If your investment is small, you have a short-term time frame and plan to do frequent buying and trading with other cryptocurrencies, then the most convenient option is to keep it on the exchange where you bought it.

💡 A crypto exchange offers precisely what it was created to offer: easy, smooth and cheap transactions between cryptocurrencies. Some of the most popular ones are Binance, Bybit and Kraken.

💰 Passive interest rate: If you’re okay with taking on extra risk, some platforms will offer you a passive interest rate through lending services. You transfer cryptocurrencies there, and they undertake to lend them to third parties and reward you with a daily interest rate. Typical examples are Nexo and Wirex.

🚨 Attention: The interest rates and the viability of these companies are closely related to the condition of the market. In the past, they have gone bankrupt, with people having lost money (or still waiting for it) – see Celsius, BlockFi.

✌️ Wallet: On the other hand, if you invested a significant amount in Bitcoin, intend to keep it in your possession for a long time and want to be protected from potential hacks and scams, then the best option is to store it in your cryptocurrency e-wallet.

💡 A cryptocurrency wallet is software that allows you to send, receive and store cryptocurrencies to an address of your own, making you the sole owner of your crypto. Some of the most popular options are Ledger’s Nano S and Nano X.

Contents of Bitcoin Buying Guide:

- The Basics

- Buying Bitcoin

- Storing Bitcoin

- Frequently asked questions →

- 🎁 Bonus in Crypto →

- More Material →

👇 Keep reading, we will elaborate on each step more, below…

Buy Bitcoin through Binance, one of the largest cryptocurrency exchanges in the world. If you use the link below you’ll earn 10% off commissions… forever!

Learn more about Binance →

What is Bitcoin?

Bitcoin is the first and most popular digital currency or cryptocurrency.

It is a form of electronic money that is protected through cryptography and is only transferred digitally, directly from person to person, without an intermediary.

💬 And while Bitcoin started out to serve as a means of transferring value (as money), it now seems to have taken on the role of a digital store of value – like an updated version of gold, or otherwise, as digital gold.

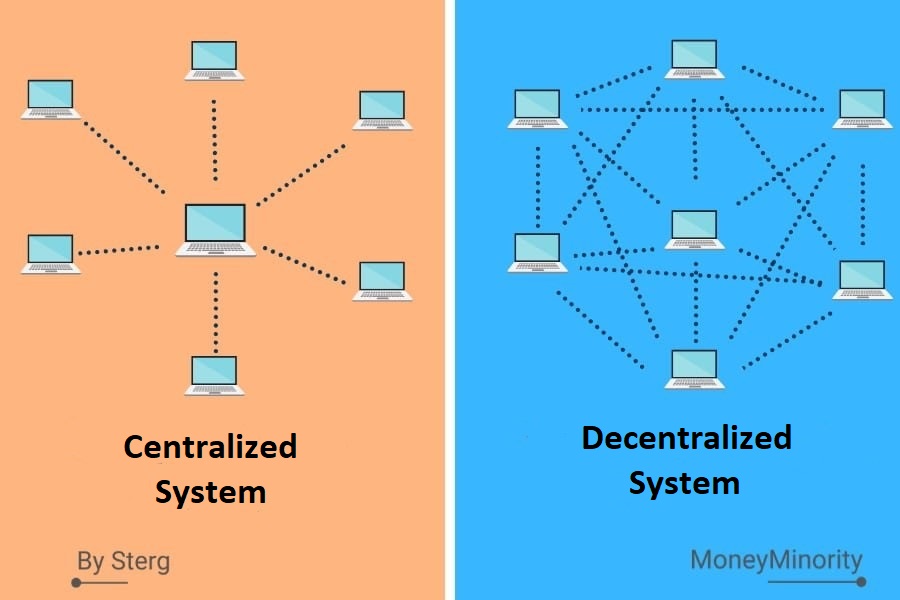

The feature that makes it unique is its fully decentralized nature.

Unlike traditional currencies such as the Euro and the Dollar, which central banks issue, Bitcoin is completely independent and not subject to the control of a specific authority.

It is a form of money born organically from the market… for the market!

How does Bitcoin work?

The operation of Bitcoin is based on BlockChain technology – a fancy term to describe a decentralized database.

This database records, at any given moment, all available balances as well as transactions taking place.

The difference with a traditional database is that the data is stored between several different computers instead of on a central server.

The storage is in the form of blocks connected in series, one after the other. Just like a chain.

🔗 Hence the name → Block + Chain = Blockchain

The blockchain gives life to the Bitcoin network, so it can be transferred directly from user to user without an intermediary.

It emerged in 2009 as a new Peer 2 Peer Electronic Cash System by someone under the nickname Satoshi Nakamoto – whose identity still remains unknown today.

₿ Any questions? Read what Bitcoin is and how it works →

Why buy bitcoin?

Since 2016, the large fluctuations in its price have often brought it into the spotlight – and respectively, into the background – with more and more people wanting to own it.

Each for their reasons…

Some see it as a fresh market suitable for trading: it is open 24/7, accessible to all and characterized by incredible volatility.

💡Think about how it has managed to lose 80% of its value in a few months… only to regain it in multiples in the immediate months.

Several traders try to take advantage of these rapid price fluctuations, buying and selling constantly for immediate profit.

✊Others, see it as a financial revolution: they see how Bitcoin has come along and, little by little, will replace the foundations on which traditional fiat currencies operate.

They argue that we are still at the beginning because it has not been adopted by the mass population. And they hope that once it is, the price will skyrocket!

These are called investors, they tend to buy bitcoin and hold it in their possession for long periods. If you wanted to liken them to something, that would be gold investors.

Why is it important?

The truth is that for the first time in modern history, an alternative to the existing financial system is being presented.

How? Through a currency that is operated, issued and circulated in a decentralized manner without being controlled by a central bank or government.

Unlike fiat money, bitcoin has a fixed monetary policy that no one can interfere with and is known to all:

On the other hand, our current money is characterized by secrecy: you don’t know who issues it, how much they issue, and where it goes. You just hope that whoever has the power will exercise it properly, fairly and without bias.

To help you understand your meaning, I’ll use an analogy:

⚠️How were people informed before the internet?

They turned on the television, bought their preferred newspaper or went to their neighbourhood library. In short, the flow of information came in a centralised way, through specific sources.

Today, the internet has changed things, and the flow of information is completely decentralized. You can transmit and receive information, news and knowledge to and from anyone easily and quickly with just a few clicks.

📡The transmitter has become the receiver… and vice versa.

Good so far?

Once again, use this example, only this time replace the key components:

information → money

Internet → Bitcoin

In short, just as the internet decentralized the flow of information, Bitcoin will come and decentralize the flow of… money!

Its fanatical proponents – bitcoin maxis – claim that it has come to shake up and completely change the foundations on which money is based today.

Money today has value because:

- we all believe it has value

- and a central authority tells us that it guarantees its value

Bitcoin is telling us that instead of placing our faith in someone… let’s place it in every one of us, decentralized, through technology!

Read more about the importance of Bitcoin →

When to buy Bitcoin?

After looking at the why and before we move on to the how, I think we should talk about the when.

The million-dollar question that comes effortlessly and puzzles everyone who is thinking about buying Bitcoin is:

When is the right time to buy Bitcoin?

Is it now? Should you wait a little while so that the price drops and you can buy cheaper? What if it never drops again? Does it never go up and remain stable?

As you can see, this is a question that no one can answer!

Given that time travel has not yet been invented, and past returns do not guarantee future returns, no one can know how the price will move.

Anyone who claims to know the future price path of Bitcoin with certainty and can reveal it to you is lying and, in all likelihood, aiming to make money off you.

The price of Bitcoin right now:

As we mentioned at the beginning, the reasons why most people buy bitcoin are two:

- 🔛Short-term trading: they buy and sell continuously making an immediate profit from the price volatility.

- 🔜Long-term investing: they invest with a long-term horizon aiming for future profit as they believe the value will appreciate

₿ And while no one knows the future, some bitcoin indexes claim to be able to predict its price →

Direct Bitcoin trading

or else, buying and selling for immediate profit

There are two ways in which you can make an immediate profit through Bitcoin trading:

- 🟢Going Long on Bitcoin: you buy when the price is low and sell when the price is high, profiting from their difference.

- 🔴Going Short on Bitcoin: you sell when the price is high and buy again when the price drops low.

The strategies are varied. You can go the way of scalpers who buy and sell in a few seconds or a swing trader who keep their positions open for days or weeks.

The ulterior purpose of any trader, at its base, is to be positioned in the market in a way that it continuously profits from the volatility of a price.

🔺When the trend is bullish, open long positions →

🔻When the trend is down, open short positions →

The essential tool of a trader

🛠️The tool that anyone who wants to engage in bitcoin trading should have in his quiver is technical analysis →

This analysis deals with the psychology of the market and studies how changes in demand and supply affect price movements.

It analyzes data from the Bitcoin price chart to discover any patterns that will show what is “more likely” to happen in the future.

In short, based on the price trend in the past, it attempts to interpret the future.

⛔Bitcoin trading – in all likelihood – is NOT for you.

To be here, you are probably a beginner, so I have to warn you, that it requires knowledge, and experience, involves high risk and a good mental state.

Long-term investment in Bitcoin

or else, investing for the distant future

If you wish to get involved in the Bitcoin market without getting involved with technical analysis, trading and other incomprehensible things, then again there is a solution!🥳

Whether you believe that Bitcoin will become the new global store of value, it will radically change the monetary system, or simply that its price will rise, then it makes sense to invest in it by following a long-term strategy.

💭Broadly speaking, the concept of investing refers to the process whereby you put your money into something with the expectation that it will be returned to you in the future… many times over!

Quite a few people who invest in Bitcoin intend to hold it for many years – some say forever – because they believe that its unique characteristics make it inevitable that will increase in value.

They understand that the price you pay today may not have much significance in the long run, as it is likely to be much higher. Therefore, it is not crucial whether you manage to get a better deal by $200 or $2,000. The most important thing is simply to buy.

If you ignore the extreme volatility – i.e. the constant ups and downs – of the price, over the long term, it has shown to be bullish:

So far, at least…

How long will the price of Bitcoin continue to rise?

In addition to the positive historical trajectory to date, the monetary nature of Bitcoin tends to reinforce the rhetoric around its ever-increasing price increase – with one small detail.

The total number of Bitcoins that will ever be in circulation is finite and cannot exceed 21,000,000.

💡Right now, there are about 19,500,000 bitcoins in circulation, with 93% of the total already mined.

Bitcoin mining, the process of creating new coins, is strictly predetermined and cannot be altered by anyone unedited.

📉Unlike today’s money, whose supply is constantly increasing (through inflation), bitcoin has a predetermined supply known to everyone.

Is the fixed supply a strong indication of a future price increase?

Yes… But only on one condition… that continues to be in demand in the market!📈

🧠Let me introduce you to what I believe is the most basic mental model of economics, which is none other than the law of supply and demand.

What does it say? The price of any good, service or asset is determined by only two variables: its demand and supply in the market.

🟢As long as there is demand (i.e. we believe bitcoin has value), constant supply (there can’t be more bitcoin) drives the price up.

🔴If we stop finding value in Bitcoin, demand will decrease, and no matter how stable its supply is, the price will move downwards.

The above reasoning is only confirmed if Bitcoin succeeds in the long run. If there is no integration into the economy and demand is low, it won’t trigger a price increase.

Bookmark it

I would recommend bookmarking this guide so you can refer back to it anytime you want.

How do I buy Bitcoin?

The fastest, safest and easiest way to buy Bitcoin online is through a cryptocurrency exchange.

They are online platforms through which you can buy and sell cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). In a way, they act as intermediaries by bringing buyers and sellers together, keeping a small commission from each transaction.

The Bitcoin buying process involves the following steps:

- Choosing the right exchange platform (based on fees, reliability, and security)

- Creating a new account

- Account verification via KYC (usually requires a passport, ID card or driving licence)

- Transferring money to the exchange platform (either by wire transfer or debit card)

- Converting Euros to Bitcoin

The most popular Bitcoin exchange platforms

Here are some platforms that I have tested, are highly regarded by the international community and have been in operation for years:

Binance | ByBit | Crypto.com | Nexo | Wirex | Pionex | |

|

|

|

| 💳 |

| |

Founded: | 2017 | 2018 | 2016 | 2018 | 2014 | 2019 |

Coins: | 401 | 555 | 321 | 70+ | 250 | 365 |

Pairs: | 1.507 | 799 | 669 | 596 | ||

Spot Fees: | 0.1% | 0.1% | 0.075% | 0% | depends | 0.05% |

Futures Fees: | 0.05% | 0.055% | 0.017% | 0.02% | ||

Crypto Card: |  |  |  |  | ||

Cashback: | up to 5% | up to 2% | up to 8% | |||

Interest on Stables | up to 6,5% | up to 16% | up to 20% | |||

Interest on BTC | up to 5% | up to 7% | up to 6,5% | |||

Bonus: | -10% fees + $100 rebates | up to $30.000 | $25 in CRO | $25 in BTC | $15 | -10% on fees |

📚 Guides: | Read more → | ByBit | Read more → | Wirex | Pionex | |

Looking for an app to track your portfolio? Try GetQuin for free → | ||||||

🏆Take a look at the best cryptocurrency exchanges →

Below, I will briefly mention 3 platforms through which one can buy, sell, invest, save and pay with bitcoin.

- Binance, the largest exchange platform →

- Crypto.com, a one-stop solution →

- Kraken, one of the oldest exchange platform→

How not to fall victim to a scam?

The most common reason people tend to contact me is because they have been a victim of fraud… And specifically, cryptocurrency fraud!

And while cryptocurrencies are not a scam per se… they tend to attract scammers like sh*t attract flies.

⚠️ What are the most common scams?

Usually, the scammer approaches the victim on social media and promises very high profits with minimal risk. All he has to do is to use a specific platform for his investments.

The victim is convinced, sends the money, the investments seem to have progressed, and everything is going great until he wants to withdraw his capital…

The scammers will come up with 1,001 excuses to get him to deposit more money until they stop responding.

When something sounds too good to be true, it probably is.

Binance: The Biggest Exchange

Binance was founded in 2017 and has already become the largest exchange platform in terms of trading volume worldwide. It is the most popular cryptocurrency platform offering a complete ecosystem of services around the crypto world.

It is one of the most comprehensive projects in the industry through which you can buy, sell and trade more than 400 different cryptocurrencies (including Bitcoin) with (perhaps) the lowest commissions on the market (0.1%).

You can buy Bitcoin using your debit/credit card, by making a bank transfer, or simply by trading other cryptocurrencies with it.

Through Binance you can access interest-bearing savings accounts(1.2% APY for BTC), cryptocurrency pledged loans, Staking/Investing options, as well as Trading (leveraged or unleveraged) cryptocurrency derivatives (such as Futures & Options).

If I had to attribute something negative to it, it would be that the plethora of options in features & functions it offers might be confusing to a new and inexperienced user.

In conclusion, Binance is an all-in-one solution, and is an excellent choice for both Bitcoin Traders and Bitcoin Investors who have a familiarity with the subject matter (or are willing to acquire one):

📚If you want to learn about Binance, read the exchange’s detailed guide as well as the steps to buy bitcoin through it → →

Crypto.com: the most comprehensive solution

Crypto.com was founded in 2016 and is, in turn, one of the most comprehensive projects in the cryptocurrency space, offering a complete range of services to its users.

Through the Crypto.com Mobile App, you can buy and sell more than 250 cryptocurrencies (+ Bitcoin), use lending services to earn interest every month, and also take loans with it as collateral.

While the mobile app is ideal for beginners, Crypto.com also gives you access to Exchange, a trading platform in a desktop version, where experienced Crypto/Bitcoin Traders will find all those advanced features they need bundled with competitive fees (0.075%/0.075%).

Also, you can get the Crypto.com Visa Card allowing you to use your cryptocurrencies to make daily trades with cashback up to 8%.

🎁Sign-up bonus $25 [Crypto.com]

Crypto.com offers CRO tokens worth $25 for every new member.

* To earn the Bonus in the App you must order a metal Crypto Debit Card.

Kraken: the safest exchange🛡️

Founded in 2011, Kraken is considered one of the “dinosaurs” of the industry and one of the safest Crypto Trading Platforms, as it has never been hacked.

Through Kraken‘s platform, you can Spot and Margin Trade (for the more experienced) more than 40 Cryptos.

(including, among others, Bitcoin).

Its commissions despite being in third place after Binance and Crypto.com Exchange, are still considered competitive.

They start from 0.16%/0.26%, depending on the transaction volume can go up to 0%.

On the negative side, the absence of an option to purchase cryptocurrencies by credit/debit card and, admittedly, the not so efficient Customer Service can be accounted for.

How do I store Bitcoin?

The best way to keep your Bitcoin safe is by storing it in your electronic wallets (bitcoin wallets).

It is a piece of software (a program) that interacts with the basic Bitcoin code and allows you to store, accept and send it to other users.

Its main difference from an exchange platform is that it allows you to be the absolute and sole owner of your Bitcoin.

How does a Bitcoin wallet work?

To make it easier to understand, you can make the following analogies:

- A Bitcoin wallet works like an email client (Gmail and Outlook)

- Bitcoin itself works like emails

To receive and send emails you need 2 things:

- Some kind of software – e.g. Gmail

- a sending/receiving address – e.g. [email protected]

The same is true with Bitcoin. To receive and send Bitcoin you need:

- a Bitcoin Wallet – the software

- a sending or receiving address – e.g. 3CNSjdCJJJzf2PByw5iT1G1fEPWNA2C7i2r

A Bitcoin e-wallet provides you with exactly that. The necessary “address” from and to which you can receive bitcoins.

How can I be 100% safe?

If you have been even slightly concerned with the security of your cryptocurrencies then you will have heard the phrase, “Not your keys, not your Bitcoin”.

What does it mean?

To be the true owner of a cryptocurrency you must also possess the unique key (private key) that proves its ownership. In short, the owner of the private key is also the one who has the power to decide what to do with it.

And while all cryptocurrency exchanges will take it upon themselves to hold your bitcoins for you, none will give you access to your unique keys.

Two examples to make it clearer:

- If you store your Bitcoin on an exchange platform, you are trusting them to keep it safe for you.

- If you keep your Bitcoin in a wallet of your own then you are the only person with access to it

Does this mean keeping it in your wallet is a one-way street?

If you hold a significant amount of Bitcoin and want to be 100% safe, then yes.

On the other hand, if you want to use (e.g. Trading) or exploit (e.g. Staking/Lending/Investing) your cryptocurrencies then it might be a roadblock. You have to put them in and take them out all the time, which is inconvenient and costly.

Perhaps, the best option is a combination of both. The logic is that you keep what you don’t need immediately in the safety of a Cold Wallet while keeping what you use outside.

Bring your wallet and bank account to mind: In the former, you keep the money you need for your daily transactions, while in the latter, you keep your lifetime savings.

You can follow the same policy for the amounts you keep in exchanges and e-wallets.

Andreas Antonopoulos aptly said: to use a cryptocurrency exchange like a public toilet:

Get in → Do your job → Get out.

Which Bitcoin e-wallet to choose?

There are e-wallets for all tastes. The best way to choose the right one for you is to refer back to the reason you bought Bitcoin in the first place.

What do I mean?

As we mentioned at the beginning, the determining factor in where you choose to store your BTC is which of the 3 categories below you fall into:

- 🧑🏻💻 Bitcoin Trader: you have a short-term investment horizon and make frequent purchases and sales of cryptocurrencies, stablecoins and traditional currencies.

- 📈 Bitcoin Investor with risk appetite: you have a short-term investment horizon and want to earn interest on your Bitcoin by taking some risk.

- 🛡️ Bitcoin Investor (Hodler) without risk: you have a short-term investment horizon and want your Bitcoin to be 100% safe without taking any risk.

Let’s go over the options:

#1 Bitcoin Storage for Traders 🧑🏻💻

If you want to make frequent purchases and sales of Bitcoin and other Crypto then, understandably, you need immediate access to them.

The easiest and most practical solution is to keep them in an Online Exchange through which you can make all your purchases and sales. Most Bitcoin Exchanges (e.g. Binance, Kraken, Coinbase) act, in parallel, as Wallets.

If you choose this solution, you trust the exchange platform to store your Bitcoin.

This means that they are at risk from the following:

- Fraud/Scam risk

A beautiful morning when you can’t get into your platform because the owners have shut everything down and are drinking Pina Coladas with your Bitcoins in the Bahamas.

See Mt. Gox & BitConnect - Hacking Risk

Just because your Exchange is honest and won’t steal doesn’t mean it can be hacked by third parties who want to take your Bitcoins.

See Binance Hack

Some of the most popular and tested exchanges to buy Bitcoin are:

Before you choose the Online Exchange platform do some research and check:

- Establishment Year & Age

The older, the better.

For example, Kraken was founded in 2011 and has been operating without a hacking issue since then. - Active Security

See if they offer tools to safeguard your account, like 2FA, SMS Authentication, Anti-Phishing Codes, etc.

Oh, and activate them! Don’t be bored! - Passive Security

See if they offer any security/guarantee for their users’ deposits.

For example, Binance maintains a separate fund (SAFU), insuring their customers’ deposits if something happens.

And guess what… It happened!

In 2019, hackers stole 7,000 Bitcoins from its customers, and it compensated them 100%

#3 Storing Bitcoin with 100% (?) security 🛡️

If the amount you invest is not large, you can always keep it there and not create an account in a separate wallet.

The risk is still there!

The bigger the amount of investment, the bigger the risk, so the more precautions you need to take.

It’s up to you, though!

If you have a large amount of Bitcoin or are a long-term investor, the safest option to keep your head clear of hacks and bankruptcies is Cold Storage in a Hardware Wallet.

You can think of it as a USB stick that is designed in such a way that it keeps your Private Addresses safe and receives/sends crypto to other addresses once you plug it into a device and unlock it.

The most popular and reliable Hardware Wallet solutions, at the moment, are the devices offered by Ledger, the Nano S & Nano X.

Frequently Asked Questions about Buying Bitcoin

Here are some of the most frequently asked questions online about the Bitcoin buying process:

How do I invest in Bitcoin?

You can invest in Bitcoin by buying it with the help of a cryptocurrency exchange. Popular reasons to invest in Bitcoin are to seek a “modern” means of wealth preservation (as digital gold), to hedge against inflation and to hedge against the entire modern financial system.

How much is a Bitcoin?

The price of bitcoin is constantly changing as it trades non-stop, 24/7. Right now, the price of a bitcoin in dollars is:

Don’t forget that you don’t need to buy a whole bitcoin, but sub-units of it.

How does Bitcoin price drop?

Unlike traditional currencies, whose exchange rates are easily determined by central banks, bitcoin is completely left to the law of supply and demand. When demand for bitcoin exceeds supply, then the price rises. Conversely, when more want to sell (supply), and fewer want to buy (demand), the price falls.

How do you make money from Bitcoin?

There are several ways in which you can make money from Bitcoin. You can attempt to make short-term trades for profit (bitcoin trading), hold it for a long time in the hope that its price will rise (bitcoin holding), lend it to others at a discounted rate, or accept it as payment for goods and services. Each goes with their respective level of risk, of course.

How do I cash out Bitcoin into Euros?

In general, the process of cashing out Bitcoin to Euros involves 3 steps:

- You choose the appropriate exchange platform (or the one where you already keep your bitcoins)

- You convert your Bitcoin to Euros by giving the corresponding order (either by direct conversion, limit order or market order)

- Once you have made the conversion, you can proceed to withdraw the Euros to your bank account

Don’t forget that for each of the above steps, there are corresponding commissions. Both on the part of the exchange and on the part of the bank.

📤 If you want to learn more, read the detailed article in which I explain, step by step, how you can withdraw Euros from Binance →

💡 You follow a similar procedure for each exchange

How do I buy Bitcoin ETFs?

ETFs are traded on exchanges just like stocks. The same is the case with Bitcoin ETFs. Some examples are the Physical Bitcoin ETC (BTCW) from WisdomTree (ISIN: GB00BJYDH287), the Physical Bitcoin ETN (BTIC) from Invesco (ISIN: XS2376095068) and the Physical Bitcoin ETN from CoinShares (ISIN: GB00BLD4ZL17). You can search for them by ISIN, at Saxo Bank‘s investment bank →

Can I purchase Bitcoin via PayPal?

Yes, you can buy Bitcoin via PayPal. All you need is to confirm that the exchange in question supports the PayPal payment option. For example: Binance and Crypto.com do not offer the option to deposit money via PayPal, unlike Kraken and eToro →

Can I buy Bitcoin via Paysafe?

Yes, you can buy Bitcoin with PaySafe cards. With a Google search, I found that it is supported by Paxful, Bitvalve and BitPapa platforms. Proceed at your own risk, I haven’t personally tested them.

What is a Bitcoin ETF?

Bitcoin ETFs behave just like gold ETFs. It trades on exchanges like a stock, following the price of bitcoin and the administrator is forced to mirror the value of the “fund” with actual bitcoin.

Whew!

Enough reading, right?

What did you think?

Do you feel ready to take your first steps into the world of Bitcoin? Have you already done so?

I’d love to know more about it!

I look forward to your comments!

Sterg

More material on Bitcoin:

If you liked this article, read more about cryptocurrencies in the articles below:

How to Get Free Crypto Coins – Instant Sign-up Bonus [2024]

They say that in this life nothing comes for free. So, in the case of…

Binance: Guide to the Largest Crypto Exchange [2023]

Not many introductions needed here. Binance is the biggest crypto exchange player in the game right now, worldwide. The Binance platform gives…

Crypto.com Card & App: The Ultimate Guide [2022] – Updated

Crypto.com considers itself the best place to: Buy and sell cryptocurrencies Pay for your daily…

A Bitcoin Beginner’s Guide: Everything You Need to Know [2024]

🔄 Last updated: 03 March 2024 🎁 Bitcoin buying platforms offering sign-up bonuses → To…

Risk Disclaimer:

I am NOT a professional investment advisor and the following is NOT an investment recommendation but is my personal experience and opinions.

Keep in mind that always investing = risk.

Only invest money that you are willing to lose!

Affiliate Disclaimer:

The above links to the services listed may be affiliate links. If you use the service through them then you are helping MoneyMinority to continue to exist, at no extra cost to you.

Feel free not to use them if you do not wish to.

Read more about Risk & Affiliate Disclaimers of MoneyMinority.

![Binance_ Guide to the Largest Crypto Exchange [2021]](https://moneyminority.com/wp-content/uploads/2021/03/Binance_-Guide-to-the-Largest-Crypto-Exchange-2021-300x190.png)

![Crypto.com & MCO Card: The Ultimate step by step Guide [2020]](https://moneyminority.com/wp-content/uploads/2020/03/Crypto.com-MCO-Card_-The-Ultimate-step-by-step-Guide-2020-300x190.jpg)

![How to Get Free Crypto Coins – Instant Sign-up Bonus [2024] Δωρεάν Κρυπτονομίσματα - Λίστα με Bonus Εγγραφής](https://moneyminority.com/wp-content/uploads/2021/12/Δωρεάν-Κρυπτονομίσματα-Λίστα-με-Bonus-Εγγραφής-768x432.png)

![Binance: Guide to the Largest Crypto Exchange [2023] Binance_ Guide to the Largest Crypto Exchange [2021]](https://moneyminority.com/wp-content/uploads/2021/03/Binance_-Guide-to-the-Largest-Crypto-Exchange-2021-768x486.png)

![Crypto.com Card & App: The Ultimate Guide [2022] – Updated Crypto.com & MCO Card: The Ultimate step by step Guide [2020]](https://moneyminority.com/wp-content/uploads/2020/03/Crypto.com-MCO-Card_-The-Ultimate-step-by-step-Guide-2020.jpg)