🔄 Last updated: 03 March 2024

🎁 Bitcoin buying platforms offering sign-up bonuses →

To be here, I guess you want to know more about the cryptocurrency that goes by the name of Bitcoin (BTC).

Congratulations to Google, then, for bringing you around! In the following article, I discuss Bitcoin and everything a beginner should know.

We will explore, in plain English and simple terminology, what Bitcoin is and who created it.

After clarifying what it is, we will talk about the reasons that make it significant and the problems it came to solve.

Finally, we will briefly describe how it is created, how it works and where one can buy it.

Oh, and don’t worry: no technical or financial background is required to understand everything we say.

☕ Make some coffee, and let’s see what this bitcoin is…

Bitcoin for beginners – what you need to know

Before we get to the detailed article, here are some quick answers to frequently asked questions about Bitcoin. I recommend reading the whole article – it will answer plenty of questions.

What is Bitcoin? It is the first decentralized digital currency in human history. It was created to enable people to transfer value (i.e. money) to each other over the Internet. Bitcoin is three things: software, network and currency combined.

Why is it important? Its network enables secure, direct, person-to-person (P2P) transactions. Unlike traditional currencies, it operates without a central authority or government oversight, a fact making it decentralized. Being a holder, you are the unique owner of a currency whose use does not require a third-party service (bank) or approval from an authority (government).

How does Bitcoin work? Every transaction takes place within its network, protected by cryptography and recorded in a public ledger (database) called the blockchain. Each holder has a unique address within the network to send (and receive) coins. Its operation is secured through complex mathematical operations (by miners), and the validity of transactions is confirmed by other users (nodes) in the network.

How does the Blockchain work? A blockchain is a fancier word to refer to a database that operates in a decentralized manner. In short, instead of being stored in a central location, it is maintained and distributed across many computers in different parts of the globe.

How is Bitcoin made? Coins are created through a process called mining. This involves complex mathematical operations being solved by powerful computers that consume electricity. In addition to creating new coins, this process also secures the network from malicious attacks.

Is Bitcoin legal? Yes, bitcoin is legal! Some countries have adopted it as an official state currency (El Salvador & Central Africa), and most consider it an investment vehicle (similar to gold), while in China and Egypt, it has been banned.

How did Bitcoin get started? It was introduced in 2009 by someone (or some people) under the pseudonym Satoshi Nakamoto. The project started as an open-source project to create a new form of money that would operate alongside the traditional financial system and independently of any authority or government.

How to get started with Bitcoin? The first step is to understand what it is, how it works and the purpose for which it was created. Next, you should study which role it serves on the investment chessboard (protection against inflation; a means of value preservation; a traditional finance hedge?). Finally, if you decide you want to deal with it, you should look at where to buy it and how to store it.

How do I buy Bitcoin? The easiest way to buy BTC is through a popular and secure exchange such as Binance and ByBit. After you buy it, the next step is to transfer it to your own cryptocurrency wallet for added security.

📙 Bitcoin buying guide, step by step →

What you will read today:

- What is it?

- Who created it?

- Why is it important?

- How does it work?

- How is it created?

- How do I get it?

- How is it stored?

- History

- Frequently asked questions →

- 🛡️ Storage Guide ▶

- 📙 Buying Guide ▶

- 🎁 Bitcoin Sign-up Bonus ▶

What is Bitcoin?

In October 2008, a whitepaper called Bitcoin: A P2P Electronic Cash System was published by Satoshi Nakamoto.

The very brief 9-page report talked about the creation of a fully decentralised currency, which would be called Bitcoin (BTC) and would “run” on a technology called Blockchain.

⚠️ Note:

Bitcoin is the name of the digital currency, BTC is its abbreviation, and Blockchain is the technology on which it is based/runs/developed.

Bitcoin, in short, is a form of digital decentralised money.

Digital because it is only circulated over the Internet without existing in physical form.

Decentralised because it is not issued or controlled by a central authority (a bank or a government) but runs autonomously with its own monetary policy on its network.

Money because it can both transfer and store value.

⚠️Newbie Note:

The Bitcoin-branded coins you see frequently on the Internet are the product of editing. Don’t have someone come along and sell you physical coins as Bitcoin. Bitcoin does NOT have a physical substance.

Bitcoin is 3 things: Software, Network & Currency together.

- The Bitcoin Software

I’m referring to the Software, the code that Bitcoin runs on. This code is open and accessible and anyone can test, edit or copy it. - The Bitcoin Network

I’m referring to the Network, i.e. all users who have downloaded the Bitcoin software on their computer (they have become Nodes) and operate it to help ensure its security and smooth operation. - The Bitcoin Currency

I’m referring to the mechanism with which you can transfer or preserve value in the Bitcoin Network.

The technology on which Bitcoin runs is called Blockchain.

As mentioned, Bitcoin is not issued by a centralized entity but is created, stored, transferred and exchanged exclusively within its ledger.

This register is the Bitcoin BlockChain, which is public, transparent and accessible to everyone, without exception.

You can think of it as a notebook in which all the amounts of Bitcoin, the balances that anyone can hold and all the transactions that take place are recorded at any given time.

Bitcoin Review | |

❓What is it | Digital Currency |

Use: | Store of Value & Money |

₿ Crypto: | Bitcoin |

️ Abbreviation: | BTC |

Creator: | Satoshi Nakamoto |

⚙️ Technology: | Bitcoin's Blockchain |

Created: | 2008 |

Max Supply: | max 21.000.000 BTC |

Supply Style: | Deflationary |

⚙️ Consensus Mechanism: | Proof of Work (POW) |

⛏️ New Coin Issuance: | via Mining |

Who Created Bitcoin?

The creator of Bitcoin as mentioned in the Whitepaper, is a man, self-proclaimed as Satoshi Nakamoto.

This name is a nickname as we do not know, to this day, who the man or group behind it is. Satoshi’s last communication with the community was in 2011.

As you can understand, the Internet can’t let something like this go by without looking for the true identity of the creator of such a radical technology.

Some people rumoured (according to the Internet) to be behind Satoshi Nakamoto’s alias are Dorian Nakamoto, Hal Finey, Craig Wright and Nick Szabo.

How do I buy Bitcoin?

Buy Bitcoin through Binance, one of the largest cryptocurrency exchanges in the world. Using the link below you’ll earn 10% off commissions… forever!

🎁 Get the bonus →

Why is Bitcoin important?

Or else, why decentralization is so important

For the first time in history, since the appearance of digital money, there is an alternative to the traditional monetary system.

What makes Bitcoin stand out is that it is a form of money not controlled by a higher competent authority but exists and operates independently and autonomously.

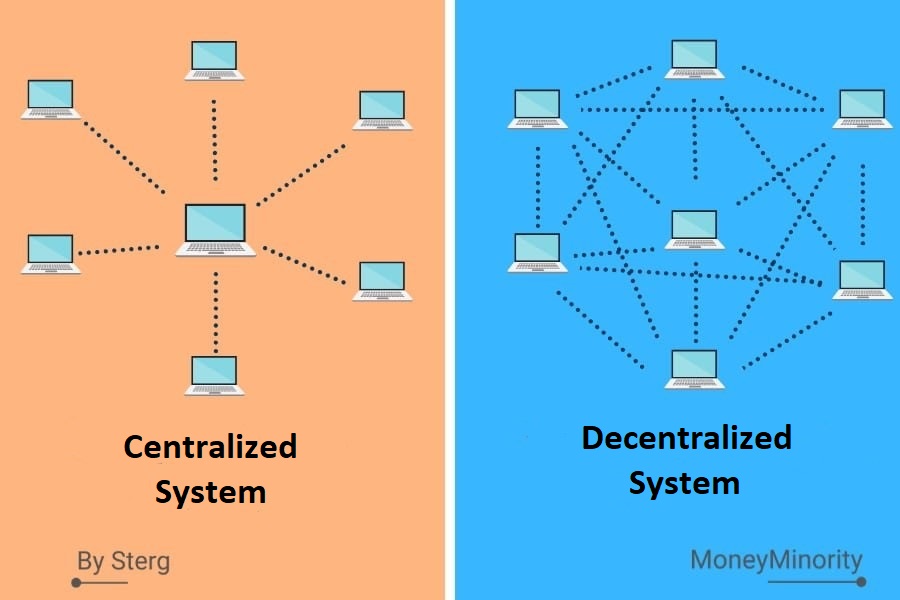

Bitcoin is decentralized

For a clearer understanding of the concept of decentralization, I will use the analogy I used in the Bitcoin Market Guide.

Consider, for a moment, how you could access any information you were looking for before the Internet existed.

All you could do was turn to specific sources such as major newspapers, TV channels, encyclopedias, libraries, etc.

This means that the flow of information was centralized.

The Internet came to radically change the above assumption and make the flow of information completely decentralized.

Now, anyone can transmit information to anyone and receive information from anyone easily and quickly with a few clicks.

The transmitter can become a receiver and vice versa.

Great, Bitcoin is something equivalent to money!

In the same way that the Internet came to bring the decentralization of information, bitcoin can be the decentralization of money!

Anyone can send or receive payments on their own without any intermediary!

“Bitcoin will be to banks what email is to post offices.”

Rick Falkvinge

I can already hear you asking:

“Why is decentralization important?”

Because it will make you a real owner of your money!

“Why, what are you talking about, Sterg!

So the money I already have in the bank is not mine?

Whose is it?

Indeed, it is yours, but with a little star. Your money is always accessed through a third-party service that of a bank.

You’re a holder until the bank refuses to send you a transfer, denies you an ATM withdrawal or freezes your account altogether. You are a holder until a government decides to implement a bank cut and reduce your deposits.

On the other hand, all Bitcoin will require is an Internet connection and a cell phone or computer.

With these two, you can transfer your money anywhere on the planet and make shipments to any user, anywhere in the world, anytime, without anyone being able to deny you.

The negatives of the centralized money model

The monetary model in place right now is completely centralized. Central banks are responsible for issuing and controlling the fiat money, while commercial banks are responsible for the circulation of it.

However, when full control of the issuance and supply of money is controlled by specific institutions, the following can happen:

#1 Mismanagement

Frequently, the interests of the central authority issuing the money are not in line with the interests of most of the people.

One such example is the issuance of money to bail out a financial institution (e.g. a bank or a private company).

Issuing large amounts of money increases inflation, meaning that the purchasing power of consumers is reduced.

#2 Corruption

Power leads to corruption.

Too much power leads to too much corruption!

When one can create money, i.e. how we exchange value, one practically controls the world.

#3 Control

Practically, fiat money makes banks and the state the ultimate and real controller of your money. It can at any time and moment it sees fit, intervene and freeze your money or deny you access to it.

Hmm… Does it ring a bell?

On 15 March 2013, after the Eurogroup meeting on the political decision on Cyprus and the bailout programme, a 6.5% haircut on deposits up to €100,000 and 9.5% for deposits of €100,000 and above was decided across the entire banking system.

In June 2015 Capital Controls were introduced in Greece to prevent a complete collapse of the Greek banking system from an uncontrolled bank run. As a depositor, you were limited to a daily cash withdrawal limit of €60, and couldn’t even send funds to foreign accounts.

And these were examples that involved entire countries, imagine the amount of power they have over individual citizens’ bank accounts.

Comparison of Bitcoin & banking model

Let’s try to compare Bitcoin with the model of a traditional bank.

As you probably already know, most fiat money (€, $, etc.) is in digital form in bank registers. Very little of it is in physical form as cash.

Each bank is responsible and obliged to maintain its database in which it records all the available balances of its depositors and updates it according to each transaction they make.

However, there is no transparency in this database (bank register)!

It is stored in the bank’s systems, which is responsible for its control and proper functioning.

No one else (apart from other regulators) can access it.

The exact opposite is the case with Bitcoin!

Anyone, anytime, can check all available balances and transactions taking place in real-time.

The only thing that cannot be seen is who owns any amount and who is involved in any transaction!

Bitcoin offers a relative, but not absolute, anonymity.

Pseudo-anonymity

While all transactions made and available balances are open and public to everyone, the owners’s names are hidden.

All you will see are Bitcoin addresses (Public Addresses) and transfers of a certain amount of BTC between them.

⚠️ Example of a Bitcoin Address:

1APVLDd15HXYVThc7v46Ys9HbQf9H5Ay

The truth is that, nowadays, there are services that can track down the details of the person behind a Bitcoin address.

This means that the anonymity behind Bitcoin is more of an Urban Legend than a reality.

The Bitcoin registry is not kept on a single computer but rather exists and is maintained as a copy for everyone participating in its network.

All of the above cannot happen in Bitcoin as it is not controlled or created by any central authority.

I see the next legitimate question coming:

“If no one controls or issues Bitcoin, how can I trust it?”

After all, the concept of an intermediary was not created without a corresponding need.

An intermediary joins to provide a guarantee and security that both sides of a transaction will be consistent in their agreement.

For example:

If you pay a merchant through a bank to send you a product and they don’t send it to you, you can go back to the bank to get your money back. Similarly, the merchant has the bank’s guarantee that he will collect the customer’s money and proceed with shipping the product.

The bank, acting as a middleman, eliminates this risk that both parties would have to take in exchange for some money.

Bitcoin comes to take out the human factor as an intermediary (bank) and replace it with technology (Blockchain).

But how can we be sure that this technology works correctly or will not be hacked by a hacker?

How does Bitcoin work?

Why Bitcoin cannot be hacked

As we mentioned at the beginning, Bitcoin is a digital currency based on Blockchain technology.

Simply put, the Blockchain is a kind of database.

This database records, at any given moment, all available Bitcoin balances and all transactions taking place.

The difference with a classic database is that in the Blockchain the data is stored between many different computers and not only on one central server.

Data is stored in the form of blocks connected in sequence, one after the other. Just like a chain.

Block + Chain = Blockchain

See what they did there?

The Bitcoin network operates and grows through continuous updates of this database, including all transactions taking place.

Each computer participating in the network (Bitcoin Node) maintains a copy of the blockchain and confirms each transaction taking place on it.

So, every time a new bitcoin transaction is “announced” everyone participating in the network will have to update the copy of the blockchain they maintain to be on the same wavelength.

And this is exactly why Bitcoin cannot be hacked.

For any new information to be accepted into the system, it must be confirmed by the computers participating in the network that maintain the copy of the Blockchain.

Think of it this way: To hack a bank you have to hack its systems. To hack Bitcoin you have to hack all the computers participating in its network (or, to be more specific, 51% of them).

⚠️ Newbie Tip:

When we say that Bitcoin is unHackable, we are referring to the Blockchain technology and how it works.

But this does not refer to the accounts you maintain on various Online Exchange Platforms which may well be hacked by Hackers who want your cryptocurrencies.

How does the Blockchain work?

To make it simpler, let’s take a look at an example:

Being “large”, I want to send a whole Bitcoin to my friend Christos for his excellent editing of MoneyMinority’s YouTube videos.

This transaction will result in a change in the Blockchain data, as a transfer of Bitcoin from my address to Christos’ address will be made.

The data of this change will be added to a brand new block, also containing the data of other transactions taking place at that moment.

Each Block can hold a certain amount of information. Once it is “filled” with the information it can hold, then is closed and added to the blockchain.

As you can see, each Block in the chain is inextricably linked to the previous one and the next one.

Once a Block is added to the chain it CANNOT receive any kind of processing because it will “break” the chain.

This makes Bitcoin transactions irreversible.

In the Bitcoin Blockchain, a new block is added to the chain approximately every 10 minutes.

How is Bitcoin created?

If you’ve been even remotely involved with Bitcoin, you’ve surely heard of the concept of Mining.

Bitcoin Mining is the process through which new Bitcoin coins are created and added to the Bitcoin network.

What is Bitcoin Mining?

Bitcoin mining is the process of “upgrading” the Bitcoin transaction log, namely the Blockchain.

The work is done by powerful computers (e.g. ASICs) trying to “guess” a specific number that solves an equation generated randomly by the system.

The first miner who correctly “guesses” the number solving the above equation succeeds in “upgrading” the Blockchain and, at the same time, “earns” the new bitcoins created!

To make it even clearer how bitcoin is created, you can imagine the following:

Every time your computer “guesses” correctly the number solving the equation, then a “new page” is created in the bitcoin registry (blockchain) with all bitcoins participating there becoming yours.

As it makes sense, the more powerful the computer you use for mining, the more “guesses” it can make per second, so the more chances you have to get the right number and solve the equation!

The good old days when Bitcoin mining was profitable for casual users are gone forever!

These days, to be able to do Bitcoin mining you need to make a serious investment in equipment (along with proper cooling and storage), as you won’t succeed if you try with a conventional computer.

📚 More Material:

You can easily do the math and see if it “works out” using an online Bitcoin mining calculator.

How do I buy Bitcoin?

There are 2 ways in which you can acquire bitcoin:

- Through Bitcoin Mining

- Through buying Bitcoin

If you read the previous chapter you will have seen that Bitcoin Mining is not financially advantageous for the average home user.

*Unless you have access to free electricity and professional mining equipment

So we are left with the second (and more realistic) option, obtaining already-mined Bitcoin from some other source.

The price of Bitcoin (BTC) at the moment:

⚠️ Newbie Note:

You are not required to buy whole Bitcoins.

You can buy multi-decimal subdivisions for any amount of money you want. e.g. 10€, 20€, 150.000€

The safest, fastest and most economical way to get Bitcoin from the Internet is by buying it through a popular cryptocurrency exchange.

Exchanges are platforms connecting users who own cryptocurrencies and want to sell them with those who want to buy them.

Caution is needed in choosing platforms which have a proven track record of several years of operation on their back. This way, you will minimize the risk of potential scams, Ponzi schemes and possible security vulnerabilities that a “fresh” platform may face:

Binance | ByBit | Crypto.com | Nexo | Wirex | Pionex | |

|

|

|

| 💳 |

| |

Founded: | 2017 | 2018 | 2016 | 2018 | 2014 | 2019 |

Coins: | 401 | 555 | 321 | 70+ | 250 | 365 |

Pairs: | 1.507 | 799 | 669 | 596 | ||

Spot Fees: | 0.1% | 0.1% | 0.075% | 0% | depends | 0.05% |

Futures Fees: | 0.05% | 0.055% | 0.017% | 0.02% | ||

Crypto Card: |  |  |  |  | ||

Cashback: | up to 5% | up to 2% | up to 8% | |||

Interest on Stables | up to 6,5% | up to 16% | up to 20% | |||

Interest on BTC | up to 5% | up to 7% | up to 6,5% | |||

Bonus: | -10% fees + $100 rebates | up to $30.000 | $25 in CRO | $25 in BTC | $15 | -10% on fees |

📚 Guides: | Read more → | ByBit | Read more → | Wirex | Pionex | |

Looking for an app to track your portfolio? Try GetQuin for free → | ||||||

In summary, the Bitcoin buying process is:

- Choose the right exchange for bitcoin

- Create an account and confirm it through KYC

- Sending money to the exchange via card or wire transfer

- Purchase BTC

- Transfer your Bitcoins to another secure Wallet (or not)

If you’re interested in learning how you can buy Bitcoin safely, take a look at the detailed guide I’ve created.

10% Discount on Commissions at Binance

Create your account from the link below and get a 10% Discount on all commissions for EVER.

Learn more about Binance.

Bitcoin Storage

After buying your first Bitcoin, the next step is to safeguard it from Hackers and Scammers.

In the same way you store your money in wallets and bank accounts, Bitcoins are stored in corresponding wallets. Crypto Wallets.

I won’t go into more detail on this topic as there are two detailed articles on MoneyMinority which will direct you to what you need:

- Cryptocurrency Security Guide ▶

- Storing Cryptocurrency in Crypto Wallets Guide ▶

The one thing I’d like you to keep in mind is that a Bitcoin is not yours unless you safeguard it in a wallet of your own.

As long as you keep your Bitcoins on an Online Crypto Exchange or Platform, you are essentially “trusting” them with them.

You are placing your faith in them, their systems and processes, and that they will do a good job safeguarding them for you.

Not your Keys, not your Cryptos

The history of Bitcoin

Here are some of the most important events that have marked the evolution and impact of Bitcoin since its creation.

📅 31.10.2008

Publication of the Bitcoin Whitepaper by Satoshi Nakamoto

📅 12.01.2009

The first Bitcoin transaction took place

📅 22.05.2010

The well-known Bitcoin Pizza Guy makes the worst (as it turned out) decision ever by buying 2 pizzas for 10,000 BTC.

📅 06.11.2010

Bitcoin’s market cap exceeds 1 million dollars

📅 02.2011

Bitcoin price reaches $1 for the first time

📅 10.2011

The first Bitcoin Fork was made, and LiteCoin was created

📅 06.2012

The most famous crypto broker platform, CoinBase, was created

📅 27.09.2012

The Bitcoin Foundation was established

📅 11.2013

The first Bitcoin bubble bursts, dropping the price from $1,213 /BTC to $600

📅 07.02.2014

Mt. Gox, the largest Bitcoin exchange of the era (it handled over 70% of all Bitcoin transactions), fell victim to hacking resulting in the loss of over 850,000 Bitcoins.

📅 06.2015

BitLicense, one of the most important Bitcoin regulations, is established

📅 01.08.2017

Another fork for Bitcoin, which “gave birth” to Bitcoin Cash

📅 10.2017

China bans Bitcoin exchanges

📅 10.2018

Cryptocurrencies collapse 80% from their previous peak

📅 09.2021

On September 7, 2021, El Salvador became the first country to adopt Bitcoin as a state currency.

📅 11.2021

On November 10, 2021, the price of Bitcoin reached its all-time high of $68,789.63.

📅 2022

Following the example of El Salvador, the Central Republic of Africa adopted Bitcoin as a state currency.

📅 10.2023

The dominance of bitcoin in the cryptocurrency market once again reaches 54%. Back in 2017, it was at 80% but there were no stablecoins nor so many altcoins.

📅 01.2024

On January 10, 2024, the U.S. Securities and Exchange Commission (SEC) gives the green light to the first U.S. Bitcoin ETFs.

Frequently Asked Questions about Bitcoin

Here are some of the most frequently asked beginner questions about Bitcoin and its operation on the internet:

What do I need to know about Bitcoin?

Bitcoin was created as an alternative way to transfer money (and value) over the internet. The word bitcoin refers to 3 things: network, software and currency. Miners through solving complex mathematical operations, are responsible for securing the network and creating new coins. The nodes are responsible for confirming the transactions. The blockchain is the decentralised database in which all transactions taking place on the network are continuously reported.

Is Bitcoin dead?

Every time the price of bitcoin drops, analysts and international media immediately scramble to tell us that bitcoin is dead. And while the volatility of its price is truly enormous, reality shows that after every big drop, it has managed to come back… with a vengeance. According to 99bitcoins, the most popular cryptocurrency on the planet has been declared dead more than 475 times since 2010.

What is the value of Bitcoin in Euros?

Can I convert Bitcoin to Euros?

Of course! Bitcoin can be converted into Euros and any fiat currency such as Dollar and Pound through a cryptocurrency exchange. The conversion process is relatively simple: Create an account, send your Bitcoin to it and choose to exchange it for Euros.

Is Bitcoin an investment?

Bitcoin is considered an extremely risky investment due to the very high volatility of its price. While a daily drop of 10% is capable of shutting down a stock market, for Bitcoin it is… a Tuesday. It is only recommended for investors with high-risk tolerance who have no problem losing 100% of their capital.

Why invest in bitcoin?

Some of the most popular reasons to invest in Bitcoin are to seek a “modern” means of wealth preservation (digital gold), to hedge against inflation and to hedge against the entire modern financial system.

What was the highest value of Bitcoin?

The highest price Bitcoin ever reached was $68,789.63 on November 10, 2021.

Which Bitcoin to buy?

Bitcoin is only one – it’s called Bitcoin and you’ll encounter it with the initials BTC. The other cryptocurrencies are called altcoins and serve different purposes than bitcoin, with the dominant one being profit. Through the years, several Bitcoin “clones” have appeared, such as Litecoin (LTC), Bitcoin Cash (BCH) and Bitcoin SV (BSV), which have slowly faded or are fading away…

Where do I find Bitcoin?

Bitcoin exists, lives and is only transported within its blockchain. There are various services linked to the blockchain through which you can acquire it. For example, a cryptocurrency exchange like Binance and ByBit.

Can I make purchases with Bitcoin?

While you can make purchases with Bitcoin, there is still a long way to go before Bitcoin becomes a mainstream way of paying for goods and services.

If you ask me, I believe it never will.

Many reasons make Bitcoin an excellent means of storing value and not a good means of transferring value (as money).

If you want to use cryptocurrencies for your everyday shopping, I would advise you to take a look at Crypto Debit Cards.

The three most prevalent options are Nexo, Wirex and Crypto.com cards.

More material about Bitcoin:

If you liked this article, read more about cryptocurrencies in the articles below:

How to Get Free Crypto Coins – Instant Sign-up Bonus [2024]

They say that in this life nothing comes for free. So, in the case of…

Binance: Guide to the Largest Crypto Exchange [2023]

Not many introductions needed here. Binance is the biggest crypto exchange player in the game right now, worldwide. The Binance platform gives…

Crypto.com Card & App: The Ultimate Guide [2022] – Updated

Crypto.com considers itself the best place to: Buy and sell cryptocurrencies Pay for your daily…

How Do I Buy Bitcoin For The First Time – In 3 Simple Steps

🔄 Last updated article: 02 March 2024 🎁 Online exchanges to buy BTC with sign-up…

Risk Disclaimer:

I am NOT a professional investment advisor and the following is NOT an investment recommendation but is my personal experience and opinions.

Keep in mind that always investing = risk.

Only invest money that you are willing to lose!

Affiliate Disclaimer:

The above links to the services listed may be affiliate links. If you use the service through them then you are helping MoneyMinority to continue to exist, at no extra cost to you.

Feel free not to use them if you do not wish to.

Read more about Risk & Affiliate Disclaimers of MoneyMinority.

![Binance_ Guide to the Largest Crypto Exchange [2021]](https://moneyminority.com/wp-content/uploads/2021/03/Binance_-Guide-to-the-Largest-Crypto-Exchange-2021-300x190.png)

![Crypto.com & MCO Card: The Ultimate step by step Guide [2020]](https://moneyminority.com/wp-content/uploads/2020/03/Crypto.com-MCO-Card_-The-Ultimate-step-by-step-Guide-2020-300x190.jpg)

![How to Get Free Crypto Coins – Instant Sign-up Bonus [2024] Δωρεάν Κρυπτονομίσματα - Λίστα με Bonus Εγγραφής](https://moneyminority.com/wp-content/uploads/2021/12/Δωρεάν-Κρυπτονομίσματα-Λίστα-με-Bonus-Εγγραφής-768x432.png)

![Binance: Guide to the Largest Crypto Exchange [2023] Binance_ Guide to the Largest Crypto Exchange [2021]](https://moneyminority.com/wp-content/uploads/2021/03/Binance_-Guide-to-the-Largest-Crypto-Exchange-2021-768x486.png)

![Crypto.com Card & App: The Ultimate Guide [2022] – Updated Crypto.com & MCO Card: The Ultimate step by step Guide [2020]](https://moneyminority.com/wp-content/uploads/2020/03/Crypto.com-MCO-Card_-The-Ultimate-step-by-step-Guide-2020.jpg)